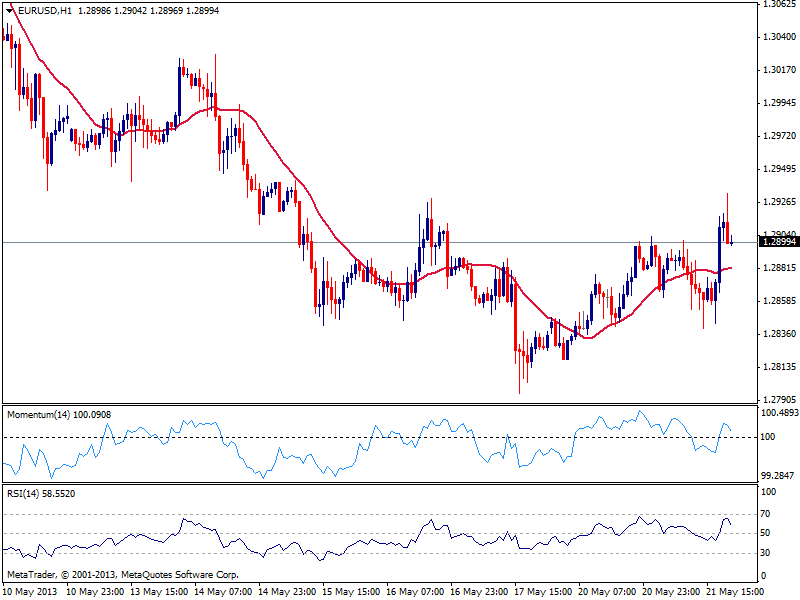

EUR/USD Current price: 1.2898

View Live Chart for the EUR/USD

Investors are eager to find out what next QE chapter will bring to the table, after today’s words from Dudley and Bullard, that tend to diminish chances of an end for quantitative easing. With Bernanke offering testimony before the Joint Economic Committee and FOMC Minutes to be released tomorrow, comments were relevant enough to hit the greenback. But the true is that the dollar began its slide before the comments, and after being on demand for most of the European session.

The EUR/USD reached a daily high of 1.2932 after the latest speech, as stocks soared again on hopes QE won´t see an end anytime soon. Sellers however forced the pair to retrace back towards current levels; as for technical readings the hourly chart shows indicators above their midlines although losing upward potential, while price stands above 20 SMA. In the 4 hours chart there is a quite limited upward momentum, although technical readings maintain a pretty neutral stance. Having found buyers around 1.2840, the pair will likely range in the 1.2840/1.2950 area ahead of the FED, while clarifications on QE status will decide the trend from then on.

Support levels: 1.2885 1.2840 1.2810

Resistance levels: 1.2920 1.2950 1.3000

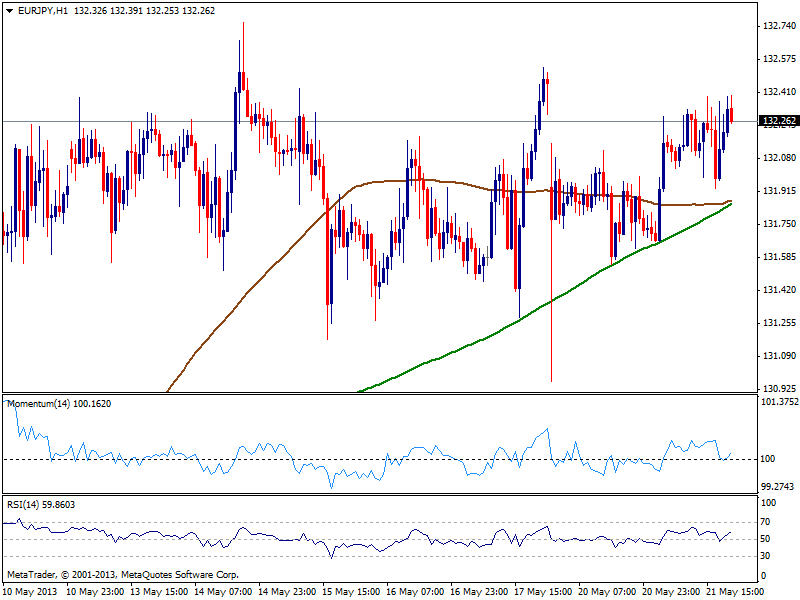

EUR/JPY Current price: 131.26

View Live Chart for the EUR/JPY (select the currency)

Slightly higher on the day, the EUR/JPY traded as low as 131.92 before bouncing with local share markets. Still yen sellers will have to face BOJ economic policy decision today, and their determination will be challenged, as no changes are expected, neither new announcements: can the yen continue falling after Amari’s words over the weekend, and an on hold stance? The fact that 200 SMA in the hourly chart is now along with 100 one in the 131.84 area suggest there was not much buying interest around, over the last few days, increasing downside risk. A break below this support should lead to a quick test of next and stronger one around 131.40 while if below this last, panic can take over the pair and push it all the way down to 130.00 over the upcoming sessions, without really affecting the long term bullish trend.

Support levels: 131.60 131.10 130.40

Resistance levels: 132.00 132.40 132.90

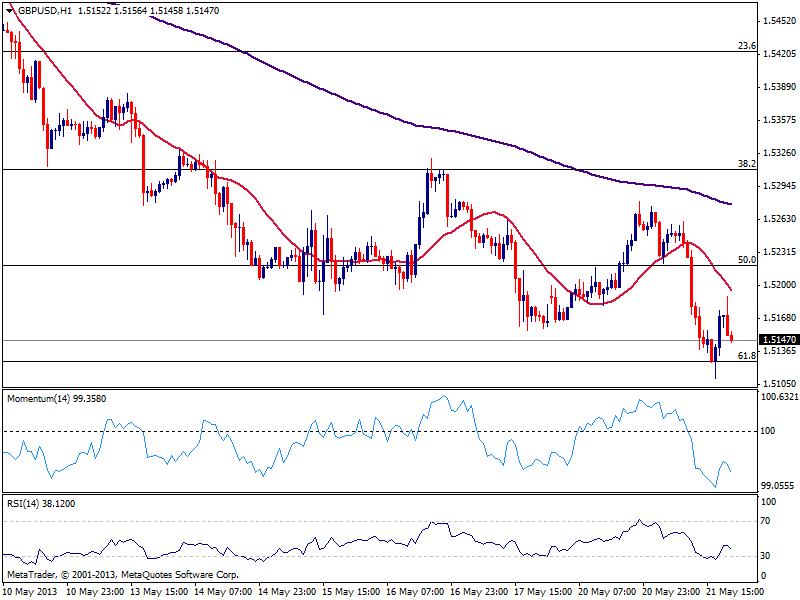

GBP/USD Current price: 1.5147

View Live Chart for the GBP/USD (select the currency)

GBP/USD fell to 1.5111, and was poised to extend its slide before dollar selling pushed the pair back higher, towards 1.5189. Worse than expected UK inflation readings early Europe, are far from Pound positive, and risk of further slides is still high: the hourly chart shows latest spike higher was capped by a bearish 20 SMA, while indicators are heading back south in negative territory after correcting extreme oversold readings. In the 4 hours technical readings maintain a bearish tone although without momentum at the time being: price needs to break below 1.5120/30 Fibonacci area to confirm further slides ahead, with 1.5050 still at sight.

Support levels: 1.5130 1.5090 1.5050

Resistance levels: 1.5180 1.5210 1.5250

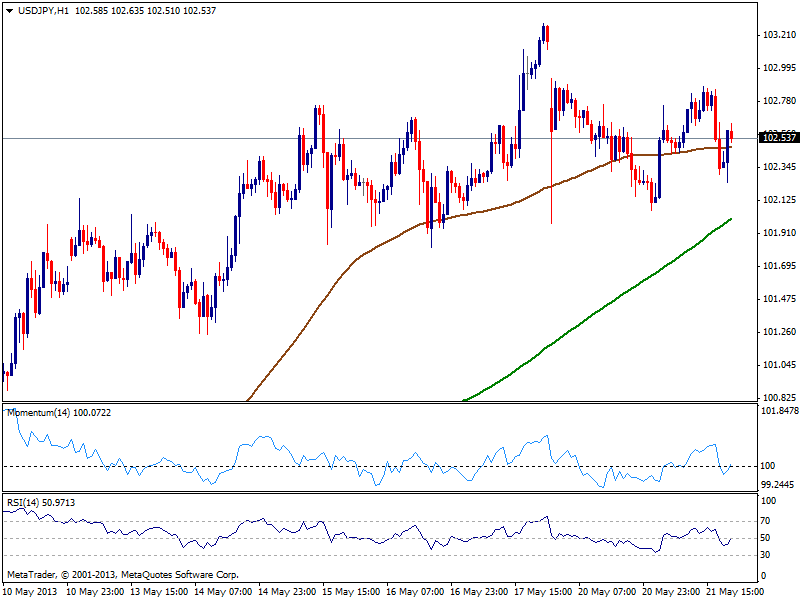

USD/JPY Current price: 102.53

View Live Chart for the USD/JPY (select the currency)

The USD/JPY maintains a quiet range, finding buyers on dips towards 101.80/102.00 area, but unable to take over the 103.00 level. With the BOJ and the FED in the next 24 hours, the pair is expected to wake up from current lethargic and may be able to give a clearer picture of whether a top is or not, in place. As for the short term, the hourly chart shows price struggling to hold above 100 SMA while 200 one slowly approaches to the shorter one, reflecting less buying interest around. In bigger time frames, technical readings are slowly turning south but buyers are still aligned around 101.25 past week low and key support to break to confirm a stronger downward correction.

Support levels: 102.40 102.10 101.80

Resistance levels 102.93 103.20 103.60

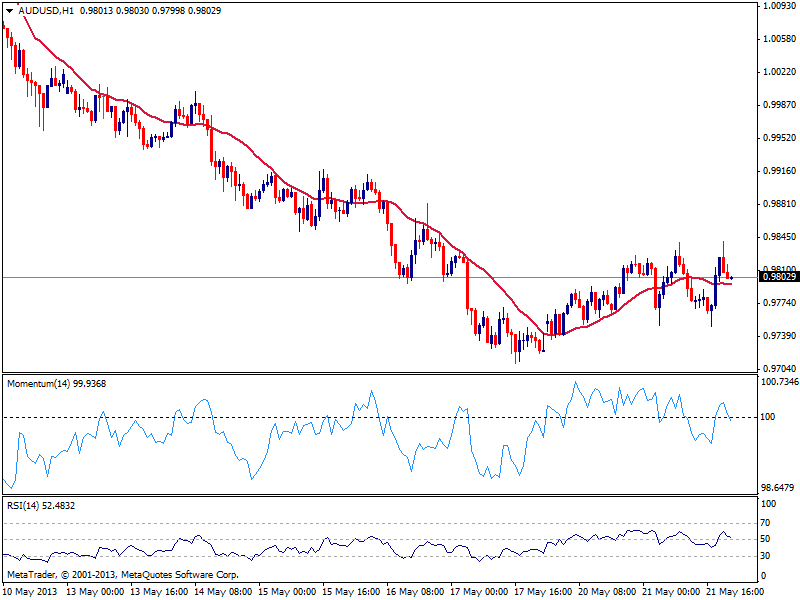

AUD/USD: Current price: 0.9802

View Live Chart for the AUD/USD (select the currency)

The AUD/USD remains capped below 0.9840 daily high, from where the pair retraced twice already this Tuesday, setting a short term double roof. Finding buyers around 0.9750, the pair remains biased lower, as short term time frames show indicators heading back lower around their midlines, while price hovers around 20 SMA. Further recoveries and to call an interim bottom, will depend on the ability of the pair to regain at least 0.9900 this Wednesday.

Support levels: 0.9750 0.9710 0.9660

Resistance levels: 0.9800 0.9840 0.9880

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.