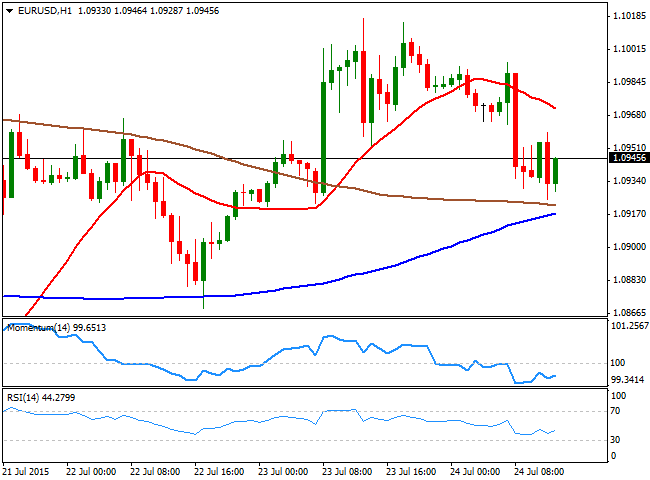

EUR/USD Current price: 1.0946

View Live Chart for the EUR/USD

The EUR/USD pair trades near a daily low established at 1.0924, as the dollar got a boost from nose-diving commodities. The greenback strength started in Asian hours, following the release of poor Chinese manufacturing data, and accelerated with the European opening, as local manufacturing and services PMIs disappointed. In fact, the EU region numbers remained in expansionary levels, although the small tick lower from the previous month reading weighed over an already weak EUR. With US manufacturing and housing data ahead, the EUR/USD pair presents a limited intraday bearish tone, as in the 1 hour chart, the 20 SMA heads lower above the current level whilst the technical indicators are aiming to recover, but remain below their mid-lines. In the 4 hours chart, however, the downside seems more constructive as the technical indicators maintain strong bearish slopes below their mid-lines, whilst the price struggles around a bullish 20 SMA. The pair has an immediate support at 1.0920, with a break below it required to confirm additional declines towards the 1.0830 region.

Support levels: 1.0920 1.0875 1.0830

Resistance levels: 1.0950 1.1000 1.1045

GBP/USD Current price: 1.5481

View Live Chart for the GPB/USD

The GBP/USD pair sunk to 1.5466 this Friday, accelerating lower after breaking the key 1.5500 figure. The pair has bounced some from the 61.8% retracement of its latest bullish run at 1.5460, but consolidates below the mentioned 1.5500 level ahead of the US opening, looking for the most weak. Technically, the 1 hour chart shows that the 20 SMA continues to head lower well above the current level whilst the technical indicators lack directional strength in negative territory. In the 4 hours chart, however, the technical indicators maintain their sharp bearish slopes, despite being near oversold readings, supporting another leg lower, particularly on a break below 1.5460.

Support levels: 1.5460 1.5420 1.5385

Resistance levels: 1.5500 1.5545 1.5590

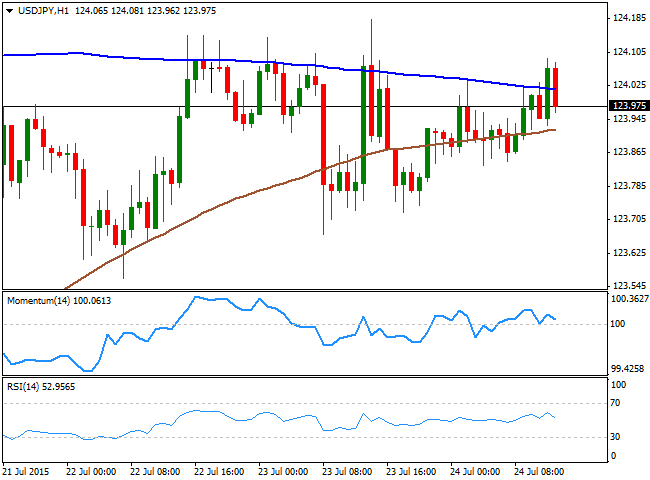

USD/JPY Current price: 123.97

View Live Chart for the USD/JPY

Little progress, below 124.00. The USD/JPY pair continues to trade in a tight intraday range, having advanced up to 124.09 this Friday, contained once again by strong selling interest around the level. Despite a generalized dollar strength, the upside seems quite limited, although upcoming US housing and manufacturing data, if positive, may trigger a firmer upward continuation. Short term, the 1 hour chart shows that the price is unable to extend beyond its 100 SMA, whilst the 200 SMA offers an immediate support in the 123.85 region, and the technical indicator turned south, but remain above their mid-lines. In the 4 hours chart, the bias is neutral-to-bullish, as the price holds above its moving averages that anyway remain flat around 123.30, whilst the technical indicators lack directional strength above their mid-lines. Some follow through beyond 124.45 is required to see the pair accelerating north, whilst only below the 123.30, the bears will be back in control.

Support levels: 123.85 123.30 122.90

Resistance levels: 124.20 124.45 124.90

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.