Copper futures

The dollar traded lower against all of its G10 counterparts during the European morning Thursday, as the demand for safe have assets soared after Saudi Arabia and a coalition of Gulf region allies launched air strikes in Yemen. The greenback traded in a wide range of -0.30% to -0.90% against its peers.

UK retail sales beat expectations and rose 0.7% mom in February, a turnaround from -0.3% mom previously. The rebound in February’s data along with the sizeable upward revision to the January figure (to -0.3% from -0.7%), suggests that Q1 as a whole should see a strong reading. Lower oil prices and slower inflation leave consumers with more money to spend, which is reflected in the rise in retail sales. GBP/USD jumped to hit resistance a few pips below the 1.5000 level but declined in the following hour to find support near 1.4940. Given the negative sentiment towards USD in the last few days, we expect GBP to remain supported and the bulls to aim for another test near the 1.5000 level.

Eurozone’s M3 money supply grew 4.0% yoy in February, at a faster pace than +3.7% yoy previously. Loans to the private sector continued to fall on a yoy basis but at a slower pace than in January. This may be a sign that the pre-QE stimulative measures announced by the ECB may be starting to have some positive impact. This could support EUR somewhat.

Industrial metals soared along with oil and gold, while copper surged around 1.6% as torrential rain in Chile closed mines in the world’s biggest producer of the metal. The distortion of copper supply pushed the price of the metal up. As long as the mines remain close the price is likely to remain elevated. On top of that, the recent weakness in the dollar increased demand for raw materials, which are generally priced in dollars. Nevertheless, I believe that expectations of a slower global growth and fears about future demand from China could eventually weigh on copper prices and push them down again. Stock prices retreated Thursday and the safe-haven JPY and CHF were both strong, indicating that Thursday’s rally in copper is not based on any great revival of enthusiasm over the prospects for the global economy.

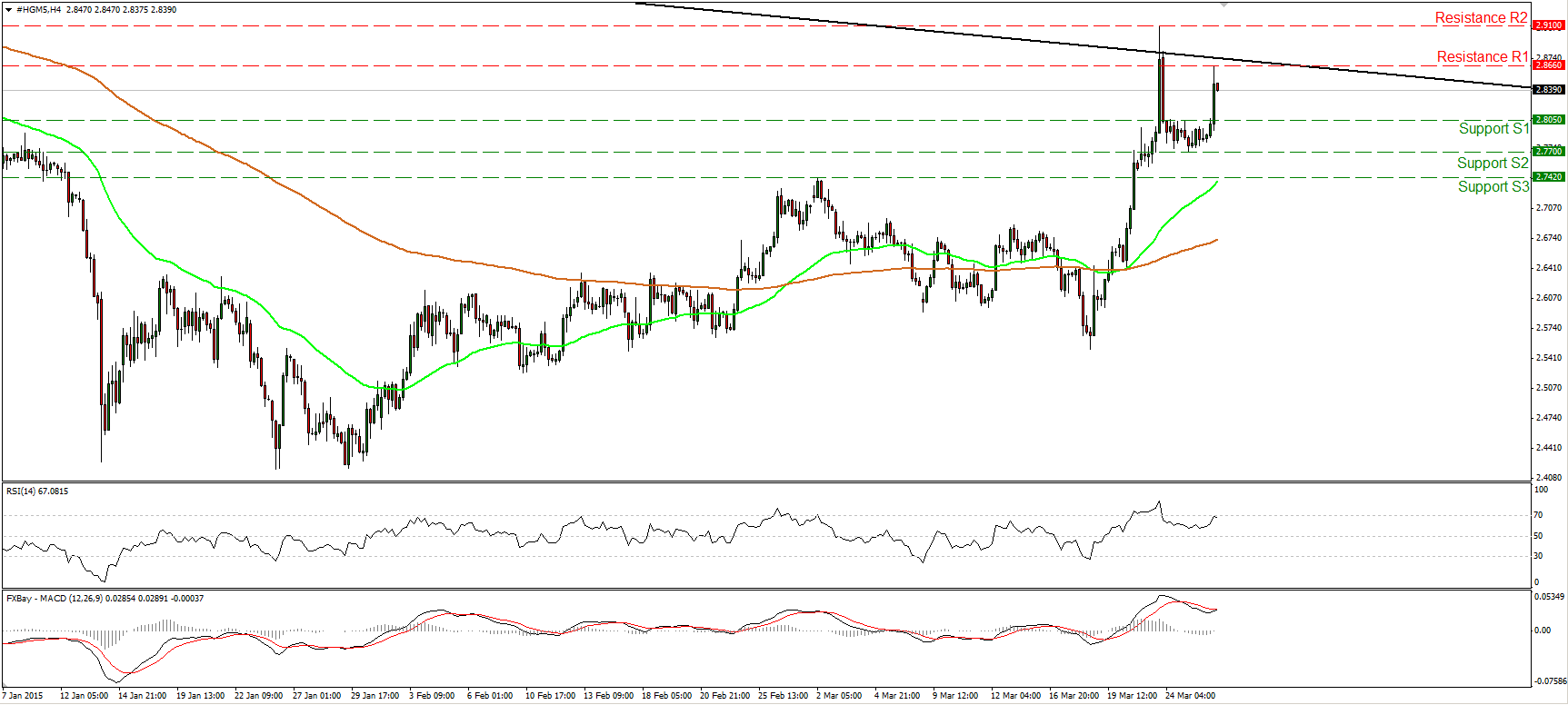

Copper futures traded higher during the European morning Thursday, but the rally was halted at 2.8660 (R1), marginally below the longer-term downtrend line taken from back the peak of 14th of July. Although the price structure on the intraday timeframes is somewhat positive, I would like to see a close above the aforementioned trend line and the 2.8660 (R1) obstacle before getting confident about further advances. Such a move could challenge as an initial resistance the 2.9100 (R2) line, marked by Monday’s peak. Zooming out on the daily chart, we can see much clearer that the longer-term downtrend line taken from back the peak of 14th of July provided resistance to the price action several times. Moreover, that line now coincides with the 200-day moving average, which makes it an even stronger resistance. This is another reason I would like to see a close above 2.8660 (R1) before becoming bullish on copper, despite the fact that our daily oscillators detect positive momentum. After pulling back from its 70 line, the 14-day RSI turned up again, while the daily MACD continues north, above both its trigger and signal lines.

Support: 2.8050 (S1), 2.7700 (S2), 2.7420 (S3).

Resistance: 2.8660 (R1), 2.9100 (R2), 2.9600 (R3).

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.