![]()

Despite seeing some hints of “risk-off” trade in other markets, traditional safe-haven gold has failed to catch a bid this week. In fact, the yellow metal has actually dropped to a 6-week low below $1290 in today’s early US session. The persistent strength in the U.S. dollar is undoubtedly one of the biggest factors driving gold lower; all things equal, if the value of the dollar rises, it will take fewer of them to buy an ounce of gold. Beyond the buck’s resurgence, gold is also pressured by weaker physical demand from Asia, a major consumer.

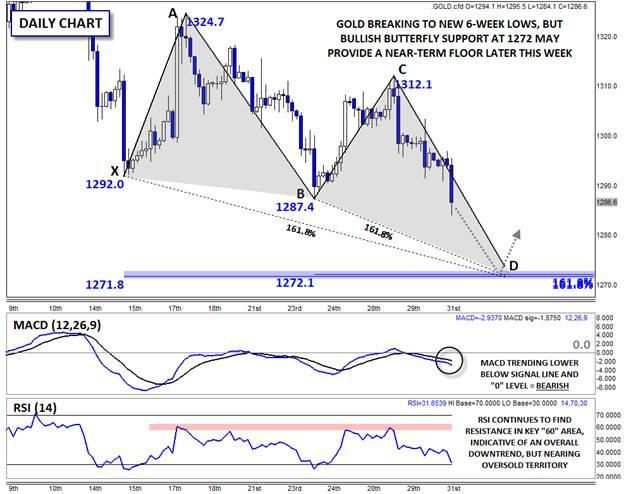

The technical picture for gold also favors the bears in the short-term. As noted above, gold dropped below key previous support in the $1290 area today, potentially paving the road for another leg lower. Meanwhile, the 4hr MACD is trending lower below its signal line and the “0” level, while the RSI continues to find resistance near the “60” level, indicative of an overall downtrend.

Though there are a plethora of near-term bearish signs, a developing technical pattern suggests we could bottom form off key support near $1272. Over the last two weeks, gold’s fluctuations have created the beginnings of a Fibonacci-based geometric pattern called a Bullish Butterfly pattern, but the name of the pattern is not particularly important. What is important is that there is a confluence of three support levels at $1272 (the 161.8% Fibonacci extension of XA, 161.8% Fibonacci extension of BC, and the ABCD pattern completion), increasing the probability of a bounce from that area. In addition, the 4hr RSI will also likely be in oversold territory if prices reach that potential floor by early next week, adding another bullish factor to the mix.

As a reminder, this pattern would only be activated if gold trades down to the $1272 level, and tomorrow’s NFP report will go a long way toward determining whether it will. That said, traders may want to watch for a bounce back toward $1300 if price starts to turn higher off $1272. Meanwhile, a break below $1272 would show that the bearish trend is incredibly strong and could expose $1280 (the 61.8% daily Fib retracement, not shown) or even $1240 (the 7-month low) in the coming weeks.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

GBP/USD recovers to 1.3300 ahead of UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers near the 1.3300 mark in the European morning on Friday. Traders digest the BoE and Fed policy decisions, awaiting the UK Retail Sales data for further trading impetus.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.