Earlier this morning, the Fed announced that it intends to keep its benchmark rate near zero as long as inflation remains under control. There will be no change until they see consistent gains in wage growth, long-term unemployment and other gauges of the job market. The central bank maintained conservative language signalling its plans to keep short-term rates low “for a considerable time” after it ends its monthly bond purchases after its next meeting in October.

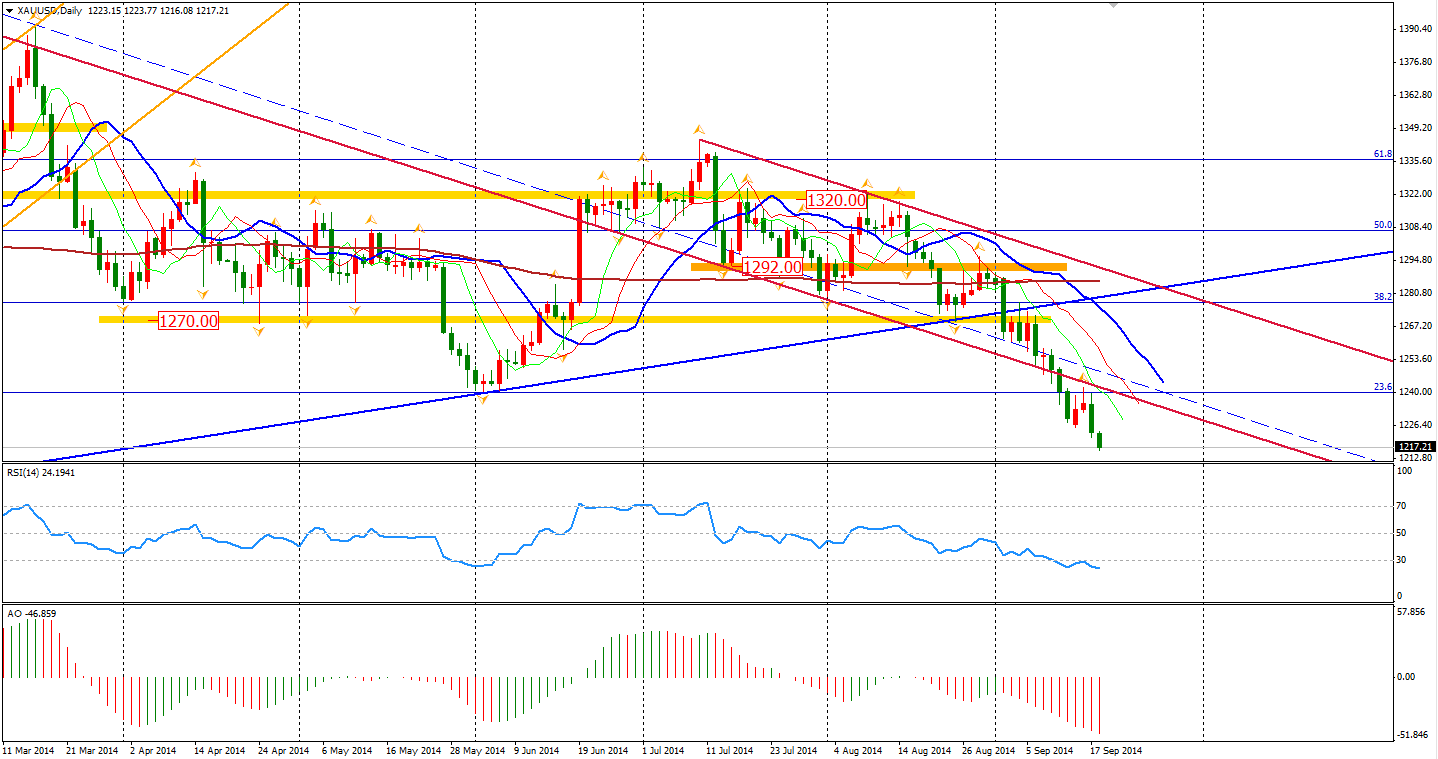

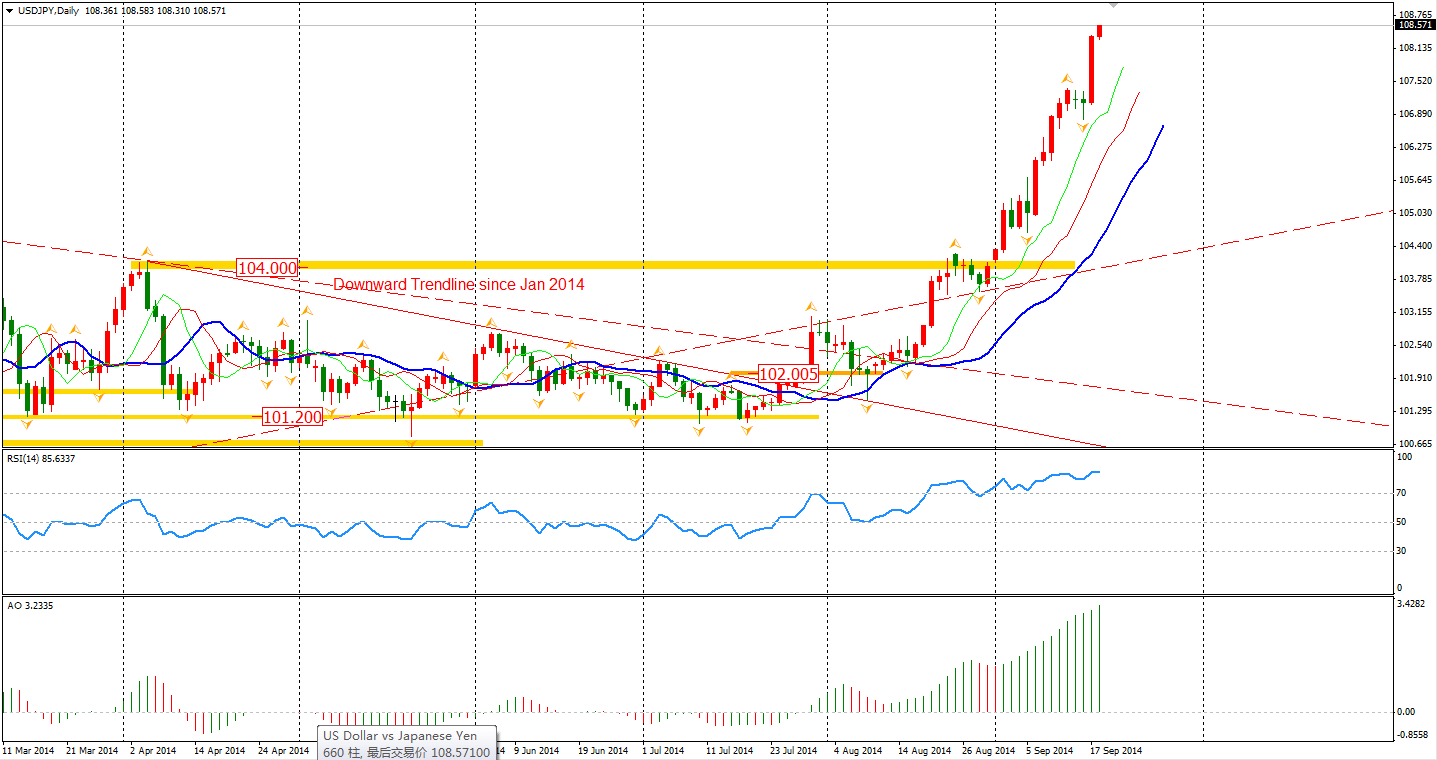

Nevertheless, the US Dollar kept its pace of ascent against other currencies, reaching a 14-month high after the release. Gold prices slumped further down and are now below $1220 per ounce.

China’s Central Bank has provided 500 billion RMB (US$81 billion) in a three-month loan to the nation’s five largest state-owned banks. The action is equivalent of a 0.5% cut in the reserve requirement ratio. The latest liquidity injection is thought as a response of recent weak economic data. It shows the monetary authority’s concern with the slowdown, especially when Fed is widely expected to quit QE and turn toward a gradual rate hike.

The industrial output expansion released last weekend was the weakest reading since the GFC. Investment and retail sales growth were also disappointing. However, Beijing shows more tolerance in this recent slowdown. In accepting that the GDP annual growth rate fell below 7.5%, it appears they are paying more attention to economic reform and liberalization which will certainly benefit China in the long term if they succeed.

With less demand for iron ore and coal from China, the Australian mining industry is suffering from the current low prices. The last time when commodity prices slumped during the GFC, Aussie/Dollar fell almost 40% to 0.60. That significant plummet is yet to happen to the exchange rate, due to the unusual operations from global central banks. However, as the Fed has pledged to normalize the monetary policy, how long will this situation remain?

The Asian stocks markets were fairly mixed yesterday before the FOMC meeting. The Shanghai Composite bounced 0.49% after the big slump on Tuesday to 2308. The Nikkei Stock Average lost 0.14%. The Australian ASX 200 dropped 0.7% to 5407. In European stock markets, the UK FTSE was down 0.14%, the German DAX gained 0.3% and the French CAC Index rose 0.50%. U.S. stocks closed slightly higher on FOMC dovish statement. The S&P 500 rose 0.13% to 2001.57. The Dows gained 0.15% to 17157, while the Nasdaq Composite Index was up 0.21% to 4562.

On the data front, UK Retail Sales will be released at 18:30 AEST. U.S. Building Permits and Unemployment Claims will be at 22:30. Philly Fed Manufacturing Index will be at midnight. However, the most watched event will undoubtedly be the Scottish Independence Vote, which may stir huge volatility in the Sterling and Euro. Investors should be wary of this risk.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.