In today’s edition of my Forex Trading Guide, let’s zoom in on another potential market-mover for the week: the U.K. retail sales release. Let’s stick to our usual routine of understanding why this report is important, what happened last time, what is expected, and how the pound might react, shall we?

Why is this report important?

The U.K. retail sales report measures the month-on-month growth of sales on the retail level. It basically measures whatever British consumers spend their hard earned pounds on. This includes household goods, clothing, footwear, fuel and other consumer goods.

Many traders and analysts pay attention to the report, because it is reflective of the current state of the economy. If sales growth is high, people are spending and the economy should be booming. If growth is stagnant or even negative, it could mean that the economy is struggling.

What happened last time?

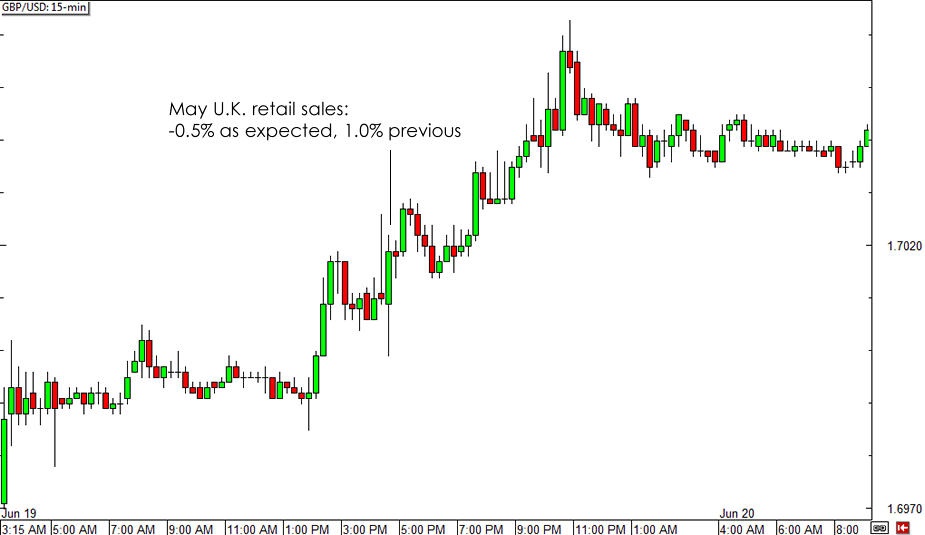

For the month of May, the U.K. reported a 0.5% decline in retail sales, erasing part of the previous month’s 1.0% gain. Prior to that, the U.K. economy has chalked up three consecutive months of stronger than expected consumer spending figures.

Despite the negative reading for May, GBP/USD still made a strong climb after the report was released, as the actual figure came in line with expectations.

GBP/USD 15-min Forex Chart

Some say that the May figure wasn’t so bad, considering the correction was anticipated to follow three months of strong data. At that time, pound bulls were also feeling giddy about BOE rate hike prospects for the year, as the central bank’s upbeat policy meeting minutes were released the previous day.

What is expected this time?

For the month of June, U.K. retail sales might show a 0.2% rebound, enough to recover some of the losses in the previous month. However, many are still crossing their fingers for a huge upside surprise, as the U.K. economy has printed consistent improvements in employment.

Bear in mind that the BOE meeting minutes are also set to be printed the day before the U.K. retail sales release, which suggests that any changes in the MPC’s bias could also influence how traders react to the consumer spending figures.

How might the pound react?

A stronger than expected reading, perhaps one that is more than enough to erase the 0.5% drop in May retail sales, could allow the pound to resume its rallies against its forex counterparts. A quick review of pound pairs’ price action would show that retracements were made recently, yet the trends still appear to be intact.

A much weaker than expected report, on the other hand, could lead to deeper pullbacks for the pound as this could undermine any upbeat remarks from the BOE. If the actual figure simply hits the mark though, the pound might still have a chance at regaining ground later on.

If you’re planning on trading the news, keep in mind that a bit of consolidation might be seen hours before the London session, creating a potential Asian box play. Price tends to start moving during the London open, as some traders are eager to place their bets, and volatility could pick up during the actual release. Stay on your toes!

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.