The €64,000 Question:

Yet another break down in talks between Greece and their European overlords bodes me to ask the question, is a Grexit actually a blessing for the Euro? Going one step further, does current EUR/USD strength reflect confidence in a deal or are the long term benefits of a stronger Euro without Greece driving trade?

Some brilliant quotes from IMF Chief, Christine Lagarde overnight:

“There is an urgent need for dialogue with adults in the room.”

“We can only arrive at a resolution if there is a dialogue. Right now we’re short of a dialogue.”

The current bailout for Greece expires on June 30 (yes, next Tuesday) when Athens is also due to repay the IMF around €1.6 billion. Most scary for markets craving certainty was Lagarde saying if the payment is not made on time, Greece will be declared to be in default and would disqualify itself from receiving any further IMF funds.

“There would be no grace period or possibility of delay to loan payments that are due on 30 June.”

With these quotes, The IMF has taken a stance that we haven’t yet seen. One of no more garbage. This highlights just how close to the end we are and a huge contributing factor to why trading in EUR/USD has been so unpredictable.

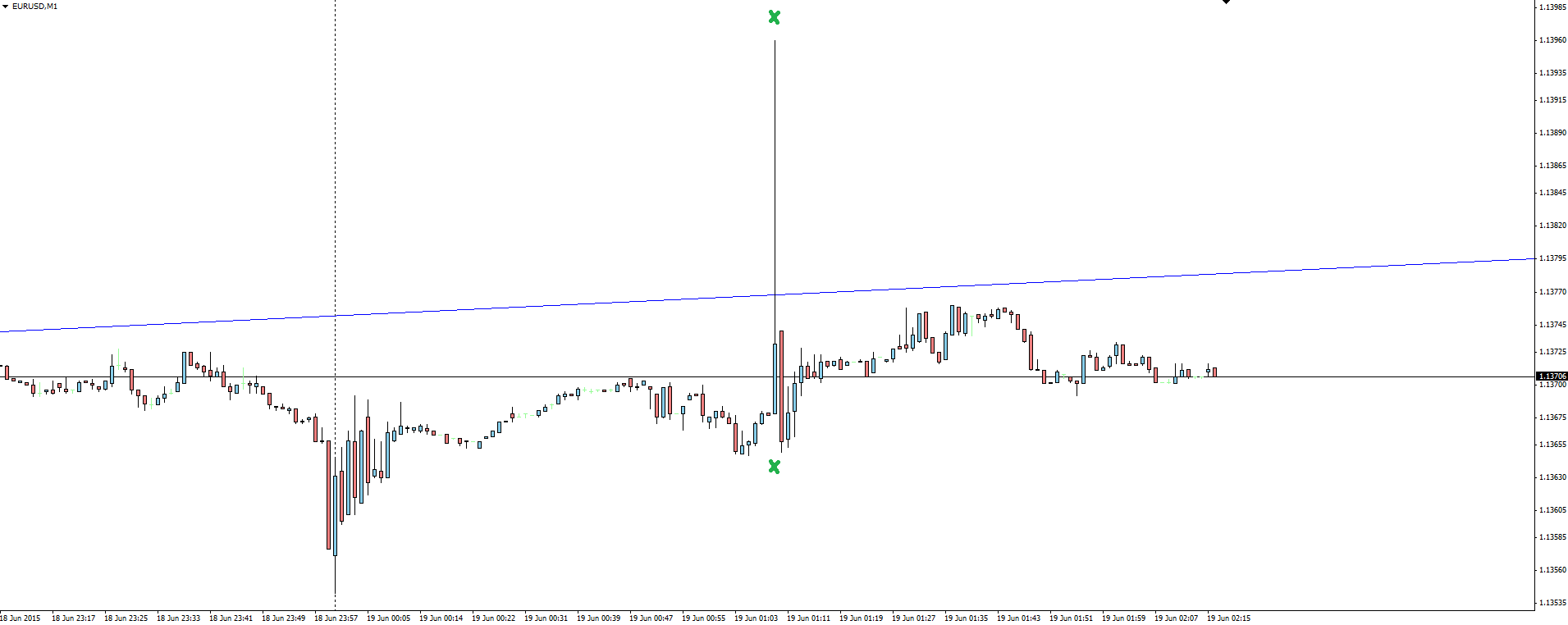

EUR/USD 1 Minute:

Take a look at the 1 minute price action of EUR/USD as already thin US/Asian session crossover trade was exacerbated by the current climate.

With uncertainty keeping the market not positioned one way or the other, any post event moves are unlikely to be fueled by the liquidation of positions but market depth is certainly going to be interesting. Heck, I’ve read analysts not being surprised to see 1000 pip EUR/USD SWINGS between parity and 1.2000 if Greece does in fact default and is forced out of the Euro. Insanity!

So no, I can’t answer either of the questions I asked at the top of this blog and anyone that tells you they can is lying. It’s all a wait and see.

On the Calendar Today:

Friday:

JPY Monetary Policy Statement

JPY BOJ Press Conference

CAD Core CPI

CAD Core Retail Sales

USD FOMC Member Williams Speaks

Chart of the Day:

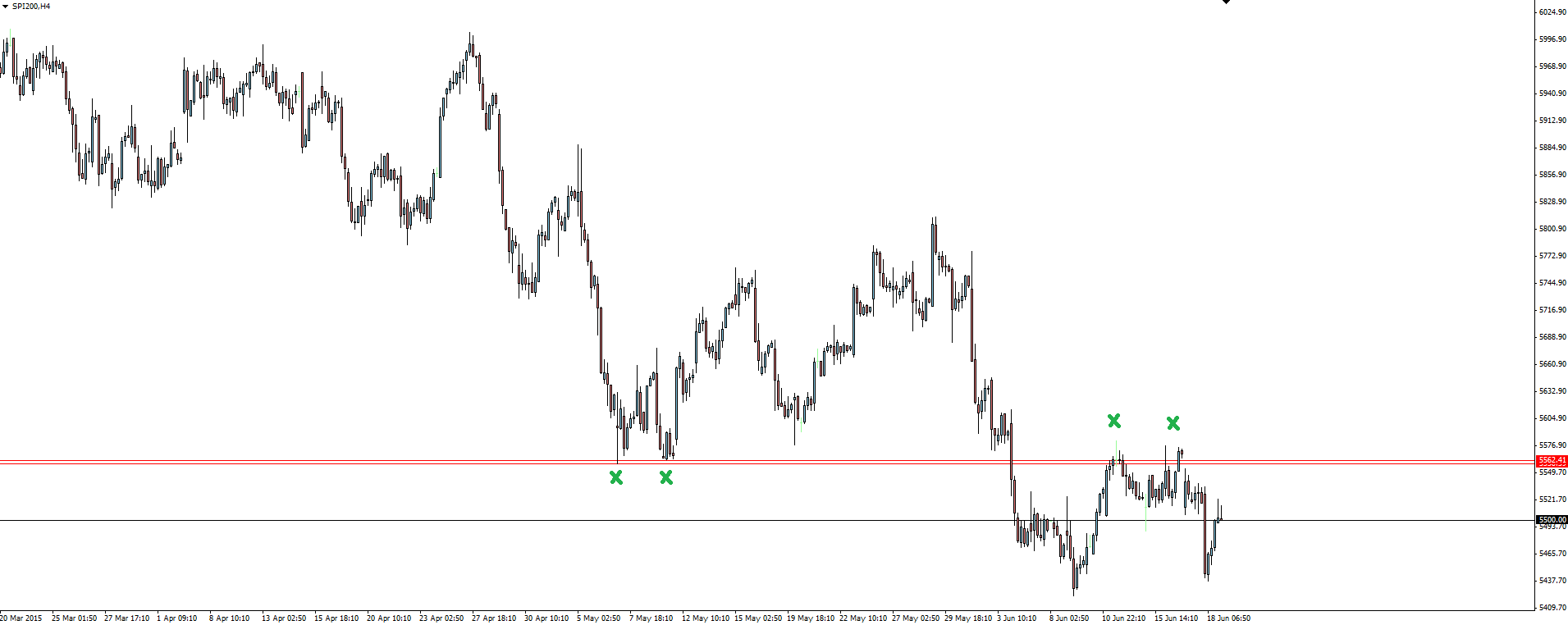

SPI200 4 Hourly:

A simple and effective technical setup on the Australian SPI200 which we brought up inside Friday week’s Morning View.

Zooming into the 4 hour chart, we can see after a major support level was broken, price retraced to cleanly re-test it as resistance. Textbook stuff on a market that not many outside of Australian futures traders generally trade. I highly recommend taking a look for yourself and adding this one to your watch list.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.