Good morning from beautiful Hamburg and welcome to our first Daily FX Report for this week. Yesterday the Spanish government said that the nurse who contracted Ebola appears to have overcome the deadly disease. The United States will issue strict new guidelines telling American health workers to cover their skin and hair when dealing with Ebola. Furthermore a recent discovered comet has past Mars and gives mankind the chance to study an object from the farthest reaches of space.

Anyway, we wish you a successful start into a new trading week.

Market Review – Fundamental Perspective

Last Friday the Dow Jones Index of shares climbed 1.6 percent and the Standard & Poor’s Index rose 1.3 percent. The ECB is going to take over as supervisor for the euro region’s top bank on November 4 and on October 26 it will announce which of Europe’s 130 largest bank have valued their assets properly and which have not, as well as whether banks need more capital to withstand another economic crash. Anticipation of the results have already affecting some bank shares.

The USD dropped for a second consecutive week for the first time since June as traders pushed out expectations for U.S. interest-rate increases to the end of 2015 with global economic growth faltering. The EUR/USD strengthened 1.1 perecnt to 1.2761, the largest weekly rose in six months. Beyond that investors sought a refuge which lead to a rising JPY versus its most major currencies. The USD/JPY declined to a five week low and was at 107.10. The EUR/JPY appreciated to 0.3 percent to 136.30 and the GBP/USD traded at 1.6080. Concerns that the global economy is loosing momentum roiled the stock and bond market last week. Today France’s finance and economy minsters will fly to Berlin and will try to convince the Germans of their plans to improve competitiveness and to press for more investment. Germany itself cut its forcast to 1.2 percent from 1.8 percent, and reduced its estimate for next year. China will set an economic growth target of about 7 percent for 2015, tolerating the weakest expansion in a generation as leaders fight against debt risks and imbalances. Nevertheless Bank of England’s chief economist said yesterday in an interview that investors have over-reacted to signs of economic slowdown.

Daily Technical Analysis

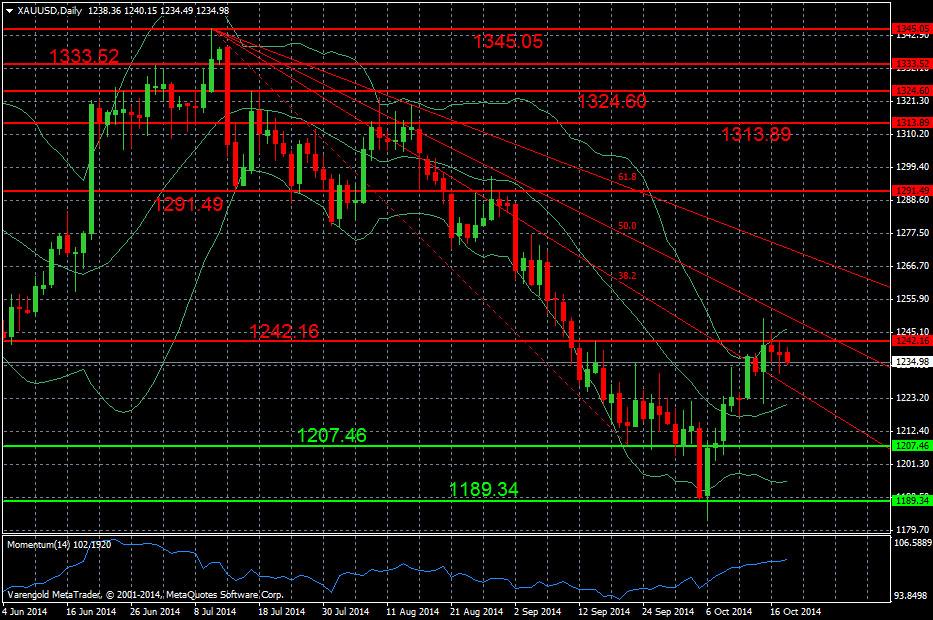

XAU/USD (Daily)

At the support level around 1189.3 the bulls took control of Gold and started a recovery which came recently to an end at the resistance level around 1242.1. Now the XAU/USD is tackling with this level while it is close to the highest Bollinger band. The Momentum is Further decrease might be seen if the pair fails to enter the upper channel of the fan by crossing the close resistance level.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.