Since the start of JuIy, the two weakest G10 currencies have been the New Zealand dollar and the Swedish krone (SEK). We've selected the start of July as this is when EUR/USD was moving higher and peaked at 1.37. Although a weak euro has since fallen 1000 pips, the Swedish krone has been even weaker in percentage terms. Therefore, we're looking for buying opportunities in USD/SEK. While there haven't been many large pullbacks of recent months, USD/SEK may be working through a minor pullback right now which we're interested to trade.

This daily USD/SEK chart shows the price action for most of 2014. It also shows a clear three-touch blue uptrend which could be extended to at least mid March 2014. Recent price action has accelerated and is quite a way above that trend line, essentially requiring a steeper trend line. This is part of the reason we're keen on waiting for a pullback before joining the current uptrend.

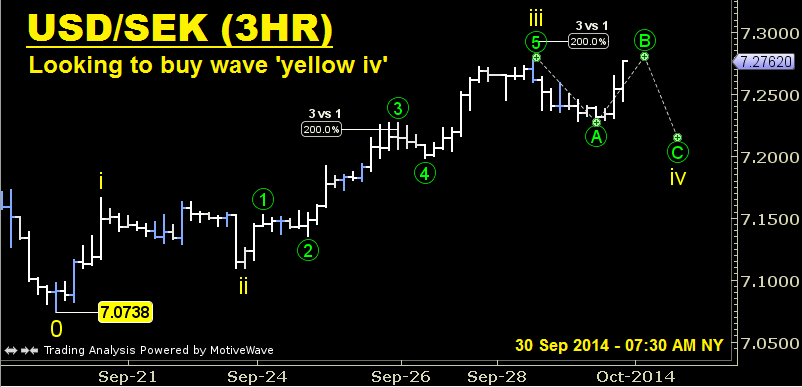

This three-hour USD/SEK chart shows the price action from the 7.0738 low and includes a suggested Elliott Wave count from that level. On this count, we've seen three yellow waves higher and are currently correcting in wave 'yellow iv'. We expect this correction to be a flat or a triangle. While we can't determine which structure may win out, we'll discuss a trade setup in expectation of a flat. If we eventually see a triangle, our entry won't be triggered and we'll nominate a level to cancel orders.

Therefore, we’d look to buy USD/SEK at (or below) 7.23 which is slightly above the wave 'green circle 3' high. Our stop will be at 7.1850 which is slightly below the wave 'green circle 4' low. We'll set two 'take profit' targets of 7.29 and 7.32.

Long Setup for USD/SEK

Trade: Buy at (or below) 7.23.

Stop Loss: Place stop at 7.1850.

Take Profit: The two ‘take profit’ targets are 7.29 and 7.32.

Trade Management: If price reaches 7.30 without triggering the entry, cancel all orders. Further, if the entry is triggered and price reaches the first take profit target of 7.29, raise stop to 7.23.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.