Higher stockmarkets overnight will give risk sentiment a positive lead during the Asian trading session. After failing to consolidate its break below 1.0200, the danger for the AUD/USD would seem to be a topside short-squeeze and EUR/JPY may also gather enough momentum to test previous lows at 122.50.

Higher stockmarkets overnight will give risk sentiment a positive lead during the Asian trading session. After failing to consolidate its break below 1.0200, the danger for the AUD/USD would seem to be a topside short-squeeze and EUR/JPY may also gather enough momentum to test previous lows at 122.50.

The recent EUR/USD sell-off looks to be losing momentum and with Sovereign bids ahead of the psychologically important 1.3000 level, it’s not surprising to see some buyers emerging after a 700 pip fall. Obviously there is quite considerable scope for a bullish retracement (see chart) but again much of what happens in Asia will depend on EUR/JPY.

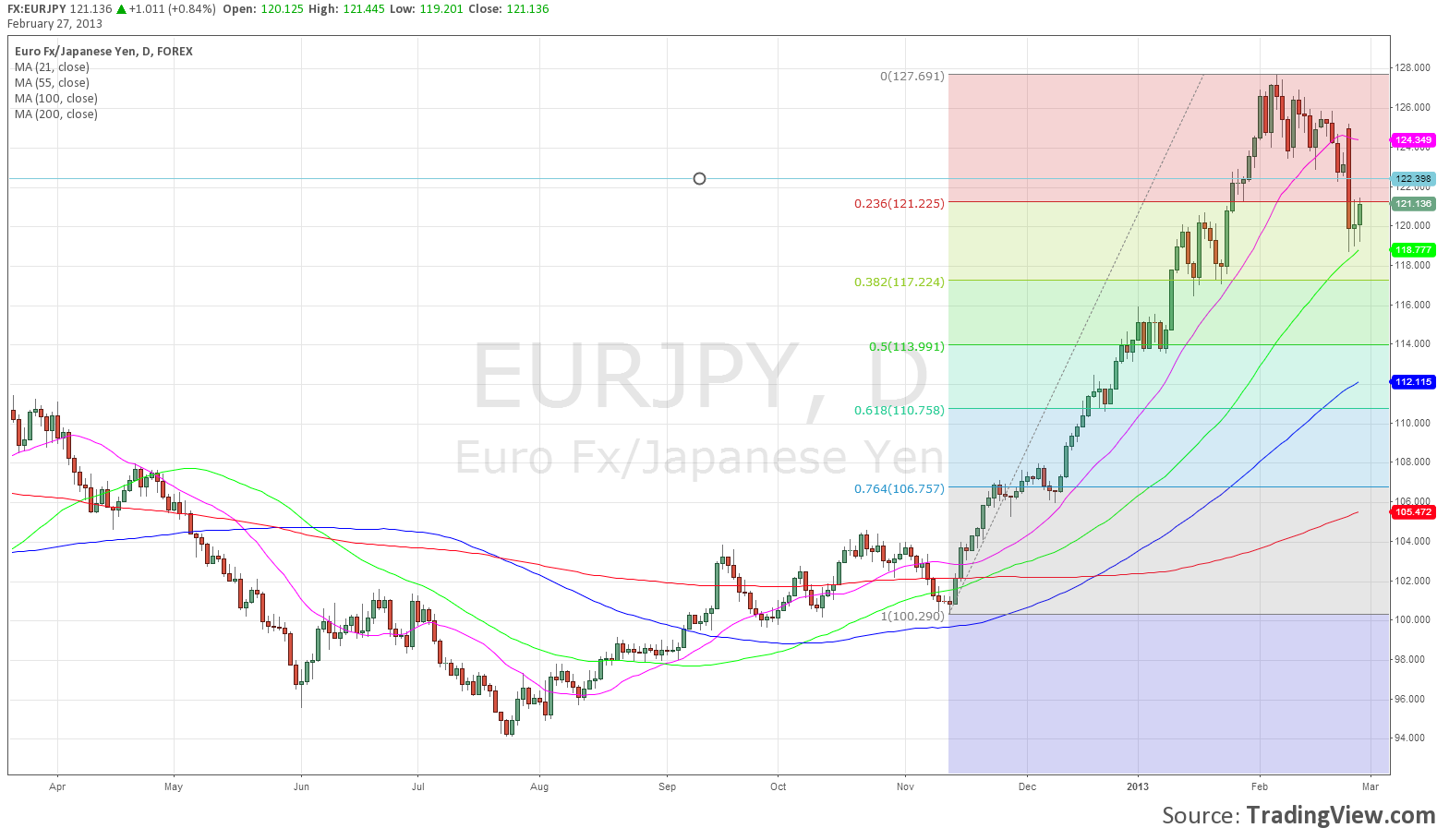

EUR/JPY looks like it has put in an interim top and is currently in retracement mode with a target at the 38.2% pull-back level near 117.20 (see chart). The Nikkei is likely to get a boost today from higher overseas markets and this should underpin JPY-crosses sentiment during Asian trade. Resistance levels start at prior lows near 122.50.

USD/JPY is back trading near its previous important support level at 92.25 and similar to the crosses, the bull trend is retracing and the question we need to answer is for how long and how far this retracement will go for. I still prefer the sell-rally play with an interim top in place near 94.50.

AUD/USD finally breached a large barrier at 1.0200 after some exceptionally high turnover but with more heavy support seen at 1.0150, in the form of barriers and Sovereign interest, the dip below 1.0200 was short and sharp. Stick to range trading mode here with edges at 1.0150/1.0350 but the danger on the day would seem to be to the topside. There is a raft of minor economic data which shouldn’t have any major effect.

EUR/CHF has bounced nicely off trendline support at 1.2125 but should hit solid resistance at previous lows near 1.2260.

Cable is still trying to close last Friday’s “Moody’s” gap to 1.5250 and is supported by option interests ahead of 1.5050.

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.