Market Brief

After rallying for the last two weeks, global equity markets falter as doubt rises. Most of Asian equity indices are now back to their pre-NFPs levels and investors are now wondering whether there is still some upside potential as China’s trade data showed the world’s second biggest economy is not the global growth driver it was used to be. Imports continue to fall dramatically with a contraction of 17.7%y/y in yuan term versus 16.5% expected and 14.3% in August. However, exports came in slightly better-than-expected, printing at -1.1%y/y versus -7.4% median forecast and -6.1% in the previous month. In the rest of the world, equity returns were already mixed yesterday with half of European indices trading in negative ground. In Wall Street, stocks were trading slightly higher in thin liquidity conditions but energy and materials stocks felt the heat from the collapse in commodity prices. This morning, metals are pairing losses: gold is down -0.68%, silver -0.60%, palladium -0.05% and platinum -1.13. Copper slides -0.90%, aluminium -0.95% while iron ore is down -1.83%.

Asian regional equity markets are mostly trading in negative territory on Chinese data. Japanese Nikkei fell 1.06% while the broader Topix index slid -0.79%. In mainland China, stocks are holding ground on encouraging Chinese exports figures with the Shanghai Composite up 0.11% while the Shenzhen Composite rose 0.91%. In Australia, the S&P/ASX fell -0.57%, in New Zealand stocks are up 0.23% while in South Korea the Kospi index edged down -0.13%.

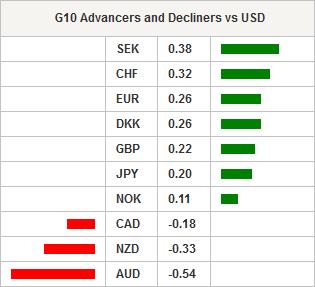

Commodity currencies erased partially previous gains - AUD/USD down 0.56%, NZD/USD down 0.48% while the Canadian dollar fell 0.34% against the dollar - driven by lower crude oil prices. AUD/USD has been unable to break the strong resistance standing at around $0.74. On the downside, the pair will find support at 0.7165 (low from October 8th), then 0.6937 (low from September 29th).

In Europe, equity futures are trading without direction, swinging back and forth between positive and negative gains. The Footsie edges down -0.02; the DAX is up 0.34%, while the SMI edges up 0.16%. In France, the CAC 40 falls -0.21%. Overall in Europe, equities edge down -0.19%.

EUR/USD is holding ground between 1.13 and 1.14 as investors await the US inflation report due on Wednesday. A support can be found at 1.1327 (Fib 38.2% on August-September debasement) while on the upside the 1.14 threshold is the closest resistance. A stronger one can be found at 1.15 (psychological threshold).

Today traders will be watching inflation figures from Sweden and the UK; German ZEW expectations; central banker speech: Bullard from the Fed, Haldane from the BoE and Wheeler from RBNZ.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 18244.06 | -1.06 |

| Hang Seng Index | 22633.46 | -0.43 |

| Shanghai Index | 3291.299 | 0.11 |

| FTSE futures | 6343 | -0.02 |

| DAX futures | 10132 | 0.34 |

| SMI Futures | 8679 | 0.16 |

| S&P future | 2007.6 | -0.16 |

| Global Indexes | Current Level | % Change |

| Gold | 1156.53 | -0.63 |

| Silver | 15.75 | -0.54 |

| VIX | 16.17 | -5.33 |

| Crude wti | 47.41 | 0.66 |

| USD Index | 94.8 | -0.04 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SZ Sep Producer & Import Prices MoM | -0.10% | -0.70% | CHF/07:15 |

| SZ Sep Producer & Import Prices YoY | -6.80% | -6.80% | CHF/07:15 |

| SW Sep CPI MoM | 0.30% | -0.20% | SEK/07:30 |

| SW Sep CPI YoY | 0.00% | -0.20% | SEK/07:30 |

| SW Sep CPI CPIF MoM | 0.40% | -0.10% | SEK/07:30 |

| SW Sep CPI CPIF YoY | 0.90% | 0.80% | SEK/07:30 |

| SW Sep CPI Level | - | 312.81 | SEK/07:30 |

| NO 3Q House Price Index QoQ | - | 1.20% | NOK/08:00 |

| UK Bank of England Credit Conditions & Bank Liabilities Surveys | - | - | GBP/08:30 |

| UK Sep CPI MoM | 0.00% | 0.20% | GBP/08:30 |

| UK Sep CPI YoY | 0.00% | 0.00% | GBP/08:30 |

| UK Sep CPI Core YoY | 1.10% | 1.00% | GBP/08:30 |

| UK Sep Retail Price Index | 260 | 259.8 | GBP/08:30 |

| UK Sep RPI MoM | 0.10% | 0.50% | GBP/08:30 |

| UK Sep RPI YoY | 1.00% | 1.10% | GBP/08:30 |

| UK Sep RPI Ex Mort Int.Payments (YoY) | 1.10% | 1.20% | GBP/08:30 |

| UK Sep PPI Input NSA MoM | 0.30% | -2.40% | GBP/08:30 |

| UK Sep PPI Input NSA YoY | -13.00% | -13.80% | GBP/08:30 |

| UK Sep PPI Output NSA MoM | -0.10% | -0.40% | GBP/08:30 |

| UK Sep PPI Output NSA YoY | -1.80% | -1.80% | GBP/08:30 |

| UK Sep PPI Output Core NSA MoM | 0.00% | 0.00% | GBP/08:30 |

| UK Sep PPI Output Core NSA YoY | 0.20% | 0.10% | GBP/08:30 |

| UK Aug ONS House Price YoY | 5.00% | 5.20% | GBP/08:30 |

| GE Oct ZEW Survey Current Situation | 64 | 67.5 | EUR/09:00 |

| GE Oct ZEW Survey Expectations | 6.5 | 12.1 | EUR/09:00 |

| EC Oct ZEW Survey Expectations | - | 33.3 | EUR/09:00 |

| UK BOE's Gertjan Vlieghe Testifies in Front of U.K. Lawmakers | - | - | GBP/09:00 |

| US Sep NFIB Small Business Optimism | 95.5 | 95.9 | USD/10:00 |

| UK BOE's Ian McCafferty Testifies in Front of U.K. Lawmakers | - | - | GBP/10:00 |

| BZ Central Bank Weekly Economists Survey | - | - | BRL/11:25 |

| US Fed's Bullard Speaks on Final Day of NABE Annual Meeting | - | - | USD/12:00 |

| CA oct..09 Bloomberg Nanos Confidence | - | 55.6 | CAD/14:00 |

| BZ Central Bank Currency Swap Auction Results | - | - | BRL/14:50 |

| UK Bank of England official Andrew Haldane speaks in London | - | - | GBP/17:00 |

| BZ oct..11 Trade Balance Weekly | - | - | BRL/18:00 |

| NZ RBNZ Governor Wheeler Speaks at INFINZ | - | - | NZD/20:10 |

| CH Sep New Yuan Loans CNY | 900.0b | 809.6b | CNY/22:00 |

| CH Sep Money Supply M2 YoY | 13.10% | 13.30% | CNY/22:00 |

| CH Sep Aggregate Financing CNY | 1200.0b | 1080.0b | CNY/22:00 |

| CH Sep Money Supply M1 YoY | 9.80% | 9.30% | CNY/22:00 |

| CH Sep Money Supply M0 YoY | 3.00% | 1.80% | CNY/22:00 |

| US Sep Monthly Budget Statement | $95.0b | $105.8b | USD/22:00 |

Currency Tech

EURUSDR 2: 1.1561

R 1: 1.1460

CURRENT: 1.1392

S 1: 1.1106

S 2: 1.1017

GBPUSD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5371

S 1: 1.5089

S 2: 1.4960

USDJPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.77

S 1: 118.61

S 2: 116.18

USDCHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9601

S 1: 0.9513

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.