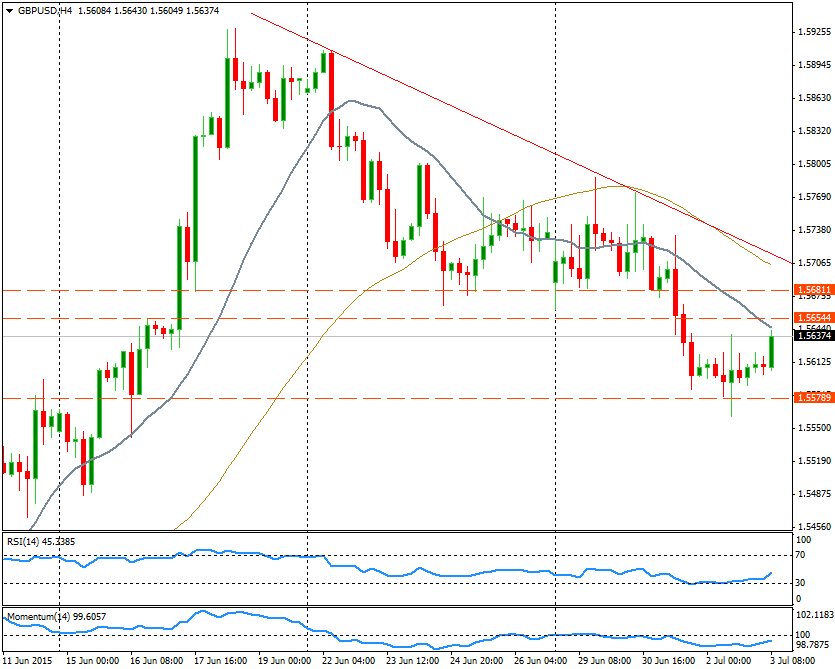

The pair is rising on Friday as it continues to bounce from 2-week lows. The UK services PMI rose in June above expectations (58.5 vs 57.4) giving some support for the pound in the market. Today not much movement in the currency market is expected considering that Wall Street will be closed. Price action should remain limited favoring a consolidation between 1.5655/60 and 1.5580; but a break could trigger further moves.

Cable is holding a slightly bullish bias in the short-term with technical indicators pointing also to the upside. The pair is moving toward the 4-hour 20-SMA that stands around 1.5650/60, area that is a static resistance level that could limit the upside. A break higher would open the way for more gains, targeting 1.5680. Above, attention would turn to a downtrend line that stands at the moment around 1.5715. A consolidation on top would set the scenario for a major recovery.

If the pair is unable to rise above 1.5650 a decline toward 1.5600 initially is likely and below there, toward 1.5580. A consolidation below 1.5580 would add bearish pressure to GBP/USD, exposing weekly lows that lie at 1.5560; under the mentioned level a slide to 1.5500/25 seems likely.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.