EURGBP

The dollar traded higher against almost all of its G10 counterparts during the European morning Wednesday. It was lower against NOK and AUD, in that order, while it was stable vs GBP.

The UK’s unemployment rate remained unchanged at 6.0% in October, its lowest level since September 2008. More importantly, average weekly earnings including bonuses rose 1.4% yoy, up from +1.0% yoy in September and higher than expected. The figure was the most important development as it was higher than inflation and therefore real wages are growing. At the same time, the Bank of England released the minutes of its early December policy meeting. The vote remained 7-2 in favor of no change in interest rates. The majority saw heightened risk that growth may soften more than expected or that inflation may stay below target for longer than expected. The latter risk has been intensified by the collapse in oil prices.

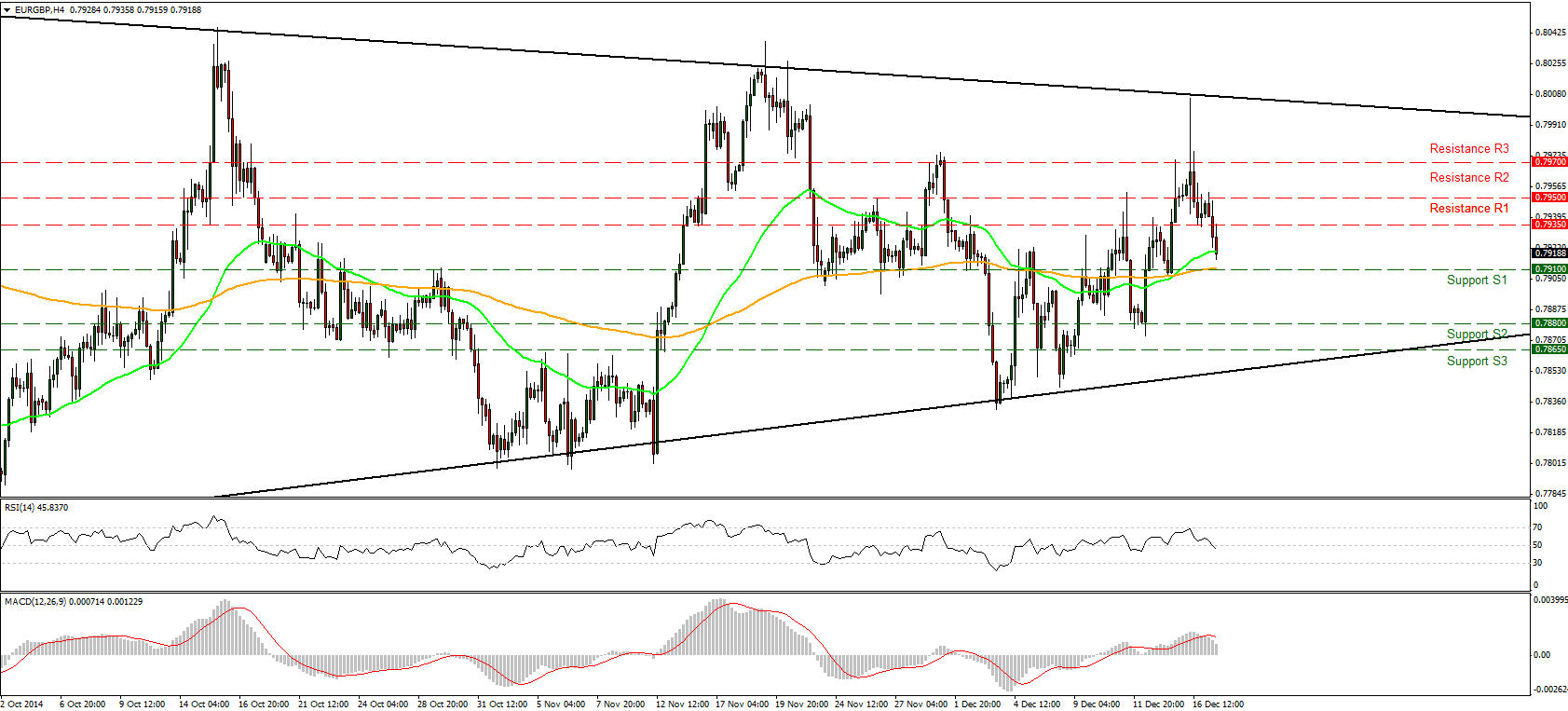

EUR/GBP moved lower following the strong labor data but the move was halted few pips above the 200-period moving average. I would expect the rate to test the 0.7910 (S1) support line, where a break of that hurdle could trigger further extensions towards our next support of 0.7880 (S2) line. Our short-term momentum studies support this notion. The RSI crossed the 50 line and is pointing down, while the MACD, crossed below its trigger line and is also pointing down. Although these signs designate accelerating bearish momentum, I would wait for a break below the 0.7910 (S1) support level to get more confident for the decline. On the daily chart, although the overall path of the pair is to the downside, it seems to be forming a symmetrical triangle formation reflecting investors’ indecisiveness in recent months. Usually, symmetrical triangles are thought of as a continuation pattern and a break in either direction is likely to determine the subsequent bias.

Support: 0.7910 (S1), 0.7880 (S2), 0.7865 (S3).

Resistance: 0.7935 (R1), 0.7950 (R2), 0.7970 (R3) .

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.