Analysis for August 14th, 2014

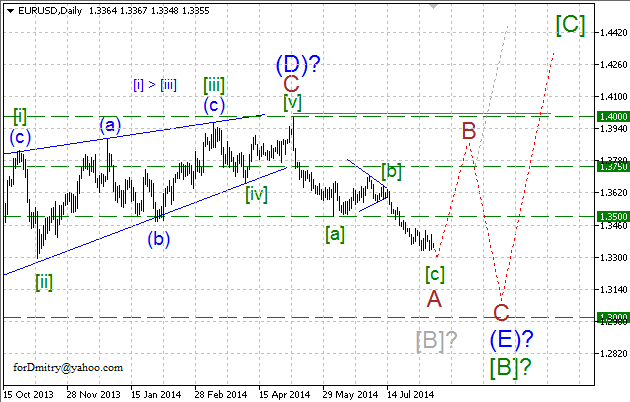

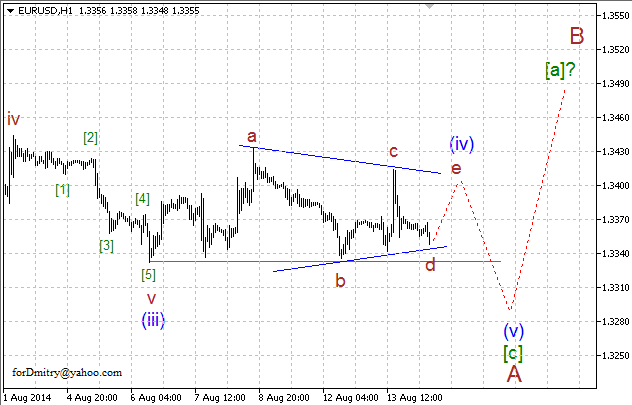

EURUSD, “Euro vs US Dollar”

One of the possible scenarios implies that Euro is forming the final descending wave (E) of [B], which may take the form of flat or some double pattern.

Probably, the price is finishing a descending zigzag A of (E), which may be followed by an ascending zigzag B of (E).

Possibly, the pair is about to finish a descending zigzag A. Right now, the market is completing a horizontal triangle (iv) of [c] of A, which may be followed by the final descending wave (v) of [c] of A.

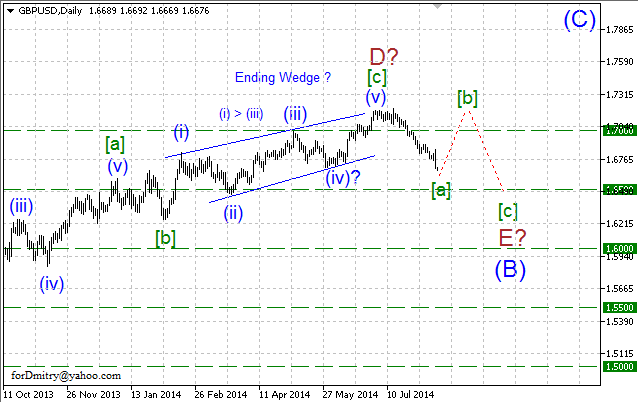

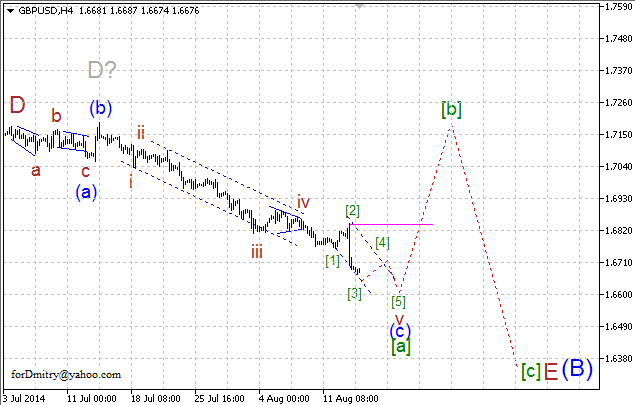

GBPUSD, “Great Britain Pound vs US Dollar”

Probably, Pound completed the final wedge [c] of D of an ascending zigzag D of (B) of a large skewed triangle (B). Right now, the pair is forming the final descending wave E of (B), which may take the form of double three, flat, or another long horizontal pattern.

Possibly, the price is forming flat [a] of E of the final descending wave E of (B). Later the pair is expected to form an ascending zigzag [b]of E.

Probably, the pair is completing a descending impulse (c) of [a], which may be followed by an ascending zigzag [b].

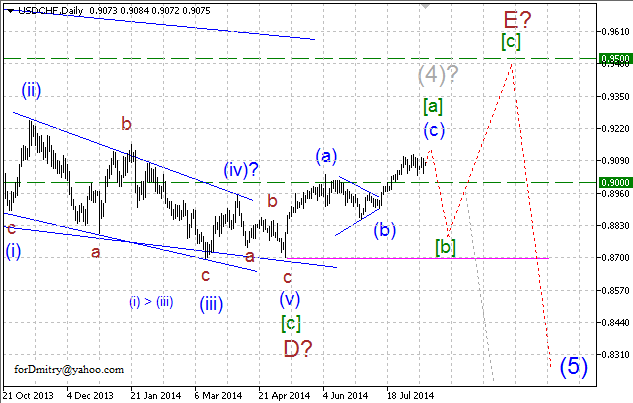

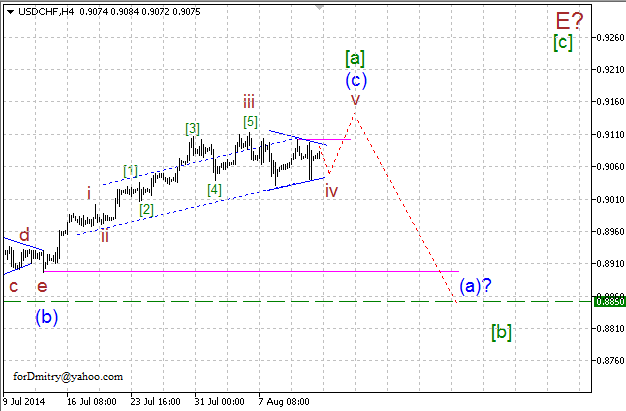

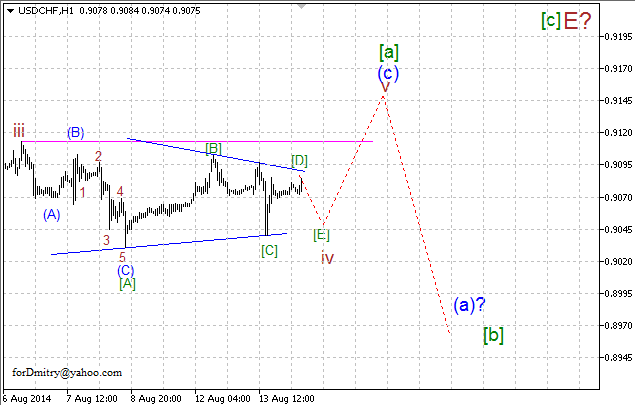

USDCHF, “US Dollar vs Swiss Franc”

One of the possible scenarios implies that Franc is forming the final ascending wave E of (4), which may take the form of double zigzag or flat.

Probably, the pair is about to finish an ascending zigzag [a] of E, which may be followed by a descending zigzag [b] of E.

Possibly, the pair is completing an ascending zigzag [a] of E. Right now, the market is finishing a horizontal triangle iv of (c) of [a], which may be followed by the final ascending wave v of (c) of [a].

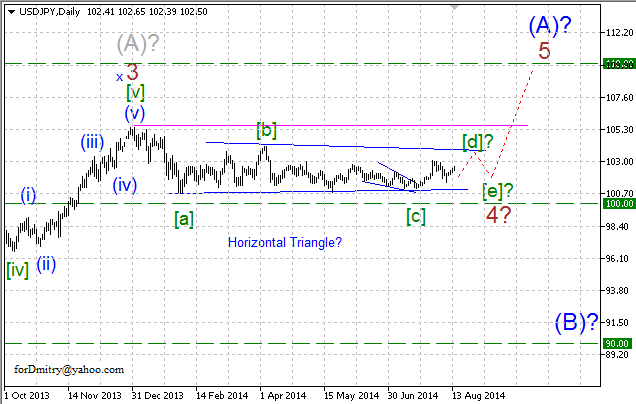

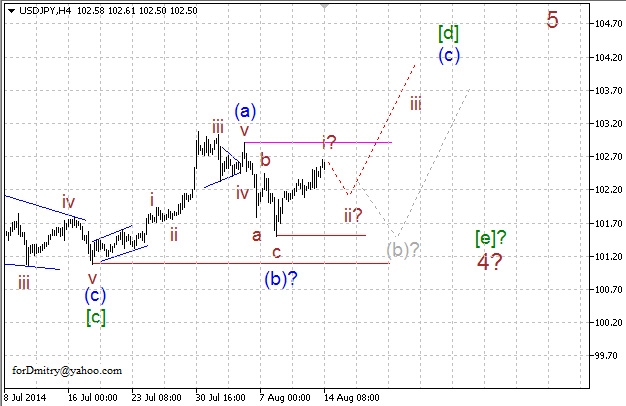

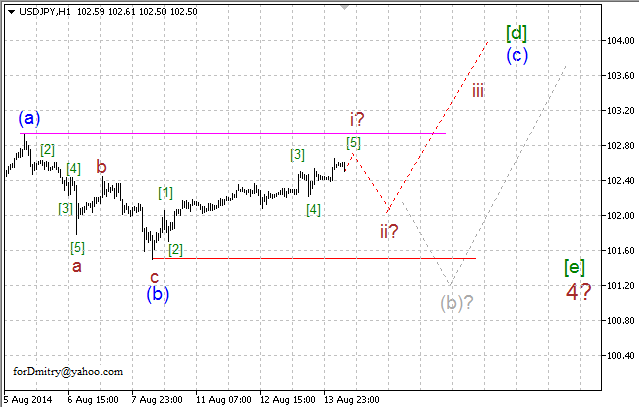

USDJPY, “US Dollar vs Japanese Yen”

Probably, right now Yen is forming an ascending zigzag [d] of 4 of (A) of a long horizontal correction 4 of (A). In this case, later price is expected to start the final ascending movement inside wave 5 of (A).

Probably, the pair finished a descending zigzag [c] of 4 and right now is forming the final ascending wave (c) of [d] of an ascending zigzag [d] of 4, which may take the form of an impulse or a diagonal triangle.

Possibly, the price completed a descending correction (b) of [d] of an ascending zigzag [d]. If this assumption is correct, then the pair is expected to continue forming the final ascending wave (c) of [d], which may take the form of an impulse or a diagonal triangle without breaking the critical level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.