Market Brief

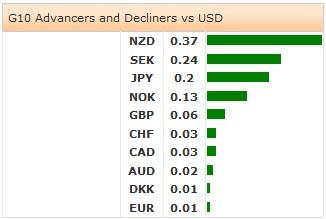

FX markets were subdued as the USD was unchanged in the Asian session. Concerning developments surrounding Ukraine which suggest re-escalation has yet to significantly damage risk appetite. Asian equity markets are mixed following the small 0.2% drop in the S&P 500. The Nikkei and Shanghai composite fell -1.05% & -0.37% respectively while the Hang Sang rose a marginal 0.6%. NZD was the big mover, rallying to 0.8637 from 0.8580 following the rate decision and hawkish RBNZ statement. In addition to probable further rate increases, the market was relieved that the central bank didn’t protest the strong NZD more persuasively. USDJPY was on offer for most of Asia falling to 102.25 from 10.2.56, while EURUSD was range-bound between 1.3810 and 1.3830. In response to yesterday's weak housing data US yields fell which pushed Asia yields lower as well.

As was universally expected due to the RBNZ candid communication, the cash rate was raised 25bp to 3.00% for the second consecutive month. The focus then became the accompanying statement which was not as dovish as expected. The RBNZ slightly ungraded its economic forecast for annual GDP growth in Q1 from 3.3% to 3.5%. In regards to the NZD, the central bank still believe its overvalued but less than previously thought. They still believe that inflation will head higher despite the recent drop in CPI which will keep policy heading toward a more ‘neutral’ level which we estimate around 4-4.50%. The RBNZ suggested that the pace of the hike will depend not only on the rate of growth and inflation pressure but also the role of exchange rates in keeping inflation in check. The statement does leave room for the RBNZ to pause, should NZD continue to rise, and stifle inflation, we think the current data trajectory will keep tightening on track.

China announced that 80 projects in eight industries dominated by state-owned agencies would now be up for private investments. The projects are across the industrial spectrum from railways and ports to clean energy and information technology. According to the central government’s website, projects would be open to public bids and participation could be through a variety of corporate setups.

In the European session, markets will be watching German Ifo, Riksbank Minutes and Turkey's rate decision.German economic data has continued to perform exceedingly well, but we could see IFO fall marginally to 10.5.8 from 106.4 given lagging seasonality. However, given the strong PMI reads, the risk is clearly to the upside. As for the Riksbank minutes, traders will be reading for any clues on the central banks expectation for inflation to provide hints for coming rate cuts. We believe that the Turkish central bank will hold key policy rates as data has not significantly changed. The effect on the TRY should be minor as the high carry still provided will keep traders interested in holding the currency. In the US session, durable good orders are likely to increase in March due to strong aircraft orders. Durable good orders ex-transportation should be slightly weaker 0.6%.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.