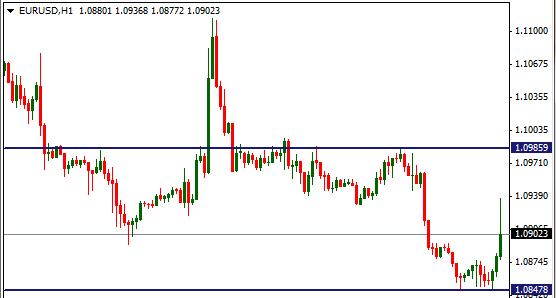

Yesterday, the US dollar strengthened across the board following comments from Fed member Lockhart encouraging a September interest rate hike. EUR/USD fell from 1.095 to bottom at 1.088 and continued to trade lower in today’s session reaching 1.0847 (see chart). This morning's decline is also influenced by PMI data indicating a slowdown in Europe's rate of expansion.

If Friday's NFP data is not as expected it may greatly influence EUR/USD price activity. If the numbers are better than expected, it can be interpreted as a final trigger for the Fed to pull interest rates higher in September. If data is worse than expected, price action will depend on by how much worse it is. A slightly poorer result may postpone a move by the Fed and uncertainty in the market regarding a September hike may emerge. If results are very bad, a hike in September will become unlikely. Either way, worse than expected data may weaken the dollar.

Today, the 1 week at-the-money EUR/USD options indicate 11.8% volatility which implies an average daily move of around 0.75% (82 pips) over the next week. When trading options, you are also trading the underlying asset’s volatility. An assessment on volatility direction is just as important as assessing the market direction. Regardless of market direction, if you believe volatility will rise you may buy options to trade this. If you believe volatility will drop and the market will stabilize, you may sell options to trade this.

If you believe that between today and the end of the trading week on Friday (after NFP data) EUR/USD is more likely move-up and become more volatile, you may take advantage of this through buying a Call option. To learn more about buying Call options on MT4 click here.

Choosing an at-the-money (ATM) versus an out-of-the-money (OTM) option depends on how much premium you want to risk and how volatile you think the market will become. For OTM options, the further away the strike of option is from today’s market price, the more the market will need to move for the option to expire in profit.

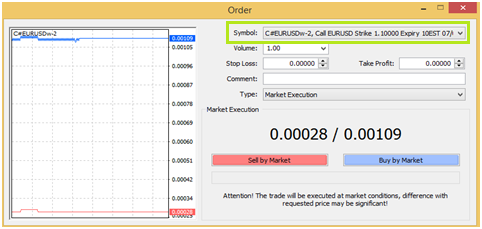

Buy example on MT4:

A Call that expires on Friday at 14:00 GMT with a strike at 1.1000 (OTM) can be found on MT4 as symbol name C#EURUSDw-2. The cost to buy 1 lot of this symbols is $100.9 (i.e. the option's ask price is 0.00109), this is also your maximum risk.

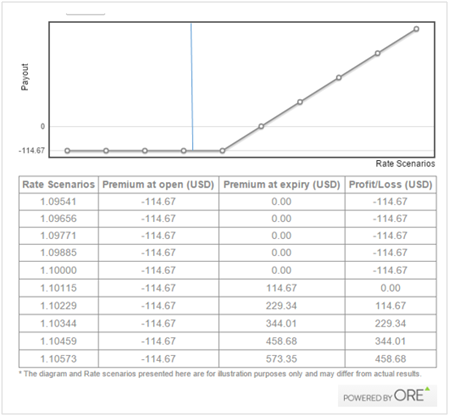

On expiry, if EUR/USD is trading above the 1.10 strike price, you will profit the difference minus the cost of the option. In fact, your break-even point at expiry is strike price + option price = 1.1000 + 0.00109 = 1.10109

Below you can see a chart & table of this trades profit/ loss scenarios over a range of EUR/USD rates at expiry.

On the other hand, if you believe the pair will trade lower and volatility will drop you may consider selling a Call option. Selling a Call option will mean that you receive premium and as long as EUR/USD doesn’t increase in volatility or trade at higher in price, you will profit at expiry. However, note that if EUR/USD does trade at a higher price, above 1.10 you may make a loss and to manage your maximum loss you may use a stop-loss order.

Lastly, if you expect volatility to increase but you do not have a view on direction you may buy a Call and a Put option at the same time. This is a popular option strategy known as a 'Long Straddle'. The Call will rise in value if the market rises and the Put will rise in Value if the market falls. As long as the market moves a significant distance in either direction, the strategy can return a profit. If the market stabilizes and trades in a range then a loss is made, this loss is limited to the total cost of buying the options.

To practice trading options on MT4 click here.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.