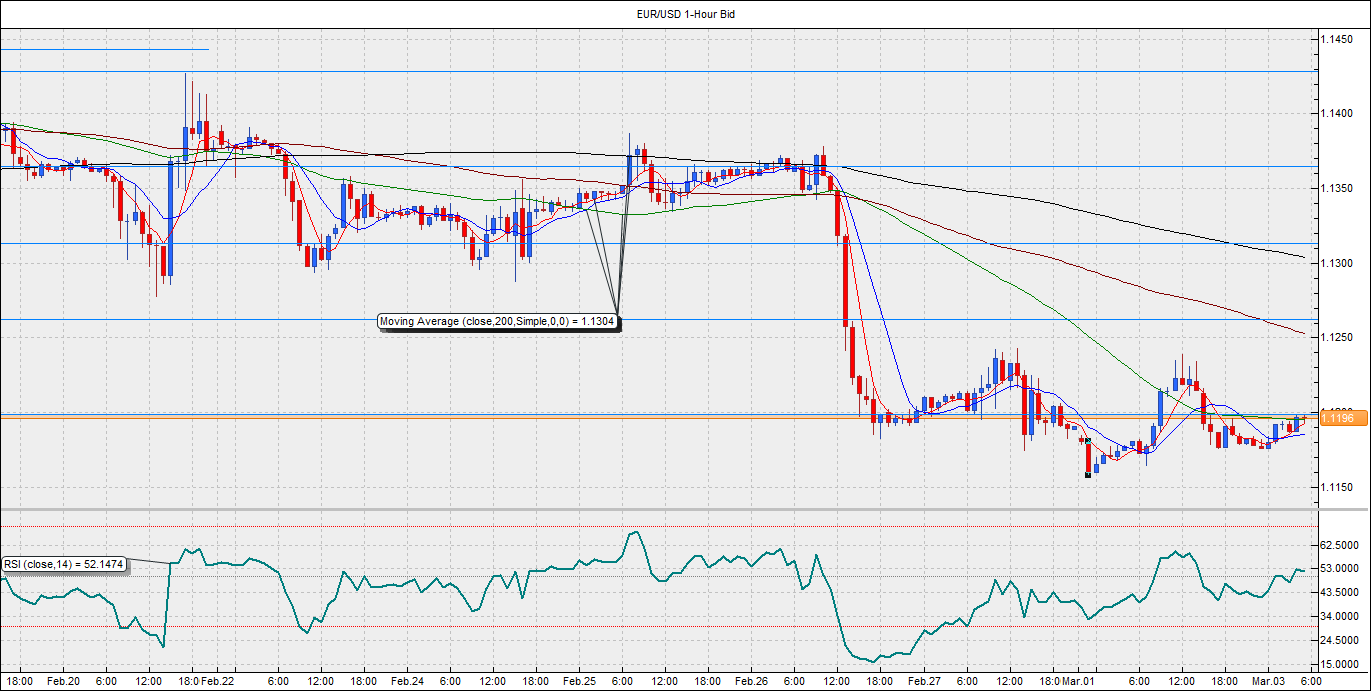

EUR/USD: Could rise to 1.1237, inverted head and shoulder on the hourly chart

The EUR/USD pair rose to a high of 1.1239 in the previous session, but failed to sustain gains above the 76.4% retracement (of 1.1096-1.1532) located at 1.12. The ECB President’s optimistic outlook on the Eurozone economy last week, coupled with the strong manufacturing PMI data released yesterday builds a strong case for an up move in the shared currency. Moreover, the strength in the US dollar contradicted the disappointing data – personal spending fell for the second month, while personal income, construction spending all disappointed expectations. Still the USD recovered, largely tracking the strength in the Treasury yields. Thus, a slight decline in the yields today could be enough to push the EUR/USD pair above 1.12 levels.

The inverted hammer candle on the daily chart supports a fresh move towards the hourly chart inverted head and shoulder neckline resistance at 1.1237. A break above the same could open doors for a target of 1.1316 levels. On the other hand, a failure to rise above 1.1237 could lead the pair down to 1.1158 levels. The growth in the German retail sales is seen slowing down to 2.6% year-on-year in Jan, compared to 4.8% in December. A better-than-expected print could help the pair rise above 1.1237 levels.

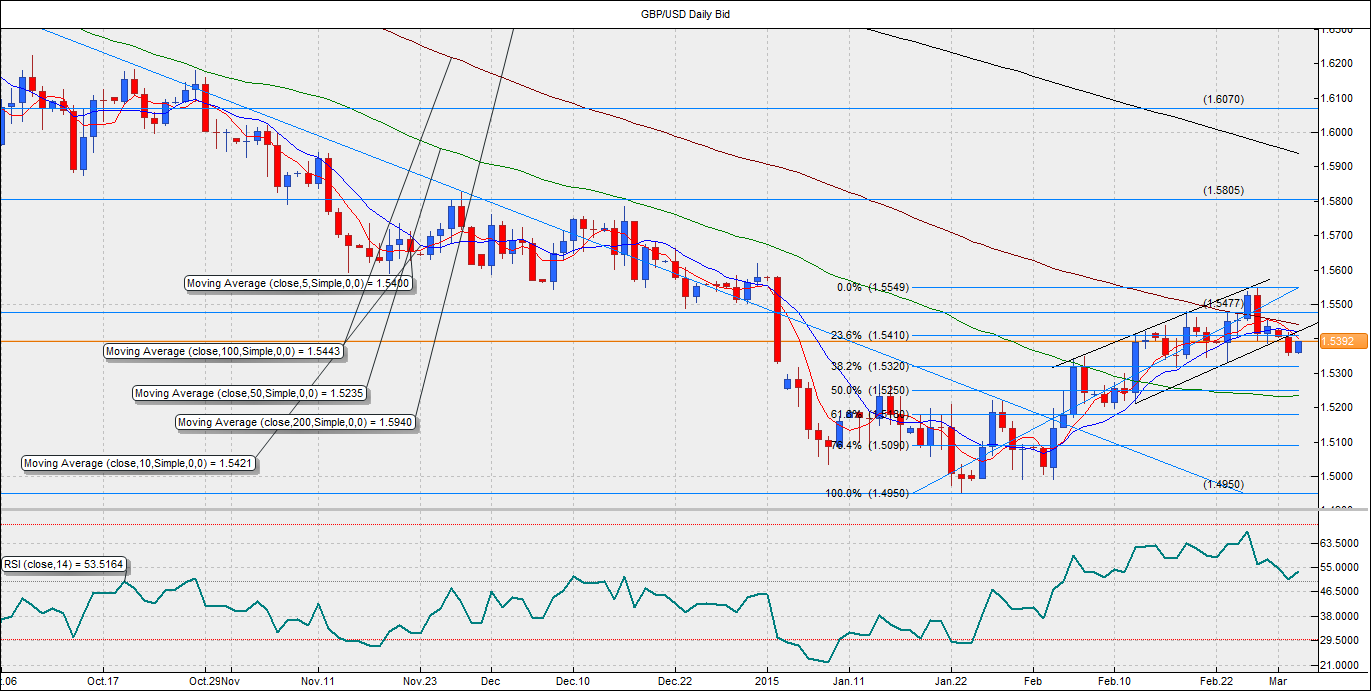

GBP/USD – Rising channel breached despite strong UK PMI

The pair ended the previous session lower at 1.5356; confirming a downside breakout from the rising channel seen on the daily charts. The British Pound weakened as the Gilt yields suffered losses as markets ignored the fact that the UK manufacturing PMI for February rose to a seven month high. On the contrary, a weak economic data in the US failed to weaken the treasury yields. Consequently, the pair dipped to 1.5350 as the bond yield spread remained in favor of the US dollar.

A minor recovery is being witnessed today as the pair trades higher at 1.5388. Multiple resistance are seen at 1.54 (5-DMA), 1.5409 (23.6% retracement of 1.4949-1.5550), 1.5420-24 (10-DMA and channel resistance), and 1.5443 (100-DMA). The pair could rise to 1.5400-1.5420 levels, whereby a fresh selling pressure can be anticipated. Given the bearish close despite an upbeat UK PMI data, the pair could drop back to 1.5350 levels from 1.54-1.5420. A break below 1.5350 could send the pair down to 1.5320 (38.2% retracement). The short term outlook stays bearish so long as the pair trades below 1.5478 (23.6% retracement of 1.7190-1.4949).

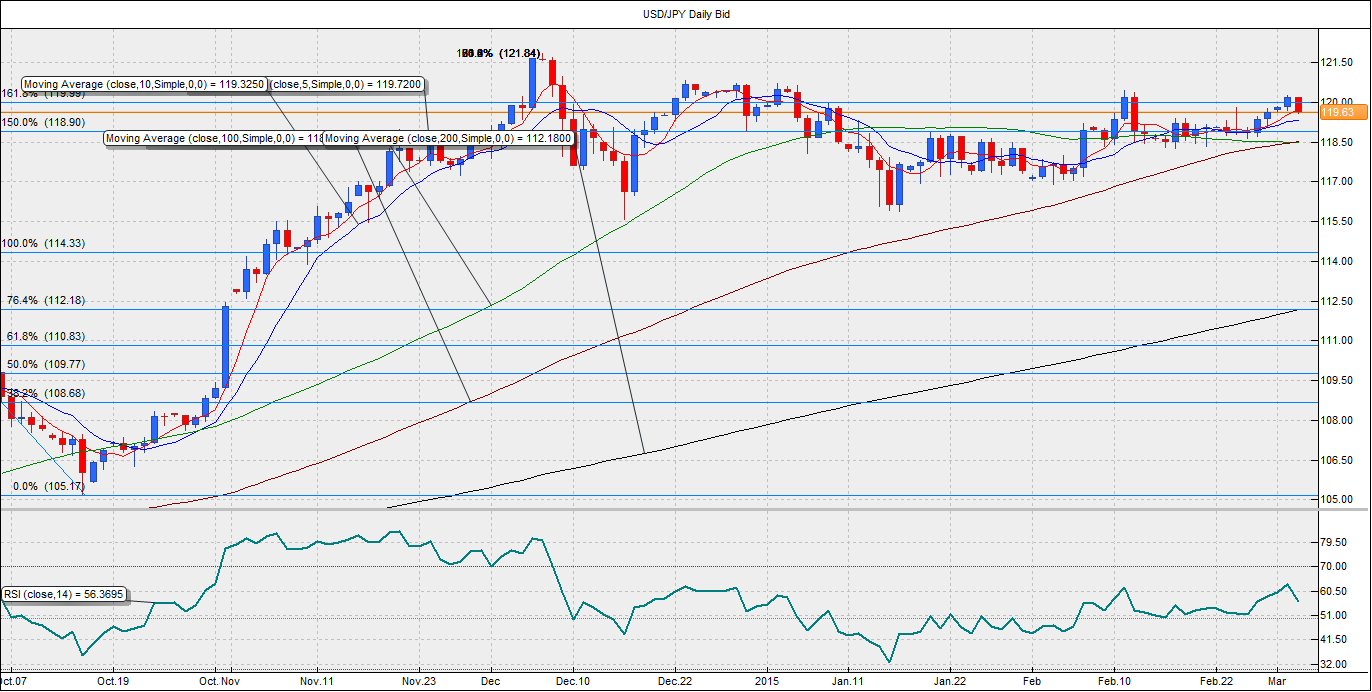

USD/JPY – Could extend the drop to 118.91

The pair rose above 120.00 levels in the previous session, although the pair fell back below the same during the Asian session as the 10-year Treasury yield in the US cooled-off from a high of 2.096% to 2.077%. The rise in the Japanese wages could have also triggered unwinding of the long positions. Dealers also cited massive option expiration as the reason behind the move above 120.00.

The drop witnessed today to the 5-DMA located at 119.72 could be extended further if the 10-year yields fall back to 2%. Moreover, the rise in the yields witnessed on Monday contradicted the weakness in the US data. Thus, there is a high probability that the yields could erase gains today, thereby pushing the pair down to 118.91 levels. The RSI on the 4-hour and hourly charts is bearish, indicating further losses in the pair. A minor up move to 119.85-119.95 could be seen, however, a fresh selling pressure can be anticipated around the same. Given the absence of the first tier economic data out of the US, the pair is likely to take cues from the Equity markets across the globe and the Treasury yields.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.