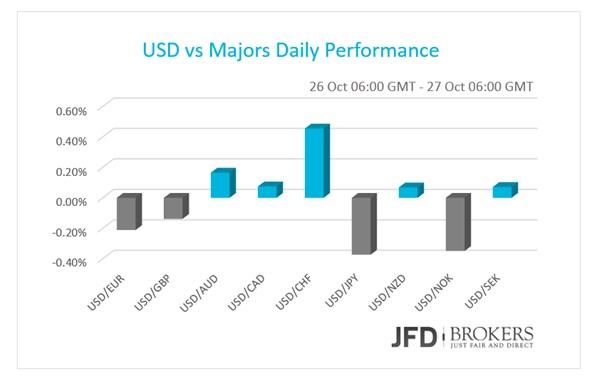

The liquidity was thin among the major currencies on Monday as the various economic indicators came out didn’t affect the market importantly apart from the euro. The dollar was mixed versus its G10 peers but posted only limited moves. The U.S. new home sales revealed a larger than expected decline in September. They shrank by -11.5% from -0.4% expected and the number dropped to a 10-month low.

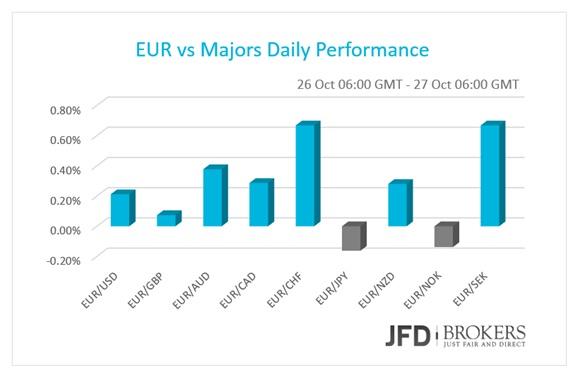

Euro supported by Germany’s IFO Survey

The shared currency edged higher against most of its major rivals on the upbeat data released from Germany, but its gains seen limited. The business climate in October hasn't been affected severely from the Volkswagen emission scandal. The IFO survey showed that the indicator regarding business confidence fell to 108.2 – the lowest figure since July – but the market was expected it to plunge to 107.8. This could lead to the conclusion that the scandal has had no crucial impact on the German car industry. Moreover, firms are expecting a further growth to the business sector in the next six months and that reflected on the IFO survey. The expectations related indicator for October rose to 103.8 – the highest since March – beating forecasts to have fallen to 102.4. However, the current assessment figure was weaker than expected, sending the message that the short-term business situation got stuck.

The EUR/USD pair fell to its lowest level in 2-months following the ECB policy announcement and press conference by the ECB President Mario Draghi. The selling pressure continued on Friday as the pair closed the day in red, -0.79%, following a -2.00% on Thursday, but for the time being the pair has bounced off the psychological level of 1.1000. The 200-SMA on the daily chart, as well as, the ascending trend line both failed to provide support to the bulls during the previous week. However, the last few hours the bulls managed to gain some ground and is now approaching a significant zone, the 1.1060 – 1.1100, which coincides with the 200-SMA and the ascending trendline. Therefore, the aforementioned zone is the immediate area to watch for. I would be fairly neutral though on any directional move and we could yet see the dollar come under further pressure, above the 1.1000, with much depending on the lead coming from the Fed policy meeting due on Thursday.

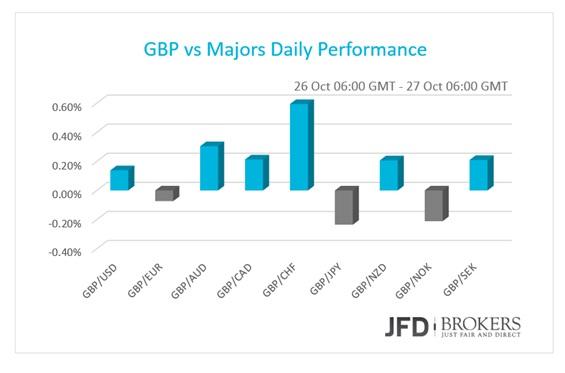

Pound slightly higher ahead of Q3 GDP

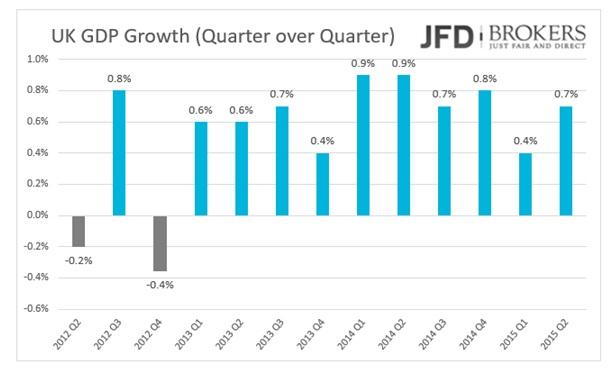

The sterling also recorded slight gains versus most of the G10 currencies on Monday and early Tuesday ahead of the release of the first GDP estimate for the third quarter. The macroeconomic data came out yesterday from the UK were not positive for the pound, however, they haven’t posed any threat to it. The BBA mortgage approvals for September slumped to the lowest since April and the CBI industrial trends survey for the orders (output, export, prices, investment intentions, business confidence and capacity utilization) plummet to -18 in October from -7 before, the lowest since June 2013.

The buck ran out of momentum the last couple of days against the pound after several unsuccessful attempts to break the strong support level at 1.5300. The GBP/USD closed the week negative at -0.78% following numerous failed attempts to break above the strong resistance level of 1.5500. For the intraday traders, the 1.5370 barrier remains key resistance level as it did earlier in the month while it acted as a support. For now, I would expect the pair to remain below the latter level ahead of some significant data coming from the U.S., including the durable goods orders and the inflation figures, both due today. Therefore, we should expect the bears to test the 1.5300 barrier in the next few hours. A move below the latter level should open the way towards the 1.5200 level.

USD/CAD – Technical Outlook

The Canadian dollar drifted sideways on Monday with investors reluctant to take big bets before the Fed policy meeting. The USD/CAD remained in a range between the psychological level of 1.3200 and the 1.3120 barrier. While the Fed is expected on Wednesday to maintain its first rate hike in nearly a decade, the tone of the statement could ruffle markets. The U.S. dollar has made an incredible rally against the Canadian dollar the last five months as it added to its value more than 10%! In addition, the U.S. dollar is set to deliver a sixth consecutive winning month, despite the fact that is negative -1.08% so far for this month. With some significant data coming up this week for the U.S., mentioned above in this article, the dollar could easily cover the distance a few days before the month ends. Having in mind the above, for the USD/CAD rally to continue, we will need to see a break above the psychological level of 1.3200. If a break above that level occurs, then I would expect to see a run back towards the 1.3300 area. For the medium to long term traders I would expect the pair to reach the 1.4300 level until the end of the year! However, it is very important for the above to occur, the monthly candle to close positive.

USD/JPY – Technical Outlook

Monday was a very quiet day in terms of scheduled data releases from the Japan, as well as from Asia. Nothing changed to the USD/JPY pair as it remained trapped in a tight range, roughly around the 120.00 area. The pair entered a sideways channel in mid-August and since then it failed to give any real direction in any way. Few days ago, it made an attempt to go higher but failed to climb above the 200-SMA on the daily chart, as well as the key resistance level of 121.70.

If last week’s buying pressure continues, I would expect the pair to increase its attempts to break above the key level of 121.70. However, I think it’s going to take at least 2-3 attempts before we see a break above here. Furthermore, we should watch for a pullback and a test of the psychological level of 120.00, where the 50-SMA is ready to provide a significant support to the price action near that area. The RSI failed to move above the 70 level, warning for a pullback as mentioned above, while the MACD crossed in a bullish territory and is now moving above both, the zero and trigger lines. A decisive break above the 121.70 level will then concentrate our focus to 123.00.

China's rate cut affected stock market

In other news, China has cut its one-year benchmark interest rate by 0.25 percentage points to 4.35%. China hopes that looser monetary policy, in the shape of cheaper money, will help it hit its growth target of 7% for this year. China's economy has grown at an average annual rate of 10% for the past three decades, last year it grew by 7.4%, but has been stabilising in the last couple of years. In reaction to the move, the Shanghai Composite closed up 0.7% at 3,435, while Hong Kong's Hang Seng index ended down 0.2% to 23,116. Japan's benchmark Nikkei 225 stayed in the positive territory throughout the day and closed up more than 1%.

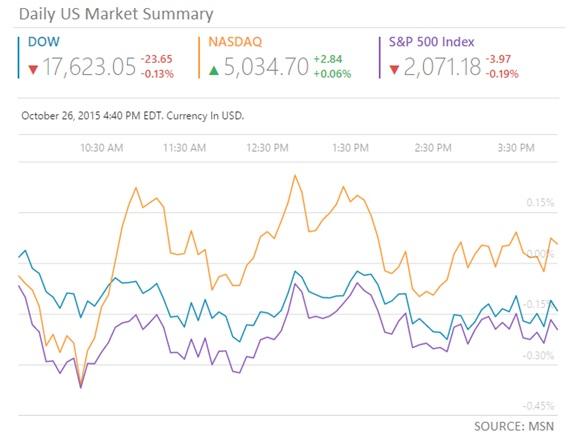

U.S. Indices mixed; Apple dropped 3% ahead of the earnings report!

The three popular U.S. indices ended the first trading session of the week mixed but virtually unchanged. The Nasdaq gained +0.06% while the S&P500 eased by -0.19%. The Dow Jones slipped 0.13% down, losing 23.65 points, on the back of Apple (NASDAQ: AAPL) that dropped more than 3% ahead of its earnings report today, after the close of the U.S. stock exchange. The company fell short of forecasts slightly in July for the Q2 earnings - $1.85 versus $1.87 expected - and the stock suffered losses more than 11%, thus the traders are more conservative now. The following worst perform stock was the Chevron Corp (NYSE: CVX) that releases its earnings report by the end of the week and dropped more than 2.6% on Monday.

Economic Indicators

Today the spotlights are the first estimate for the UK GDP growth in the third quarter, the U.S. Durable goods for September and the U.S. consumer confidence for October. In the morning, the UK GDP is forecasted be released and show that the UK economy expanded by 0.6% slightly slower than 0.7% the quarter before, on a quarterly basis. The year over year indicator is expected to have remained unchanged and show stagnant growth.

Going to U.S. durable goods orders are forecasted to show a notable improvement in September but still contracting by -1.5% instead of expanding. The ex-transportation figure, however, is anticipated to have advanced by 0.1% from -0.2% in August. October’s preliminary services PMI is expected to remain unchanged. Overnight, Reserve Bank of Australia will release the country’s inflation rate for Q3, the RBA trimmed inflation rate and a while later the RBA annual report.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.