Technical Bias: Bullish

Key Takeaways

US dollar dumped post FOMC meeting minutes despite positive indications from the Fed members in the minutes released.

Euro breaks key resistance against the US dollar to trade higher.

EURUSD support seen at 1.3620-30 and resistance ahead at 1.3660.

The Euro moved lower against the US dollar post FOMC meeting minutes release, but later the reversal in U.S. yields took the US dollar lower against all major currencies, including the Euro.

Technical Analysis

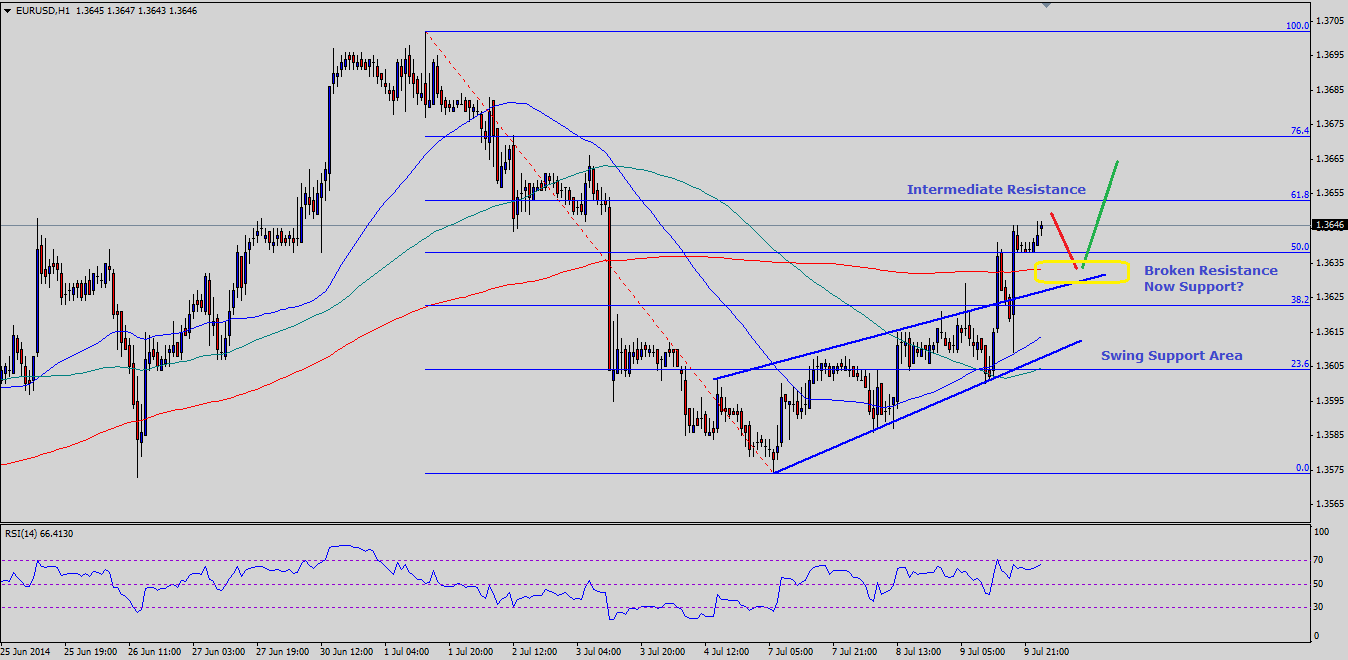

There was a critical triangle forming on the hourly timeframe for the EURUSD pair, which was holding the upside in the pair. Moreover, the 200 hourly simple moving average (SMA) was sitting just above the highlighted triangle, which was adding to the bearish pressure. However, the Euro buyers managed to break both barriers and closed above the crucial 1.3630 resistance zone. This particular break has set the tone for additional gains in the pair. If the pair moves a bit lower from the current levels, then the broken resistance zone might act as a support around the 1.3630 level, which also coincides with the 200 hourly SMA. If buyers fail to hold the mentioned support level, then a move back towards an important swing support area at 1.3600 is possible in the near term.

However, the chance of a bounce from the 1.3630 level is quite high, and if that happens, the pair might challenge the 61.8% fib retracement level of the last drop from the 1.3702 high to 1.3574 low. Any further strength might take the pair towards the last high of 1.3702.

French CPI and ECB Monthly Report

Today during the London session, the French Consumer Price Index (CPI) will be released by the French National Institute for Statistics and Economic Studies. The forecast is slated for a small rise of 0.2% in the French CPI. Moreover, the European Central Bank's (ECB) monthly report will also be published, which would highlight current and future economic conditions. Both these events can cause some swing moves in the Euro.

Overall, as long as the pair stays above the 200 hourly SMA more gains are likely moving ahead.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.