![]()

US index futures are slightly higher following the retreat on Wall Street yesterday, but they could move more sharply depending on the outcome of US data ahead of the opening bell. In Europe, it has been a quiet day so far due to the lack of top-tier economic data here and with some market participants occupied in trying to figure out the potential impact on European markets of the latest Western sanctions on Russia for the latter’s involvement in the Ukrainian crisis. So far, most of the jitters have been confined to the domestic Russian market where stocks and the Ruble have both fallen sharply. However companies with direct exposure to Russia may also start feeling the heat soon, particularly if more, tougher, sanctions are introduced in the future. For now, the mostly better corporate earnings results and the overwhelming expectations that the US economy rebounded strongly in the second quarter, and is continuing to expand in the third, are among the factors helping to support sentiment on Wall Street. Most people agree that the first quarter GDP disappointment was transitory and largely due to weather related effects. But they won’t be able to use the same playbook if Q2 GDP fails to rebound at least as strongly as it had dropped in the first three months of 2014 i.e. 2.9%. But if somehow it were to recover even more strongly than that or the 3 percent growth expected then stocks and dollar should in theory both jump in reaction to the data. However, it is not as straight forward as that because 15 minutes earlier, at 13:15 BST (08:00 EDT), we will have the latest ADP payrolls report which also has the potential to move the markets in a meaningful way. In line with the official employment report, which comes out on Friday, economists expect the APD data to reveal that around 230 thousand jobs were created in the month of July – excluding of course the government and farming industry. Today’s other key event – the FOMC policy decision – is expected to show few surprises for the Fed has already said it intends to end QE with a single $15bn transaction in October. On top of this, there won’t be a FOMC press conference.

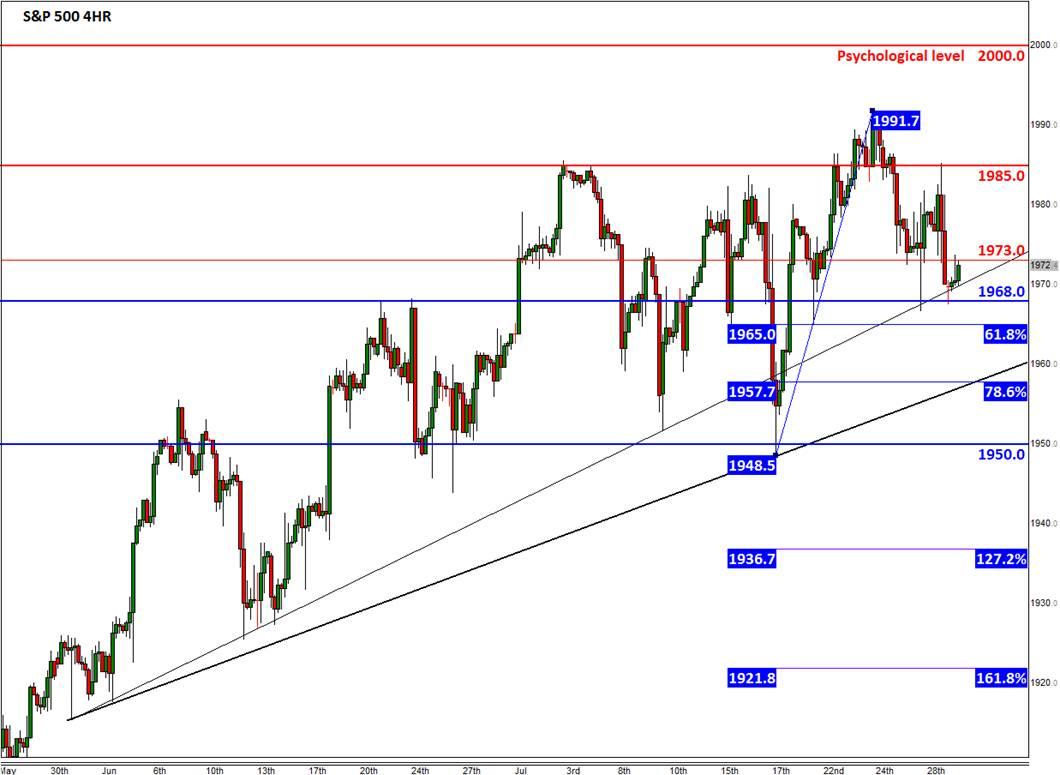

The S&P’s short-term charts clearly reflect the bulls’ hesitations as it has been consolidating just below the record level achieved last week which is not surprisingly given the high-impact economic data coming up this week. The price action is beginning to look a little bit ugly from a bullish point of view, but there are still distinct higher highs and higher lows visible which suggest the upward trend is still intact. Some of the immediate levels of support and resistance are highlighted on the 4-hour chart, below, in blue and red colours respectively.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.