NZD/USD

The dollar traded unchanged or higher against all its G10 counterparts during the European morning, on Thursday. The greenback was higher against CHF, EUR and JPY and NZD, while it remained near its opening levels against AUD, SEK, NOK, GBP and CAD.

The Swiss franc was the main loser of this morning, after the Swiss National Bank said that the currency remains high and that is prepared to take further steps if necessary. Today, the SNB maintained its benchmark rate at 0% and pledged to defend the 1.20 floor of EUR/CHF.

EUR/USD continued its decline for a second day, after Fed officials indicated that the Bank could begin to raise rates about six months after the bond-buying program winds up.

The kiwi continued declining after New Zealand’s GDP slowed to +0.9% qoq in Q4 from a revised +1.2% qoq in Q3.

The dollar was also unchanged of higher against all the EM currencies we track, with the ruble recording the biggest losses as EU leaders gather in Brussels today to discuss additional sanctions against Russia after its intervention in Crimea.

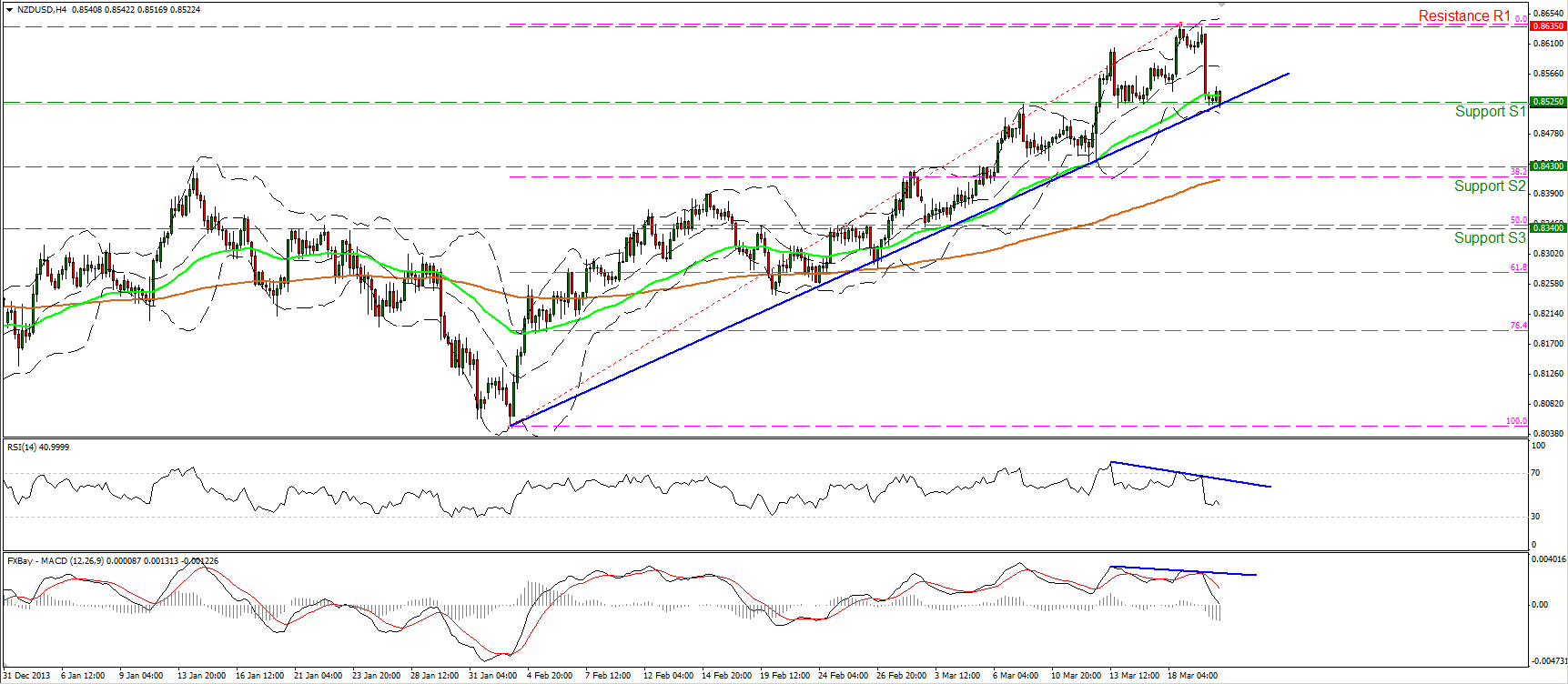

NZD/USD fell sharply overnight reaching the blue trend line and the support barrier of 0.8525 (S1). A clear dip below that support zone, may extend the decline and target the next hurdle at 0.8430 (S2), near the 38.2% Fibonacci retracement level of the prevailing uptrend. The MACD oscillator seems ready to obtain a negative sign, shifting the momentum to the downside. Considering negative divergence between both our momentum studies and the price action, I believe it is a matter of time for the rate to break through the support of 0.8525 (S1).

Support: 0.8525 (S1), 0.8430 (S2), 0.8340 (S3)

Resistance: 0.8635 (R1), 0.8675 (R2), 0.8845 (R3)

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.