![]()

There were plenty of market moving releases that helped to kick start North American trade this morning as US Retail Sales and Producer Price Index both ushered the USD lower by failing to live up to expectations. Retail Sales was the more noteworthy of the two as it only rose 0.9% whereas consensus was predicting a 1.1% rise; that makes four straight less than consensus results for the consumer based measure. The miss puts more doubt in to the sustainability and strength of the US economic recovery and helps to push out the expectation of an interest rate hike by the Federal Reserve. The USD has reacted in kind to this news as the king of the mountain has been knocked off his throne at least temporarily with EUR/USD gunning for 1.07 and GBP/USD trying to take out 1.48 as we go to press.

As with previous moves against the USD though, the question will soon be centered on how long it lasts. It seems that the market gets turned off by the USD only temporarily before coming back with great vengeance and furious anger against those who attempted to poison and destroy it (Pulp Fiction reference) over the last few weeks. If that pattern continues, watch for another USD comeback to coalesce before the end of the week.

Moving away from the USD though, the EUR may be one of the most volatile currencies by the time we get to the end of the week. Greece is making headlines once again and the European Central Bank is making a monetary policy decision as well where they are expected to rest on their Quantitative Easing laurels for the time being. That makes sense mainly because their program hasn’t had adequate time for its effects to be felt yet, so ECB President Mario Draghi and company will likely want to deploy the wait and see approach. However, just looking at the current dynamics of borrowing rates at extremely low levels for European nations along with European equity markets continuing to march higher, you could say that it is working well. The only thing Draghi could do to help even more would be to make the EUR even cheaper.

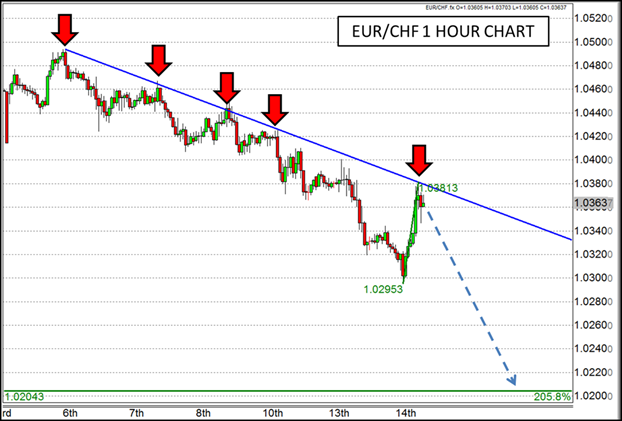

If Draghi were to talk down his currency, there may not be a better place to see it than in the EUR/CHF where a declining trend line has kept the currency capped for most of April. Recent price action saw another monthly low set before rallying back up to the trend line to be rejected once again. Assuming this trend line holds could open up the possibility for this pair to fall down to support levels seen immediately after the Swiss National Bank’s floor dropping spectacle in January near 1.02 which also corresponds with a 205.8% Fibonacci extension of the recent retracement. While the technical setup and ECB meeting are reason enough for this pair to potentially fall, if Greece were to continue making even more negative headlines as they are prone to do, that could make this decline even more likely.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.