Talk is cheap; the price of action is colossal That line, from the play Marat/Sade, pretty much sums up the European position on Russia. Many government officials have been talking harshly about the need to penalize Russia for its alleged involvement in the downing of the Malaysia Air plane over Ukraine, but when push came to shove, nobody shoved. The EU increased the list of people and companies facing asset freezes and travel bans, but said they would consider tougher measures only if Russia doesn’t cooperate in the investigation of the plane. The European Commission is now expected to publish tomorrow a list of harsher economic and trade sanctions that the EU could implement if things don’t go well.

This may not have been a great day for standing up for principle, but markets are generally apolitical. The fact that tensions were lowered switched sentiment from “risk off” to “risk on.” Stocks in Europe recovered smartly and the rally carried over into US and Asian equities too, while gold and Bund prices fell. The risk-sensitive commodity currencies were the best performing G10 currencies while the safe-haven CHF was the worst.

Against what should have been a favorable background for European assets and hence EUR, it’s particularly notable that EUR/USD is opening in Europe below 1.3500 for the first time since 3 Feb (and even that was only one day; the last time it was down here for any sustained period of time was last November). The weakness seems to be caused by the view that European growth has stalled and with the ECB on hold, the only thing that can rescue Europe is a weaker euro. For example, even while the IMF declaring that Spain has “turned the corner,” the country’s exports are falling and the trade deficit is widening out again, endangering the recovery. We will know more tomorrow when the preliminary PMIs for July are released. The Eurozone PMIs are forecast to be only a touch weaker, so there seems to me to be plenty of room for disappointment. Meanwhile, the technical picture for EUR/USD is also negative (see below). This could be the break we EUR bears have been waiting for for so long.

On the other hand, EM currencies continue to gain. RUB was the best-performing EM currency of the ones we track, followed closely by the high-yielding TRY, ZAR and BRL. EM currencies may be benefitting from the capital flight from Russia as investors (and locals) pull out of that market and put their money elsewhere. Carry trades look set to perform well even if “risk off” returns, because of the lack of contagion to other EM countries.

Q2 CPI from Australia was in line with forecasts at +3.0% yoy, up slightly from +2.9% yoy in Q1. The news sent AUD sharply higher despite the fact that the headline figure and “weighted median” were exactly as forecast, because the “trimmed mean” figure rose faster than expected at 2.9% yoy, up from 2.6% yoy and exceeding estimates of 2.7% yoy. The higher inflation rate makes it less likely that Australia might cut rates in the foreseeable future.

Today: During the European day, the only data we get are manufacturing confidence data from France and the preliminary consumer confidence for Eurozone, both for July.

In the UK, the Bank of England releases the minutes of its latest policy meeting. Recent comments and speeches by MPC members, plus the minutes of recent meetings, indicate that at least some members have moved closer to a dissenting vote, but I doubt that it will come this month. With no outright dissent, the focus will be on the range of views on spare capacity among MPC members and the debate about when to start raising rates. Separately, BoE Governor Mark Carney will speak to a business conference.

From the US, we get the MBA mortgage applications for the week ended on the 18th of July and as usual no forecast is available.

In Canada retail sales for May are expected to slow to +0.3% yoy from +0.7% yoy in the previous month.

ECB Executive Board member Peter Praet speaks.

THE MARKET

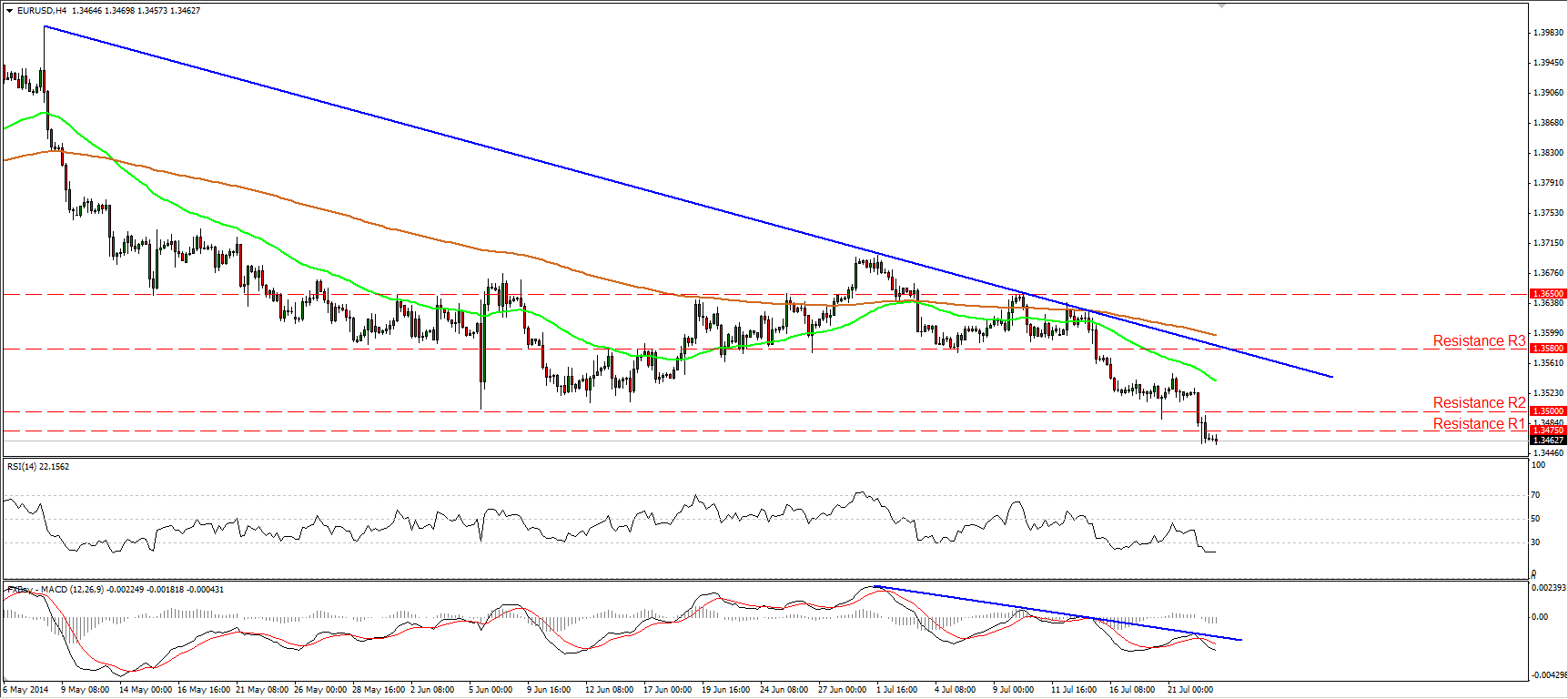

EUR/USD below the lows of February

EUR/USD declined significantly on Tuesday , falling below the psychological barrier of 1.3500 and breaking below the lows of February at 1.3475. I believe the move sets the stage for larger bearish extensions, opening the way towards the 1.3400 (S1) support area, marked by the low of the 21st of November . The MACD remains below its blue resistance line and below both its zero and signal lines, confirming yesterday’s negative momentum. The RSI dipped within its oversold zone, but it’s pointing sideways. I would search for a price bounce upon its exit from the extreme area. In the bigger picture, the move below the 1.3475 hurdle confirms a forthcoming lower low, while the 50-day moving average touched the 200-day one and a bearish cross in the near future will add to the negative outlook of the pair.

Support: 1.3400 (S1), 1.3300 (S2), 1.3250 (S3)

Resistance: 1.3475 (R1), 1.3500 (R2), 1.3580 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.