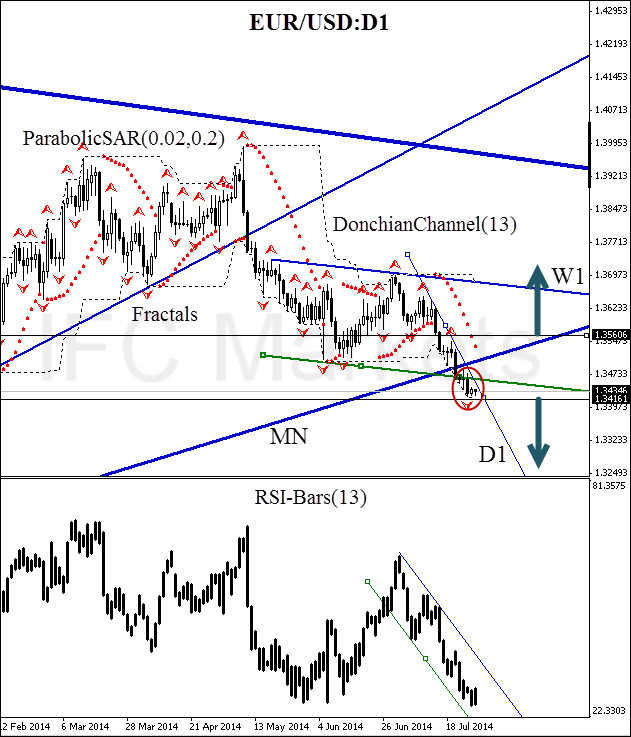

Good afternoon, dear traders. Here we consider the EUR/USD behavior on the daily chart. At the moment we can observe that the price broke the monthly trend line and is descending into the red zone. The weekly resistance was also broken, i.e. the movement is considerably accelerating. At the same time the DonchianChannel breach and the ParabolicSAR reversal occurred. Thus, there is a high probability of a new bearish momentum birth, especially that the RSI-Bars leading oscillator continues to slump in a narrow channel without significant corrections.

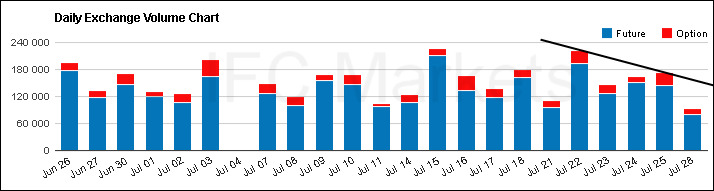

The only alarming factor is the low trading volumes. The daily volumes of the USD/CAD futures and options traded on the Chicago Mercantile Exchange are presented on the chart below. Both instruments are derivatives, and can be used to assess trends of the Forex spot market. We can see that the downtrend break is not observed yet. Thus, trading volumes do not confirm the bearish confidence, and it is possibly a disturbing signal of false breach. For conservative traders it is recommended to wait for a situation where the number of requests on futures and options exceeds 180,000. You can monitor trading volumes for this currency pair by clickinghere.

Right after that a pending sell order on euro can be opened starting from the key level at 1.34161. This support is confirmed by the 30-day DonchianChannel lower border and the fractal. It is reasonable to place the risk limitation at 1.35606, intensified by the parabolic and bearish trend line. Unlikely, but possible, that this breach might be false and the downward momentum will eventually be weakened, especially that there are low trading volumes observed. In this case, we expect a price rebound in the monthly trend channel area. Long position can be opened above the resistance at 1.35606. After position opening, Trailing Stop is to be moved after the ParabolicSAR values, near the next fractal trough (long position), or peak (short position). Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.