GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2835, target 1.2710, stop-loss 1.2890

USD/JPY: long at 105.60, target 107.50, stop-loss 105.60

USD/CAD: long at 1.1280, target 1.1480, stop-loss 1.1200

AUD/USD: short at 0.8840, target 0.8610, stop-loss 0.8820

NZD/USD: short at 0.7880, target 0.7500, stop-loss 0.8000

EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

ECONOMIC CALENDAR

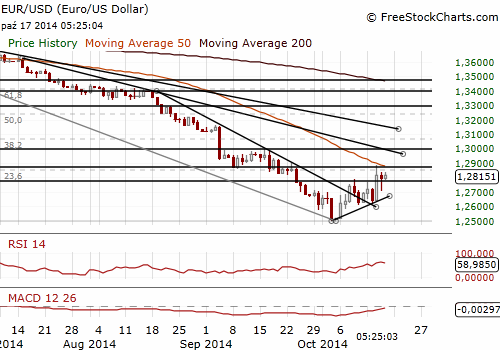

EUR/USD: Get short ahead of Yellen’s speech

(the medium-term outlook is mixed, the short-term strategy is to get short)

ECB Executive Board member Benoit Coeure said the euro zone economy is still on a recovery path and the European Central Bank expects it to grow in the third and fourth quarters. He said the external value of the EUR is not an objective of the ECB’s monetary policy.

ECB Governing Council member Ewald Nowotny said: “The economy in the euro area is not yet in deflation but it is showing clear signs of weakening.” In his opinion the euro’s recent fall is bolstering the euro zone economy and this should show up in stronger growth next year. Turning to the ECB's plans to buy asset-backed securities he said: “I am not in principle against ABS, but its quality is more important than the quantity.” Nowotny said the ECB should avoid quantitative targets. He did not believe the ABS purchases would begin before December. Such a scenario means that starting with the full-blown quantitative easing in December, as it was widely expected, is at risk.

The number of Americans filing new claims for jobless benefits fell to a 14-year low last week. Initial claims for state unemployment benefits dropped 23,000 to 264,000, the lowest level since 2000.

The Federal Reserve showed industrial production grew a larger-than-expected 1.0% mom in September, the biggest gain since November 2012. Investors have come to the view recently that slowing growth overseas will weigh on the U.S. economy and make the Fed delay a hike in interest rates. Weak retail sales data on Wednesday fuelled a global sell-off in stock markets.

Yesterday’s strong U.S. numbers did not convince traders, because of St. Louis Fed President Bullard’s dovish comments. James Bullard who is a non-voting hawk said that sticking with bond purchases for a few more months would give policymakers the time needed to assess a recent deterioration in the inflation outlook. On the other hand, Bullard said he was sticking with his projection for a first quarter rate increase for now. Minneapolis Fed President Narayana Kocherlakota, who is seen as one of the most “dovish” Fed said that a rate hike at any time in 2015 would be inappropriate.

The EUR/USD is steady aheadof today’s speech of Fed chief Janet Yellen (12:30 GMT). She is likely to express continuing confidence in the U.S. recovery, which should be supportive for the USD. That is why the trading strategy for today should be to get short on the EUR/USD ahead of Yellen’s speech. We have taken short position at 1.2835 and set the target at 1.2710. We set the stop-loss level tight at 1.2890.

Let’s take a look at next week. U.S. CPI reading is scheduled for Wednesday. Given weak inflation data from other economies that has been released so far, investor will not be strongly surprised if September U.S. CPI will be slightly weaker as well. The potential disappointment after the data is likely to be limited. On the other hand, there are preliminary PMIs releases for the Euro zone in the economic calendar for the next week. Lower-than-expected readings are likely to put some pressure on the EUR.

The medium-term outlook is mixed, however, due to uncertain outlook for US economy and likely shift in expectations of full-blown quantitative easing in the Euro zone.

Significant technical analysis' levels:

Resistance: 1.2845 (high Oct 16), 1.2853 (23.6% of 1.3995-1.2501), 1.2887 (high Oct 15)

Support: 1.2732 (hourly low Oct 16), 1.2724 (21-dma), 1.2705 (session low Oct 16)

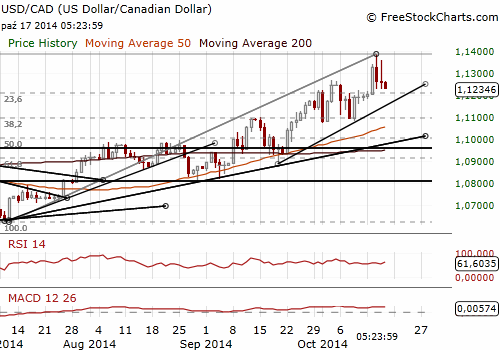

USD/CAD: Current levels attractive to get long

(we have lowered the target back to 1.1480 and are waiting for Canadian CPI and Yellen’s speech)

Canadian factory sales fell by a larger-than-expected 3.3% in August from July's record level, the steepest decline since May 2009. The strongest negative contribution to the reading came from lower sales of motor vehicles and motor vehicle parts, which fell by 11.6%. Sales of petroleum and coal products declined 3.4%.

The poor manufacturing sales data were ignored by the market. The CAD firmed yesterday to 1.1227 and today’s is slightly above this level. In the opinion of GrowthAces.com current levels are attractive to get long. We have revised the target of our long position back to 1.1480, but still believe in a rise of the USD/CAD after today’s Canadian inflation data and Janet Yellen’s speech.

Significant technical analysis' levels:

Resistance: 1.1360 (high Oct 16), 1.1385 (high Oct 15), 1.4000 (psychological level)

Support: 1.1227 (low Oct 16), 1.1226 (low Oct 15), 1.1205 (23.6% of 1.0620-1.1385)

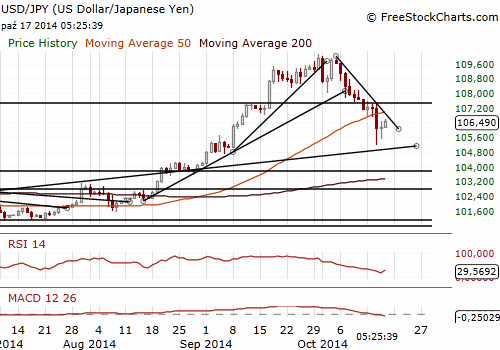

USD/JPY: JPY under pressure after weak data

(we keep our bullish outlook, the target is 107.50)

Bank of Japan Governor Haruhiko Kuroda maintained his optimism on the price outlook, saying that improvements in the economy are allowing companies to pass on rising import costs to consumers. Kuroda acknowledged that annual core consumer inflation slowed in August from the previous month due largely to falling energy prices. In his opinion in a medium- to long-term perspective, prices are gradually rising reflecting improvements in the output gap and heightening inflation expectations. Kuroda also stressed that the central bank will maintain its quantitative easing policy until its target of 2% inflation is achieved on a sustained basis. He added the BOJ would not hesitate to adjust policy if risks materialize.

The monthly Tankan sentiment index for manufacturers fell to 8 in October from 10 in September. The index was at its lowest level since May 2013. Weak economic data could complicate Prime Minister Shinzo Abe's decision by year-end whether to go ahead with a planned sales tax hike to 10% next year. The reading added also some pressure on the central bank to ease policy further although BOJ officials refrain from additional stimulus for now.

The USD/JPY is recovering after a strong fall on Wednesday. We keep our long position with the target at 107.50. In our opinion today’s Yellen’s speech is likely to support our bullish view.

Significant technical analysis' levels:

Resistance: 106.60 (session high Oct 17), 107.02 (hourly high Oct 15), 107.49 (high Oct 15)

Support: 106.14 (session low Oct 17), 105.51 (low Oct 16), 105.20 (low Oct 15)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.