Cable has been in a protracted bear trend since it broke the psychological barrier of 1.5000 last December. More recently however it has been showing signs of a correction after having been driven to extremely oversold levels. Since it reached a recent low of 1.41245 on 20th December it has managed to gain back some ground to current levels above 1.44500.

Sterling’s demise came as the Bank of England (BoE) made a U‐turn in the possibility of raising interest rates while the US went ahead and raised rates in December. This created a scissor effect given the higher interest rate scenario in the US and the now continued low interest rate scenario for the UK.

The outlook for the UK economy however does not seem to be as strong as once thought.

Manufacturing production figures released in December and January both came in with negative numbers ‐0.1% & ‐1.2% respectively. Industrial production released in January was also negative and lower than expected at ‐0.7%.

Whilst PPI (Producer Price Index) which is a measure of inflationary pressure, has been negative since the summer of 2014. Inflation has in fact stayed low throughout 2015, often reaching negative levels. There could be an increase in volatility tomorrow as the BoE holds its scheduled monetary policy meeting. They will also be voting on whether to raise interest rates, but most importantly there will be a press conference by the Governor of the BoE Mike Carney at 12:45 p.m. which should give tips as to what to expect from the BoE going forward.

The US economy doesn’t look as expansive as it did a few months ago; adding to concerns is the slowdown in China which is showing signs of being larger than expected. There are also fears that the state controlled statistics may be manipulated and not showing the true extent of the contraction.

However job creation although not as strong as in 2014 has still been high and was one of the main factors in the Federal Reserve’s decision to raise interest rates. This Friday at 1:30 p.m. Non‐Farm Payrolls will be released with an expected 190k addition to the job market, the previous data was an increase of 292k. If the actual number released differs greatly from the expected we can expect higher levels of volatility.

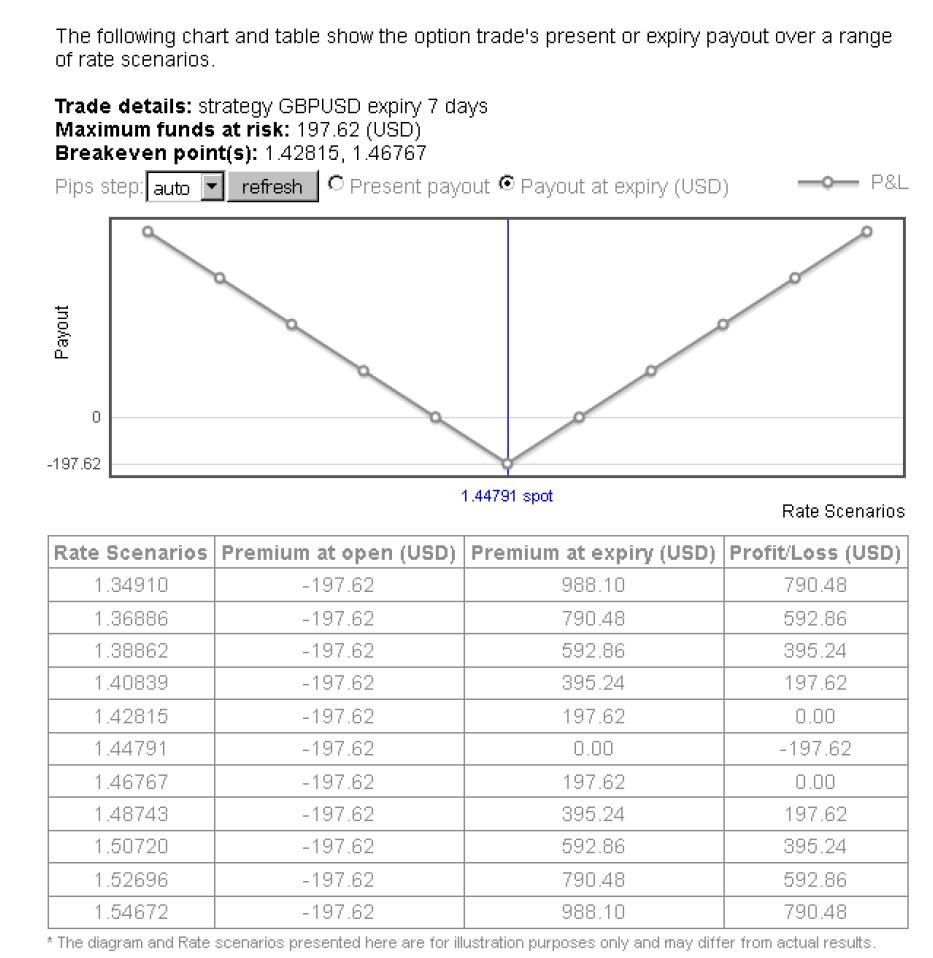

If you think the volatility of Cable will increase over the next week then you may buy a Straddle which consists of simultaneously buying Call and Put options with the same strike and the same expiry. The screenshot below shows that a Straddle with 1.44813 strike, expiry 7 days and for £10,000 would cost $197.64, which is also the maximum possible loss.

This screenshot shows the Profit and Loss profile of the above long Straddle.

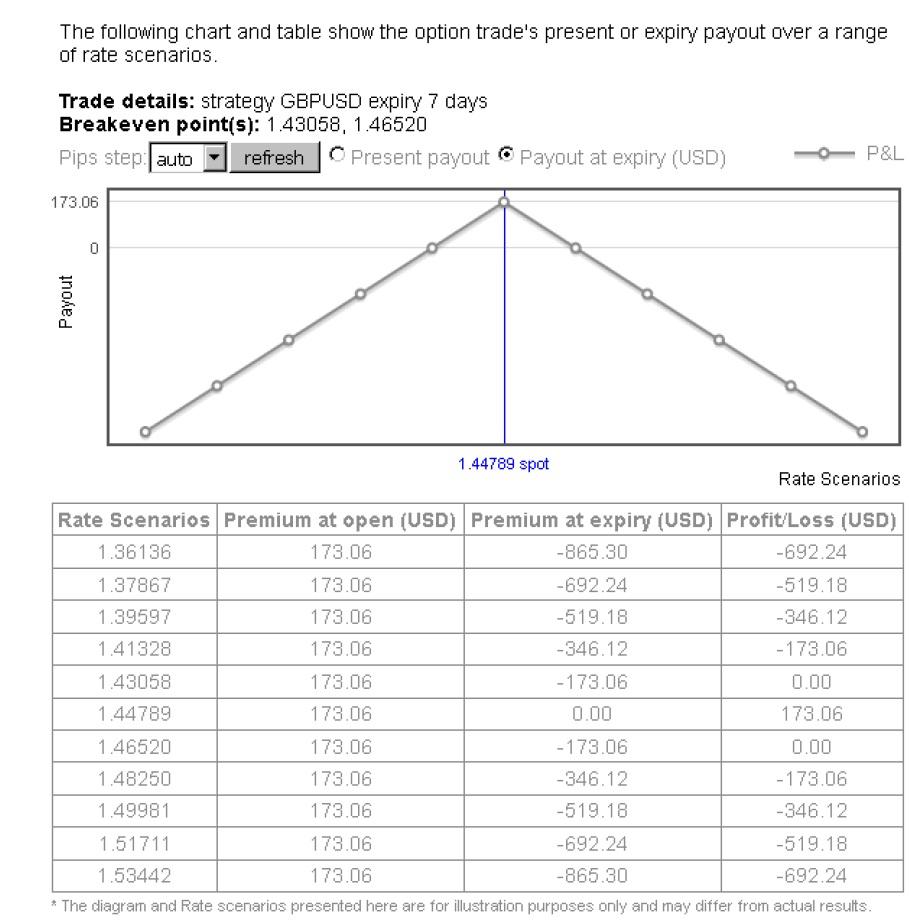

If on the other hand you feel that volatility will remain flat or fall then you may sell a Straddle which consists of simultaneously selling Call and Put options with the same strike and the same expiry. The screenshot below shows that a Straddle with 1.44721 strike, expiry 7 day and for £10,000 would allow you to pocket $173.00, the total risk of this position would be $462.44.

This screenshot shows the Profit and Loss profile of the above short Straddle position.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.