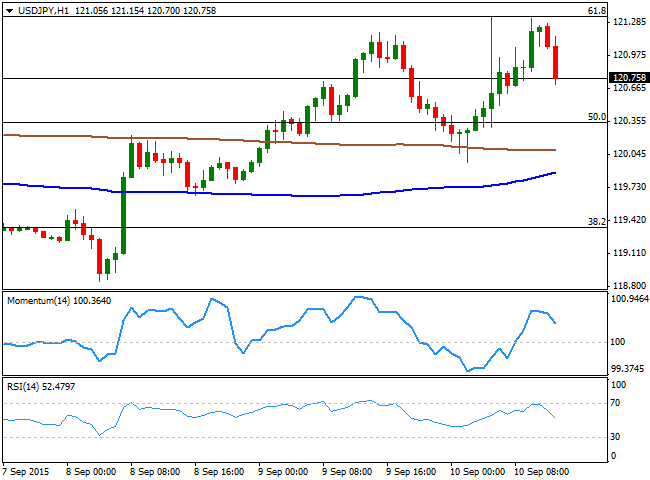

USD/JPY Current price: 120.75

Capped by critical Fibonacci resistance. Stocks fell in Asia, with the Nikkei 225 giving back some of the wild advance posted on Wednesday, and weighing on the Japanese yen. The USD/JPY pair spiked to a daily high of 121.33, as lawmakers comments added to equities volatilities. Japan's LPD Yamamoto, who has previously advised PM Abe, called for an extension of quantitative easing in the next October BOJ meeting. Also, Bank of Japan Governor Haruhiko Kuroda, noticed that whilst the economic recovery has been irregular, although conditions are given to reach the 2% inflation target. US tepid data however, is sending the pair back south, having been unable to extend beyond a key Fibonacci resistance, the 61.8% retracement of the latest weekly decline around the mentioned daily high. The 1 hour chart shows that the technical indicators have turned sharply lower from overbought levels, whilst the 100 SMA is slowly advancing far below the current price. In the 4 hours chart, the technical indicators also point for a continued decline in the short term, with a break below 120.35, the 50% retracement of the same decline, favoring a continued slide towards 119.60.View Live Chart for the USD/JPY

Support levels: 120.35 120.00 119.60

Resistance levels: 120.95 121.35 121.80

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.