A weaker US durable goods orders yesterday coupled with investor concerns about possible US military action in Syria is enough to record some “diverse” effects on Asian Capital Markets in the overnight session. Regional bourses were trading in the red while the G10 price action was modestly “risk off.” Even the Emerging Market Asia currencies are weaker across the board, led by Southeast Asian FX. Noted yesterday was the tireless work of regional central banks in last weeks rout of their own currencies. Today, they are required to double their efforts.

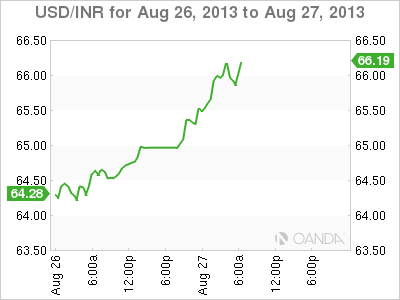

The Bank of Thailand actions are no different mounting an aggressive and stellar defense of the THB on its open, but quickly realized today was to be a losing fight – USD/THB rallied to 32.15. Bank Negara (Malaysia) tried to “smoother” a further rise in USD/MYR while the Bank of India got to witness USD/INR gapping higher on the open to 63.05 and eventually crashing to a record low of 65.93. Despite the -12bps fall in the US 10yr Treasury yield overnight (+2.76%) and the 1– 2bps off of JGB yields (+0.735%), most EM Asian yields are higher, driven by FX – obviously compounded by the liquidation of Asian bonds and equities continuing at a good clip!

The USD/IDR remains well bid but suspected Bank of Indonesia intervention is still capping the pair below the psychological 11,000 for now. Local dealers have suspected that Central Bank policy makers have sold around $100m to defend their local unit. The impact from these efforts are dwindling – may need to raise interest rates to reduce the outflow of capital. It’s a similar story throughout the Asian EM. USD/INR finally breached the crucial 66.00 earlier this morning, and along with the central banks suspected market intervention has helped little to offset market concerns. Investors continue to worry about the further widening in the country’s budget gap. The local currency has lost -19% since the beginning of May over fears that India will continue to struggle to fund its current account deficit if the US Fed reserve winds down its easy money policy.

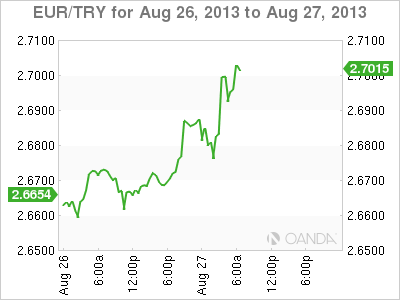

Despite FX intervention and a +50bp hike in the upper end of the Central Bank of the Republic of Turkey (CBRT) last week the USD/TRY has broken that psychological 2.00. The CBRT had promised more tightening next week, but their governor is not worried about the exchange rate, predicting USD/TRY to end the year at 1.92. Current attention is expected to turn to whether the CBRT will raise the key policy rate (+4.5%) next month. The problem is how higher rates affect both the equity and bond market – any accelerating outflows would weaken the TRY further. Even verbal comments by the governor from CBRT are capable of doing very little. This is the catch 22 that most EM Central Bankers find themselves caught in.

In previous years any worries about emerging market economies usually would mean that cash flowed into the ‘safer haven’ asset class of US Treasury’s. However, this time around the one, two three processes are as clear. The emerging economies have been selling USD to prop up their own currencies. With the global investor worried about the beginning of Fed tapering occurring as early as next month (65% of analysts surveyed by Bloomberg believe so) any capital outflows from emerging markets are not necessarily finding its way directly at first into the fixed income asset class. This has caused the US yield curve to shift higher and parallel, causing longer-term yields to print multi-years highs.

All along the market has been looking for clarity from “helicopter” Ben and company on timing from the Fed. For the most part rising global interest rates have been denting the appeal of global riskier assets.

Investors have been shifting capital back to less risky markets like the US, and to a certain extent back into Europe. Close to 35-40% of emerging capital usually finds its way into US Treasury’s, however, with so many EM Central Banks intervening on behalf of their own currencies waning reserves will reduce demand for safe haven product in the short term.

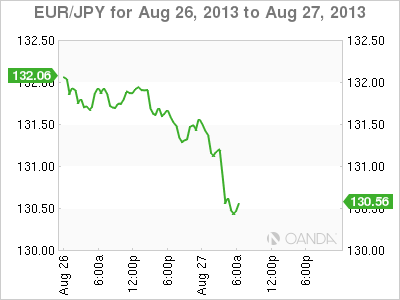

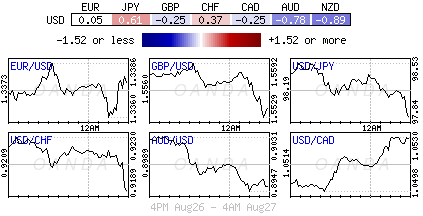

Initially, the yen’s strength was short lived after the disappointing US consumer durable number yesterday (-7.3%). With the market beginning to ask more questions about US tapering, in other words uncertainty of timing and pace, will usually lend a hand to both equities and market risk. This naturally would have begun to weigh on the usual safer-haven yen price. Investors want to know what Prime Minster Abe’s so-called tax panel is thinking when it comes to implementing a higher consumption tax supposedly beginning next April (from +5% to +8% or only hike to +6%). Abe is expected to wait until after September 9th Q2 GDP revision to expend any political will on new taxes legislation. In truth, the yen is expected to weaken further if no new tax legislation passes. The currency value (97.72) is currently being dictated by the geopolitical concerns surrounding Syrian and a potential fall out in the Middle East. Currently, projected support at ¥97.40 is a target, especially now that ¥98 has come under pressure in Euro session.

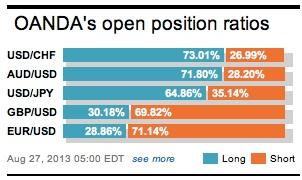

There are only a few data points this week to act as beacons and this morning’s German IFO index for August is a supposed influencer. The print of 107.5 beat market expectations and the breakdown shows gains in the current conditions index to 112 from 110.1. Its again stronger proof that the German economy continues to outshine any of their compatriots within the EU aided by supportive monetary and fiscal policy that is not a drag to German growth. The 17-member single currency’s failure to overcome 1.3400 despite the upbeat Ifo prints has led the EUR to a stronger sell off (1.3344) this morning. Investors currently prefer owning the greenback, yen and CHF – they all caught a safety bid, especially in the Euro-session – during event and geo-political risk management requirements.

Investors require “volatility and volume” when trading the various asset classes. They were the two ingredients mostly missed in the “summer lull.” With heightened political concerns in both Italy and Syrian, the twin ingredients are beginning to reappear – making it an interesting trading period for the various asset classes!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.