In today’s edition of my Forex Trading Guide, let’s take a look at the upcoming monthly GDP release from Canada and how we can make pips off this event.

Now Canada’s monthly GDP report doesn’t usually trigger a strong reaction from the Loonie unless it’s for the last month of the quarter. In other words, even though Canada prints it growth figure on a monthly basis, traders often save their reaction for the summed up quarterly reading!

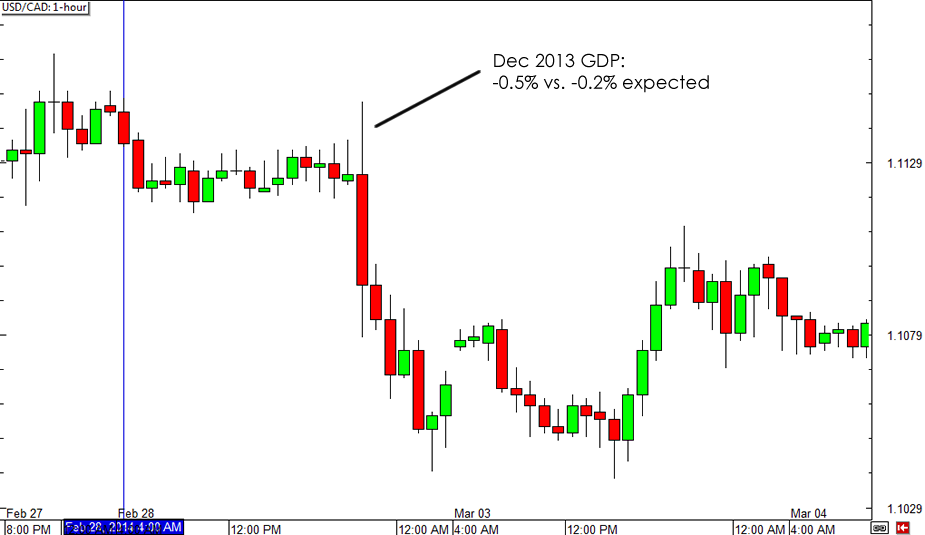

Take a look at the reaction to the December 2013 GDP figure, for instance. For that month, the Canadian economy contracted by 0.5%, worse than the estimated 0.2% GDP decline. However, as you can see from the chart below, the Loonie still reacted positively to the report since it effectively led to a 0.7% quarterly GDP Figure for Q4 2013, the same pace of growth recorded for the previous quarter.

USD/CAD initially spiked higher as traders reacted to the negative monthly reading but soon switched to long CAD positions upon finding out that Canada sustained its quarterly economic expansion.

For tomorrow’s GDP release, Canada is expecting to see a mere 0.1% uptick for March, following the previous month’s 0.2% expansion and January’s 0.5% growth figure. Analysts estimate that Q1 GDP could be up by 1.7% to 1.9%, mostly due to a pickup in oil and gas mining. If the Canadian economy winds up printing strong GDP readings, the Loonie might be in for another rally against its forex counterparts.

Keep in mind that the Canadian dollar has been surprisingly resilient in the past few trading weeks despite a few disappointments in Canada’s economic data here and there. This suggests that the Loonie might be strong enough to shrug off a weaker than expected GDP reading as it appears to be drawing support from other market factors, such as the surge in oil prices or the positive sentiment for the U.S. economy.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.