Canadian Dollar Research Report

Sterling Canadian Dollar (GBPCAD) FX Technical Analysis

Following on from the post-election rally, sterling has managed to make further gains over the course of June. We have seen a raft data surprising to the upside including a narrower than expected trade deficit, stronger industrial production and recovery in retails sales. Most importantly of all Consumer Price Index (CPI inflation) and UK average earnings both recovered strongly. With average earnings increasing 2.7% and CPI inflation turning positive once more, the market has brought forward the likely timetable for a UK rate hike from Q2 2016 to late 2015/ early 2016. This has allowed sterling to rally against most of the major currencies.

Data coming out from Canada over the course of the month has also been largely positive, with 58,900 jobs being created during May which smashed the expected 10k. We have also seen CPI inflation increase to 0.6% but retail sales missed estimates.

Today, saw the release of GDP figures both from Canada and the UK. UK GDP came in stronger than expected at 2.9% year on year for the 1st quarter. Canadian GDP however disappointed the market and came out at 1.2% year on year.

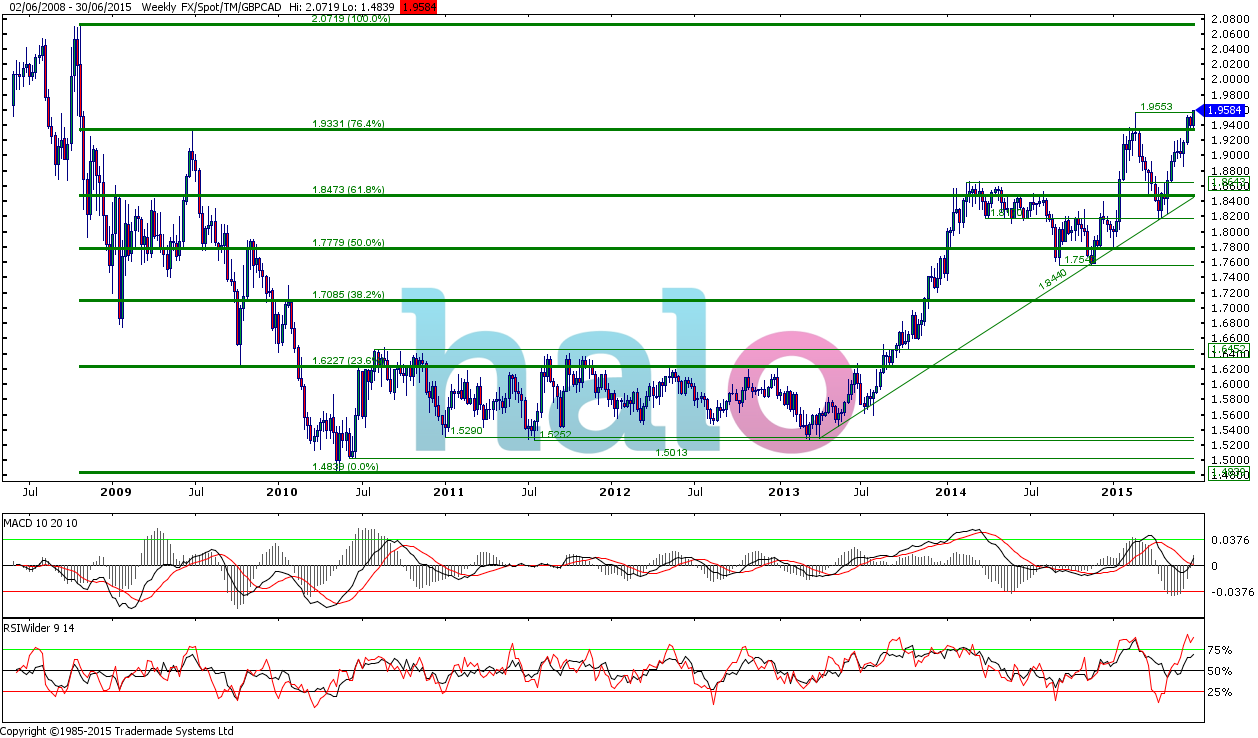

Technically, GBPCAD has been testing the near 7 year high of 1.9553 (this was first hit back in Feb 2015) but the market is currently struggling slightly to break this level. However, we have seen the market trade above and more importantly close above 1.9331 over the last couple of weeks. If we can close this week above 1.9331 this will confirm the break of resistance (I would be tempted to say we have already had a confirmed break of this level by having a weekly close above here but the rule of 3 is always a good one to follow in technical analysis) and this will then become support. 1.9331 is the final Fibonacci level of the move from the 2008 high of 2.0719 to 2010 low of 1.4839, a confirmed break of which would suggest a return to the 2008 high is likely in the coming weeks/months.

Of course, we still need to break above 1.9553 and there will be resistance at 2.00 simply because it is a round number so we still have some work to do. If the market fails to close the week above 1.9331, then a move above 2.00 is off the cards for the time being and a correction may occur. The market could in theory correct as low as 1.844 and still remain within the longer term uptrend, but fingers crossed this is pretty unlikely but a move below 1.90 would not be that surprising/concerning.

Buyers

In a trending market, a price averaging strategy is usually sensible if you have time on your side. This essentially means breaking your requirement down into smaller chunks and trading as the market moves. This allows you to take advantage of favourable rates, whilst reducing your exposure and therefore risk but hoping to take advantage of further moves in your favour. This strategy prevents you from “putting all your eggs in one basket”. If you have a short term requirement, I would be tempted to place a stop loss order below 1.933 and see how things unfold. If the market does dip down and your stop loss is triggered you will have traded close to the multi-year highs which cannot be a bad thing but you may make further gains.

Sellers

Unfortunately, the longer term trend is against you and appears to be resuming once more. Personally, I would look to get your funds moved sooner rather than later. It may be worth seeing if we close this week below 1.9331 but if the break of this level is confirmed (as I suspect it will be) then I would make your move ASAP as we appear to be heading above 2.00.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bank of Japan keeps interest rate steady, as expected

The Bank of Japan (BoJ) board members decided to hold the key interest rate steady at 0%, following its April monetary policy review meeting on Friday. The decision came in line with the market expectations.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.