Independence Day:

“Look at us. Everybody’s trying to get out of Washington, and we’re the only schmucks trying to get in.”

With it being the 4th of July in the US and with all the turmoil around Greece, today’s cover photo just seemed right. I’m sure someone with better Photoshop skills than myself can put the UFO above the Greek Parthenon and send it back to us on Twitter or Facebook!

On the back of last night’s Thursday Non-Farm Payroll miss, the odds of a Fed rate hike in September seem to be drifting. NFP came in at 223K v the 231K expected. This slight miss in itself didn’t put a whole lot of pressure on the USD, but last months’ 280K was revised down to 254K which added to the data dependent uncertainty and saw a USD sell off across the board.

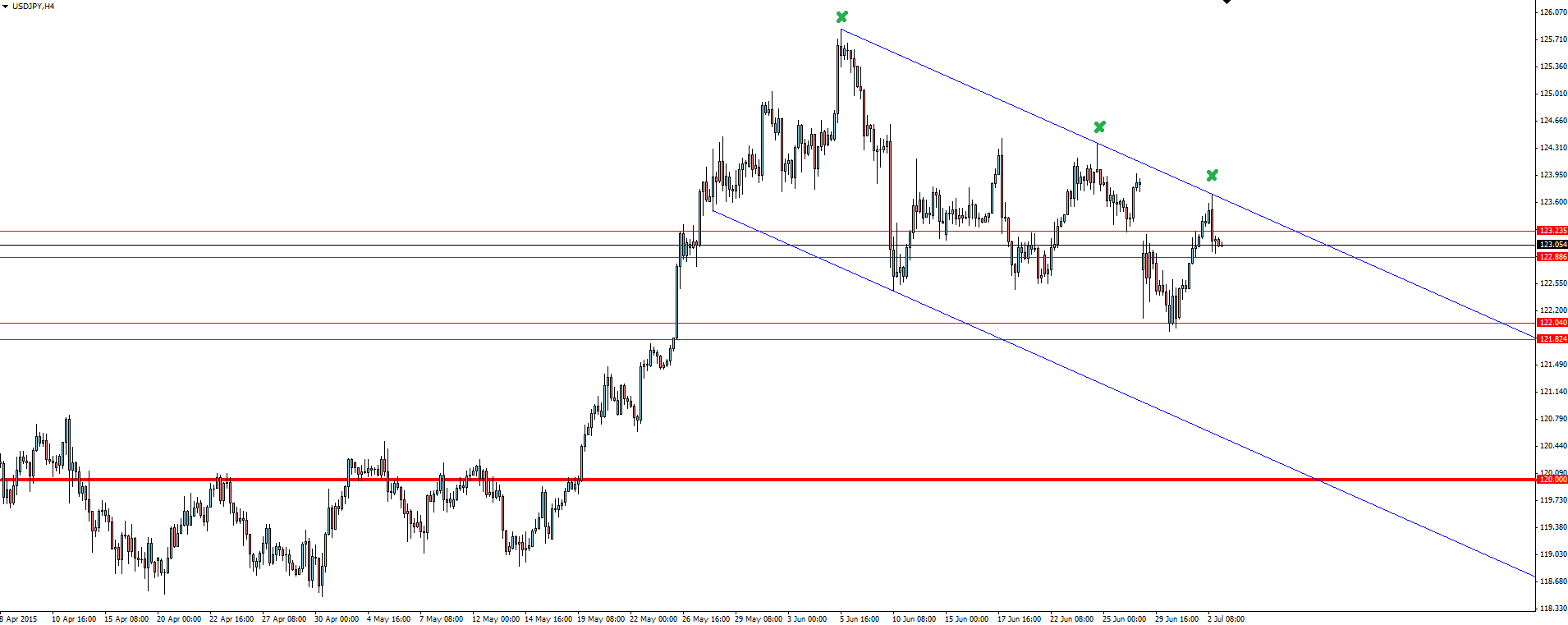

If you remembered yesterday’s Asian Session Morning blog, we took a look at USD/JPY heading into NFP and talked about the levels that we had to manage our risk around on either side of the market.

USD/JPY 4 Hourly:

Click on chart to see a larger view.

As you can see, price crept up to trend line resistance before selling off it hard on the NFP miss. This was a good result because shorting into resistance you would have made a nice 50 pips while if you were long, you could have easily taken a break-even.

———-

On the Calendar Today:

With NFP out of the way, the US on holidays and the Greek referendum to be decided over the weekend, today’s data shouldn’t be too game changing. A day like today isn’t one to get chopped out of trades on short term news spikes.

Once again, I want to just stress that with the uncertainty of what the Greek referendum result will be, I wouldn’t be holding any notable positions over the weekend. We just don’t know what markets are going to do.

Friday:

AUD Retail Sales

CNY HSBC Services PMI

GBP Services PMI

USD Bank Holiday

———-

Chart of the Day:

As the NFP spike fallout settles down, GBP/USD sits in a nice actionable zone.

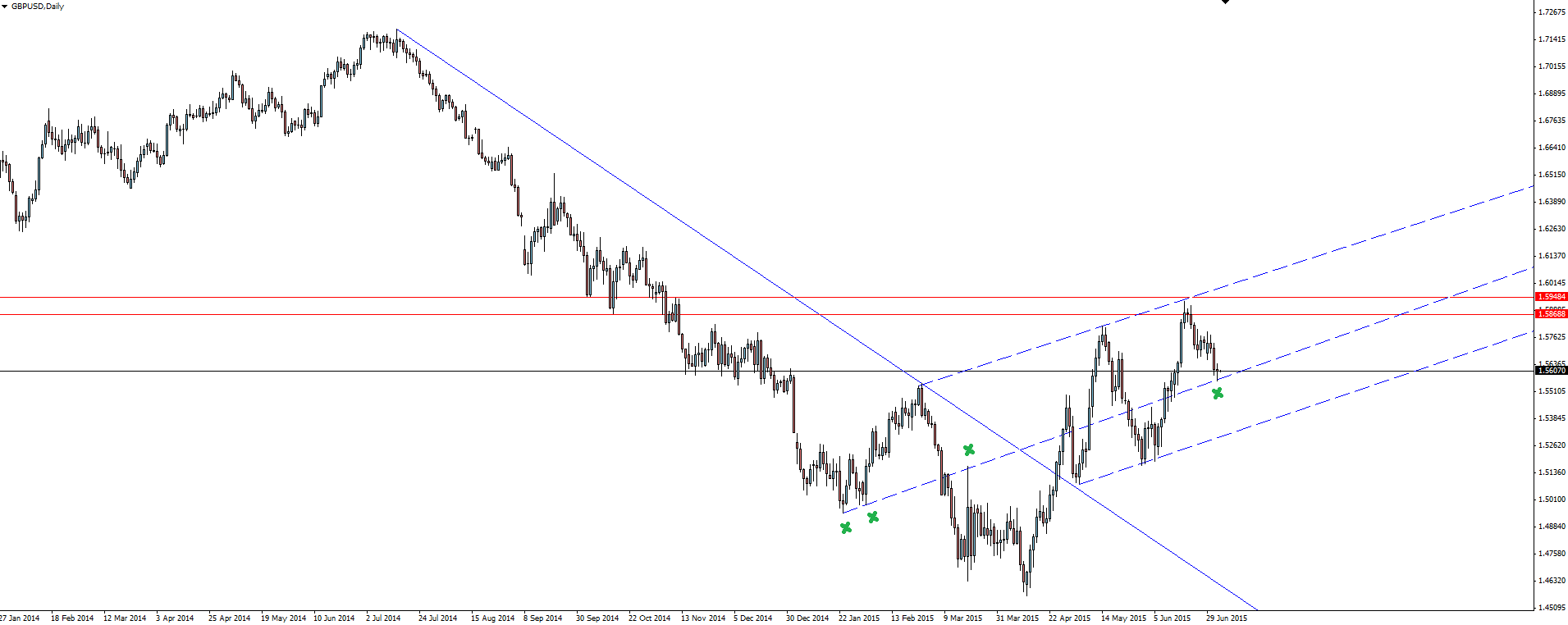

GBP/USD Daily:

Click on chart to see a larger view.

The middle line is the interesting on here, with this being the 4th touch of a previously broken and chopped trend line. So often these sorts of lines ‘re-active’ further down the line, even if they have been broken numerous times and are therefore still significant to keep on your chart.

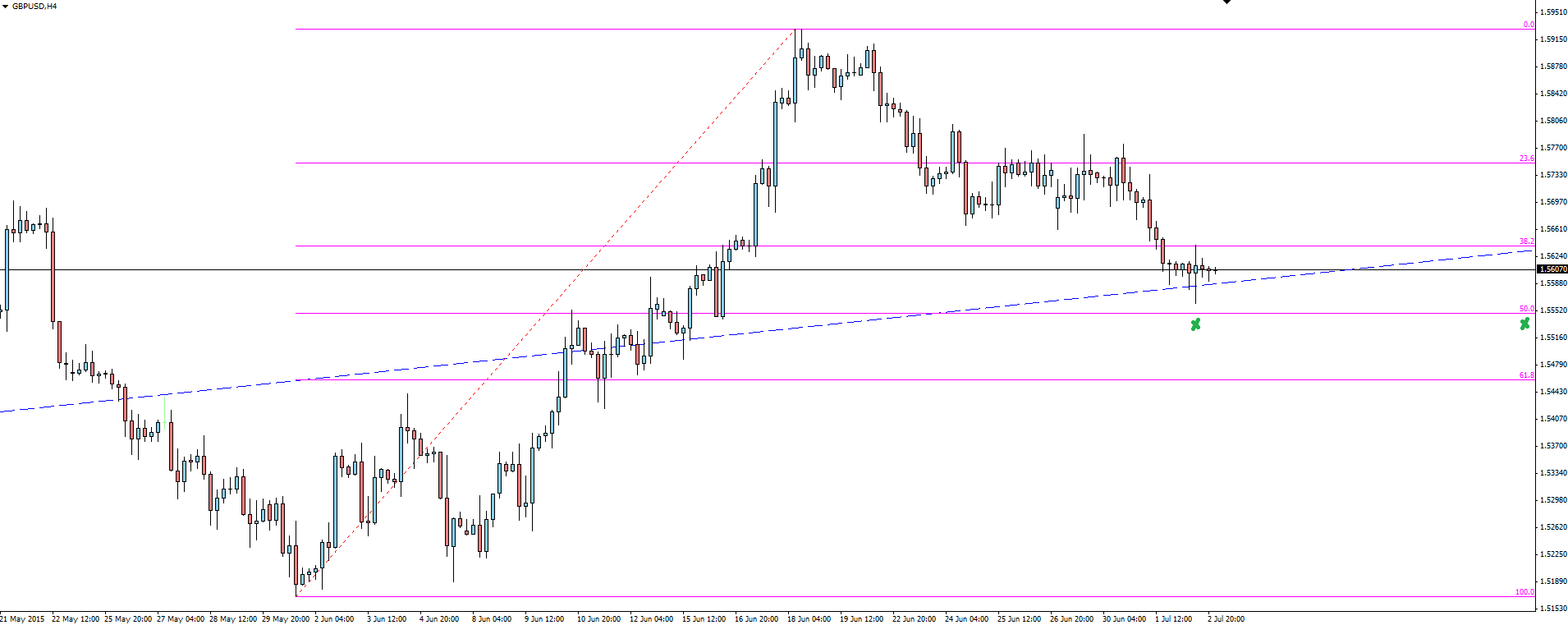

GBP/USD 4 Hourly:

Click on chart to see a larger view.

This level just happens to be the 50% fib support level as well. As I’ve said before, I’m not the biggest Fibonacci guy, but in this case it does give us some nice horizontal levels in which to place our stops around if we are trading to the long side.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.