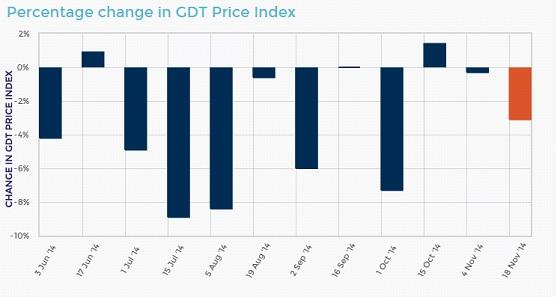

Last night's dairy auction came with no real surprises for the market; other than a further drop which was somewhat expected. The NZ economy relies heavily on its dairy export market, which accounts for over 20% of exports, and another drop spells more problems for the NZ economy in the long run as the primary sector is likely to suffer.

A quick look at the NZD on the charts shows some interesting moves and what is quite clearly a double top for the NZDUSD cross. The second such movement shows strong movements higher followed by 2 pin bar candles following strong rejection of the 0.7970 resistance level.

The trend is your friend as they say and in this case the trend line has been firmly broken during the Asian session, showing that price action remains in the hands of technicals and the future is downward looking for the NZDUSD.

The second part of the NZDUSD is that people have to realize we get very strong waves when trading this pair. Previous waves had an impulsive wave, which was in turn followed by a brief corrective wave of generally 4-5 candles. If you’re looking to coming in on the NZDUSD it may be worth waiting for a slight pull back of 4-5 candles on the 4h and then jump in as this seems to be the regular pattern.

Either way the NZDUSD is currently weak technically speaking as well as fundamentally. The bears are looking to take charge here and a pullback may be a nice time to enter and ride the waves lower over the coming week.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.