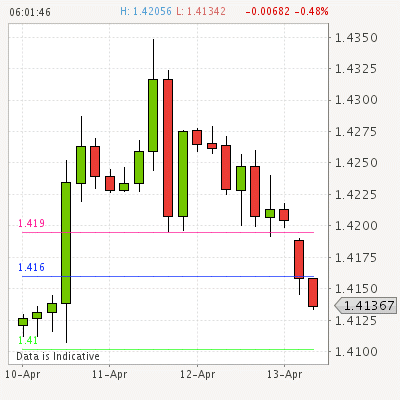

GBPUSD - We look to Sell at 1.4160 (stop at 1.4195)

GBPUSD - Broke the sequence of 3 positive daily performances. With the Ichimoku cloud resistance above we expect gains to be limited. Selling posted in Asia. The selloff has posted a correction count on the intraday chart. There is scope for mild buying at the open but gains should be limited. Further downside is expected and we prefer to set shorts in early trade. Our profit targets will be 1.4102 and 1.3980.

Risk Warning

Trading spot foreign exchange and futures on margin carries a high level of risk and may not be suitable for all investors. You may lose all your capital. Losses can exceed deposits. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in spot foreign exchange or futures you should carefully consider your investment objectives, level of experience, and risk appetite. If you are in any doubt about investment or the mechanics of such products, you should seek independent financial advice.

If you purchase a commodity option, your capital is at risk and you may sustain a total loss of the premium and all of the transaction cost.

If you purchase or sell a commodity future or sell a commodity option, your capital is at risk and you may sustain a total loss of the initial margin funds and any additional funds that you deposit with your broker to establish or maintain your position.

If the market moves against your position, your capital is at risk and you may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position.

If you do not provide the required funds within the prescribed time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account.

During certain market conditions, you may find it difficult or impossible to liquidate a trading position. This can occur, for example, when the market makes a "limit move". The placement of contingent orders by you or your trading advisor, such as a "stop-loss" or "stop-limit" order, will not necessarily limit your losses to the intended amount, since the market conditions may make it impossible to execute such orders.

The high degree of leverage that is obtainable through for example futures trading, options trading, Spread Betting, Binary Betting and CFD trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. This brief statement cannot disclose all the risks and other significant aspects of the commodity markets, including trading shares, currencies, and stock indices. You should therefore carefully study financial trading before you enter the financial markets with the view of buying and selling, including shorting, securities in the market place.

Before deciding to invest in spot foreign exchange or futures you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with spot foreign exchange and futures trading, and seek advice from an independent financial advisor (IFA) if you have any doubts. All information posted on this website is of our opinion and the opinion of our visitors, and may not reflect the truth. Please use your own good judgment and seek advice from a qualified consultant or IFA, before believing and accepting any information posted on this website.

Your capital is at risk.

Losses can exceed deposits

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.