The Dollar is the strongest it’s been versus the Euro in the past 28 months now trading at 1.2186. Further decline in the currency today occurred after better than expected GDP was released earlier today in the US.

If you want to have a position in the EURUSD towards a possible bounce back from these lows and not spend a lot to buy such a position, a Call Spread can be an interesting strategy.

Buying a Call spread involves buying a Call and selling a Call with a strike further out-the-money (OTM) (that is a higher strike than the buy Call leg).

A Call spread earns you money if the spot trades beyond the strike of the bought option and the profit is capped beyond the strike of the OTM Call you sold.

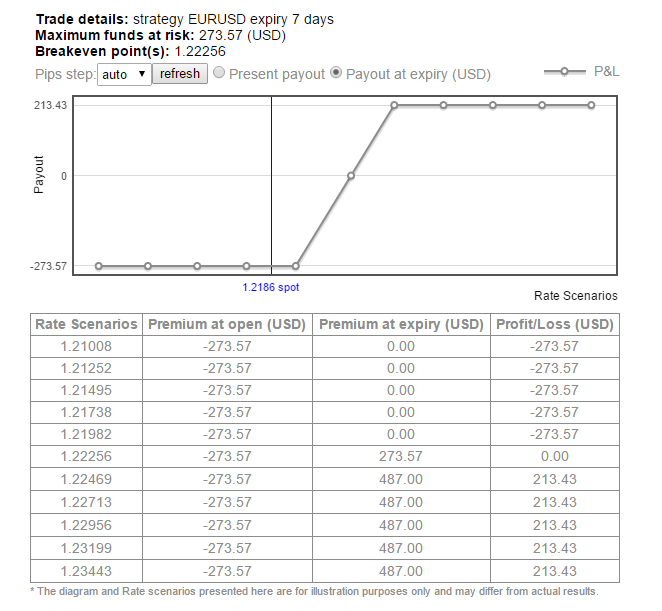

The current resistance level is 1.222. On expiry, the breakeven point of this strategy is 1.222 and your maximum profit is 77.7% ($213) of the premium at open beyond the 1.2246 level (also the second resistance level). This strategy is on the amount of a 1 lot per leg. The duration of the strategy is one week and will expire on Dec. 30th, before the New Year long weekend begins.

Below is the graph payout of the strategy on expiry. You may view and trade this strategy in the strategies marketplace™ on the ORE web-platform under the name “Christmas Call Spread”.

Recommended Content

Editors’ Picks

Bank of Japan keeps interest rate steady, as expected

The Bank of Japan (BoJ) board members decided to hold the key interest rate steady at 0%, following its April monetary policy review meeting on Friday. The decision came in line with the market expectations.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.