$/yen near term outlook:

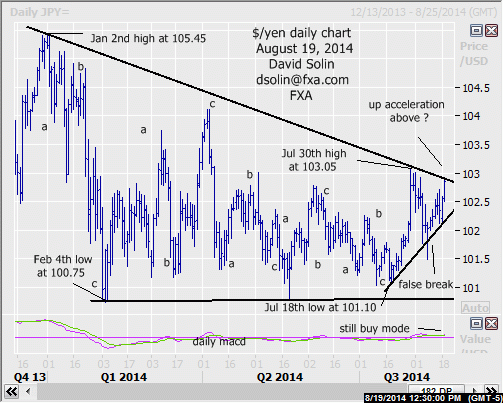

Big picture view remains unchanged, as the market is seen within an extended period of consolidating since the Jan high at 105.45. Note that the series of "sloppy", 3 wave moves in both directions (a-b-c's, see daily chart below) argues a large correction, with eventual gains back to the 105.45 high and even above after (see longer term below). Shorter term, the market has indeed continued higher, still supported by that bullish trendline from July 18th (currently at 102.05/15) and approaching resistance in the 102.90/10 area (bear trendline from Jan, Jul 30th high). Seen as a potentially important resistance area, as a break above could trigger a further, upside acceleration, and increase the likelihood that this multi-month correction is complete. At this point, the confidence of such a surge directly ahead is not extremely high with the seasonal chart for the yen that is sharply higher from now through Oct (see 3rd chart below, tumbles for $/yen) somewhat lowering the likelihood, but the potential is there. Resistance above there is seen at 104.00/15 (April high). Key support remains at that bullish trendline from July 18th, as a break/close below would argue further ranging/basing back toward the important 100.65/85 support area (base of the large correction since Jan). Bottom line : still supported by key bull trendline from July, above 103.10 area could trigger upside acceleration.

Strategy/position:

Still long from the Aug 5th buy at 102.75 and would continue to stop on a close 15 ticks below that bullish trendline from July 18th.

Long term outlook:

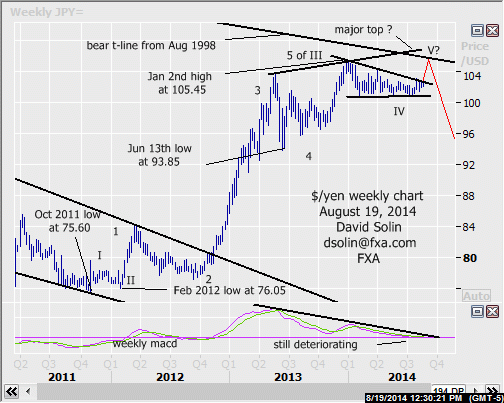

As discussed above, still view trade from the Jan high at 105.45 as a large correction (wave IV in the rally from the Oct 2011 low at 75.60), and with eventual new highs after. However, such a move higher may be limited and versus the start of a more major, new upleg (see in red on weekly chart/2nd chart below). Note that such a move above 105.45 would be seen as the final leg in that large rally from Oct 2011 (wave V), long term technicals continue to deteriorate (see weekly macd at bottom of 2nd chart below) and the market remains overbought in the big picture after the last few years of sharp gains. A final note, a clear break below that key 100.65/85 (base of the consolidation since Jan), would argue that a more major top is already in place. Bottom line : gains above the Jan high at 105.45 still favored, but magnitude of such upside a question.

Strategy/position:

With eventual gains back to the Jan 105.45 still favored, would stay with the longer term bullish bias that was put in place on Aug 5th at 102.60.

Current:

Nearer term : long Aug 5th at 102.60, some chance for up acceleration on break above 103 area.

Last : long Jun 2 above t-line from Apr (101.90, closed 102.35), stopped Jun 11th at 102.05.

Longer term: bull bias Aug 5th at 102.60 for eventual 105.45, risk for further wide consolidating first.

Last : bearish bias May 19th at 101.20 to neutral Jun 4th at 102.65.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.