The GBP/USD pair weakened on Tuesday on the back of a decline in the UK inflation in February and a slight rebound in the US inflation. The upbeat US PMI manufacturing data and the New homes sales data also weighed over Pound. Moreover, UK inflation came-in at 0.0% year-on-year for the first time on record. The increased threat of deflation coupled with the fact that Pound is trading at multi-year highs against the EUR, could actually push the Bank of England to ease further. In my opinion, so far markets speculated whether the BOE would delay the interest rate hike, however, with just one more set of disappointing inflation figures, markets would start betting on whether the BOE would cut rates further.

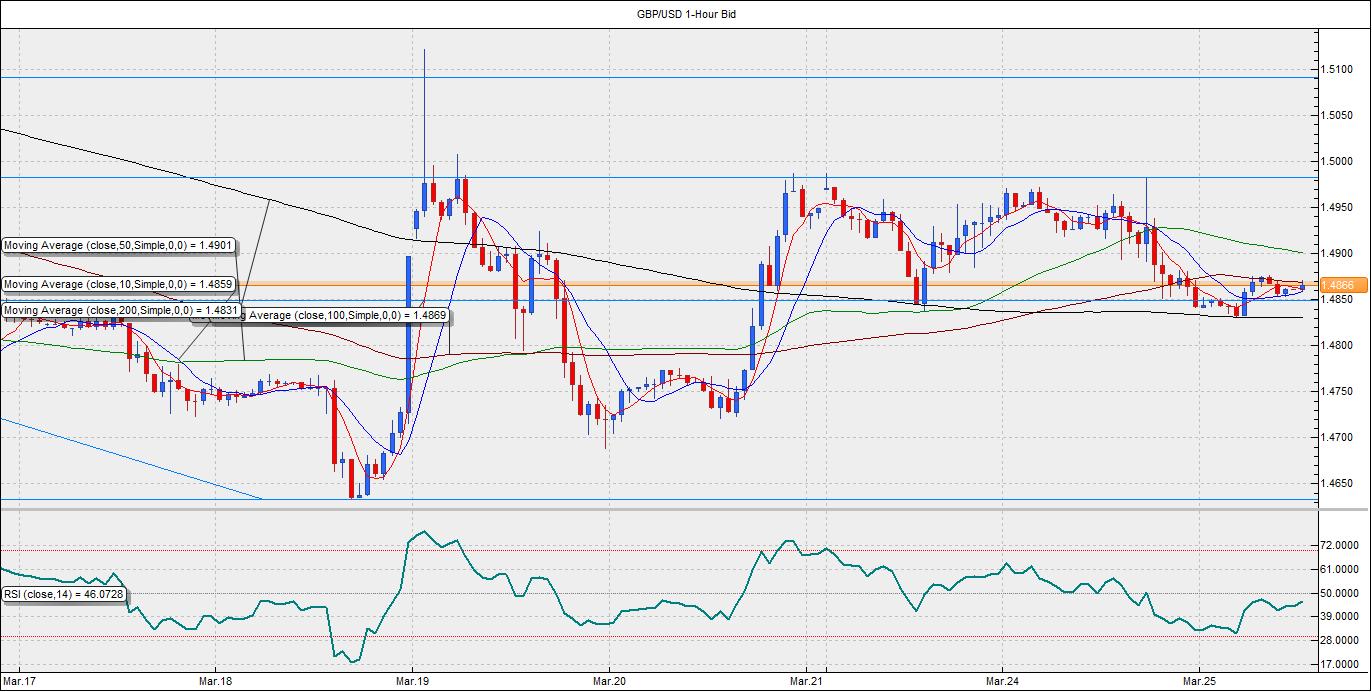

On the charts, the pair is currently trading few pips above the 23.6% Fib retracement (1.5550-1.4633) located at 1.4849. The hourly chart shows, the pair bounced back from the 200-MA located at 1.4831, although gains are being capped around the 100-MA located 1.4869. Given the daily close below 1.4850 on Tuesday, and the bearish daily and hourly RSI, the pair is likely to be sold on rallies till 1.49. The sell-off would be intense once the pair breaks below 1.4849 levels. In such a case, the pair could drop to 1.48 – 1.4758 levels.

EUR/USD Forecast: Head and Shoulder on hourly chart

The gains in the EUR/USD pair were quickly erased on Tuesday after the data in the US showed a rebound in inflation. Initially a decline in the inflation to Zero levels pushed the EUR/USD pair near 1.1030 levels, however the month-on-month rebound in inflation was enough to trigger the bets that the Fed may find comfort in the rebound in inflation, pushing it closer to a rate hike. Consequently, the EUR/USD was pushed lower to 1.0890 levels. Moreover, the markets have priced-in the upbeat PMI reports out of the Eurozone, thus a slight up move to 1.0960 levels could be seen on a better-than-expected German IFO reading. On the other hand, the disappointing IFO print could push the pair well below 1.09 levels.

On the hourly charts, the pair has breached a smaller rising trend line in the previous session. Meanwhile, the bigger rising trend line support is seen at 1.0897. The pair could also form a head and shoulder pattern with the neckline support at 1.0873 levels. Given the bearish hourly RSI, the pair could test the support at 1.0897. A weaker-than-expected IFO print could drive the pair to the head and shoulder neckline support at 1.0873; a break below the same could happen in case the US durable goods data beats expectations. On the other hand, immediate gains appear capped around 1.0960-1.0970 levels.

USD/JPY: Upbeat US data saved the day

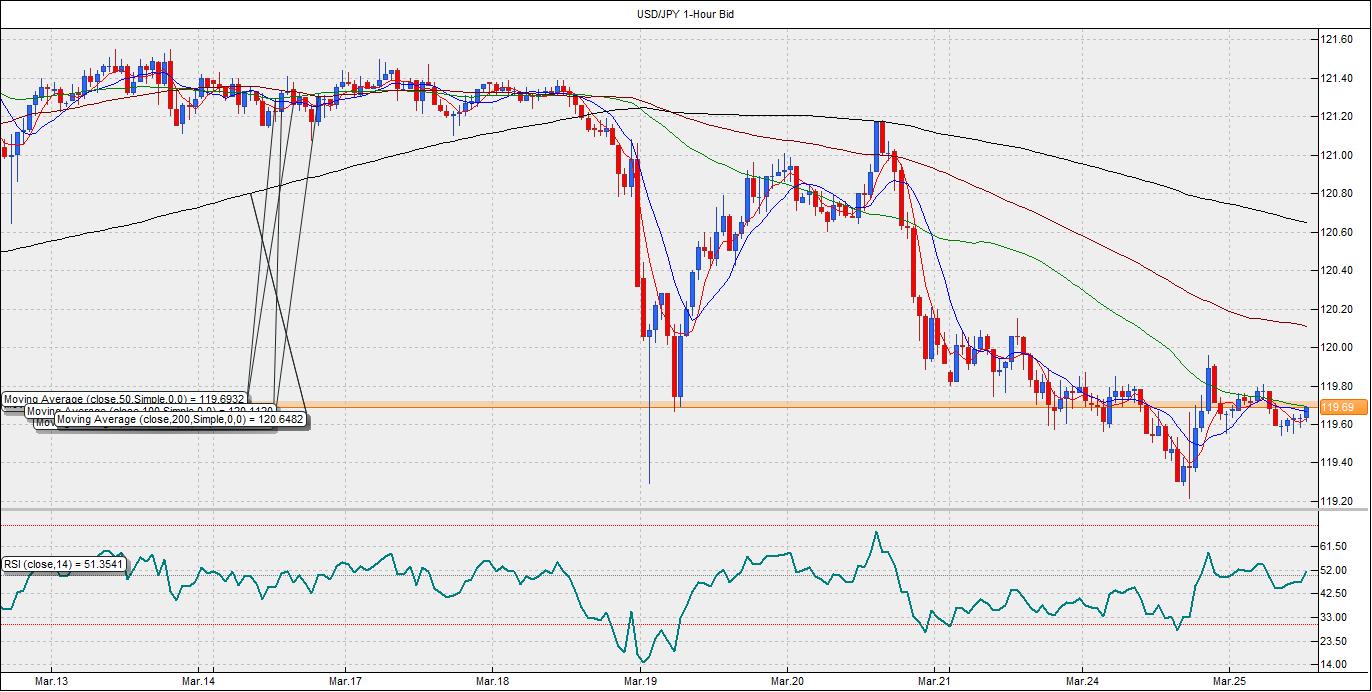

The bleeding in the USD/JPY pair was halted at the 100-DMA located at 119.22 on Tuesday after the release of an upbeat economic data in the US. The US dollar rallied on signs of a rebound in the inflation. Meanwhile, the Treasury yields told a different story. The 10-year collapsed to 1.87%, as the CPI growth to 0%, from -0.1%, is unlikely to push Fed into action. Still, the USD/JPY recovered losses to finish slightly higher at 119.77 levels. However, the pair may be catching up with the weak Treasury yields, as it trades lower at 119.64. A better-than-expected durable goods orders report in the US could push the pair higher to 119.90-120.00 levels. However, a big miss on the data could drive the pair lower to its 100-DMA at 119.22 levels. Further losses could be seen in case the US equity markets take a dip.

As per the daily chart, the pair faced rejection at the 5-DMA located at 119.82. On the hourly chart, a break above the 50-MA at 119.69 could open doors for a re-test of 119.80-120.00 levels. However, the pair is likely to be sold on rallies till 120.00. Another failure to rise above 119.80-120.00 could drive the pair lower to 119.22-119.00 levels. On the other hand, a 4-hour close above 120.00 could push the pair higher to 120.60 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.