All traders were focused on the Jackson Hole annual symposium, where central bankers meet in the one place to discuss the future of global economy and monetary policy making. However, the three-day meeting proved to be quite disappointing or even, boring by Wall Street standards.

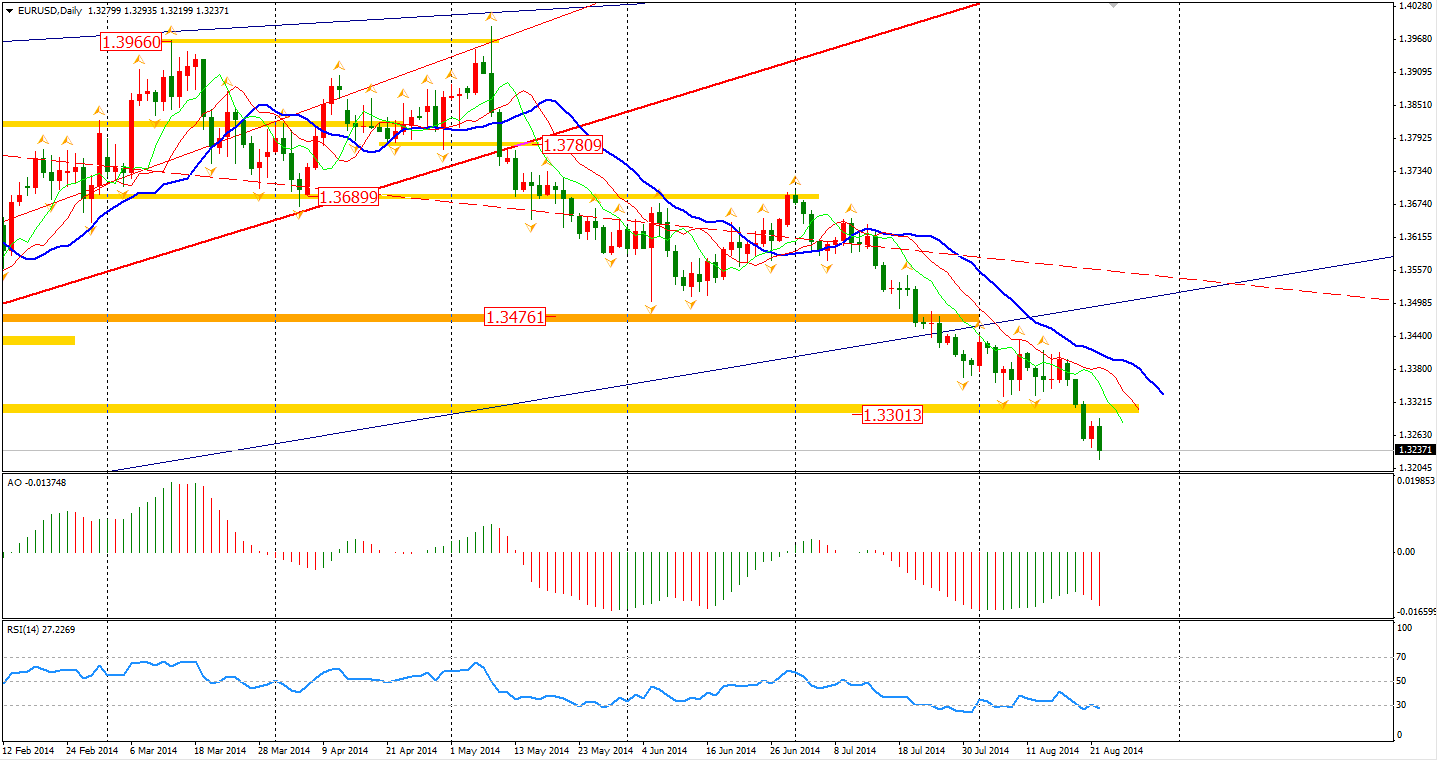

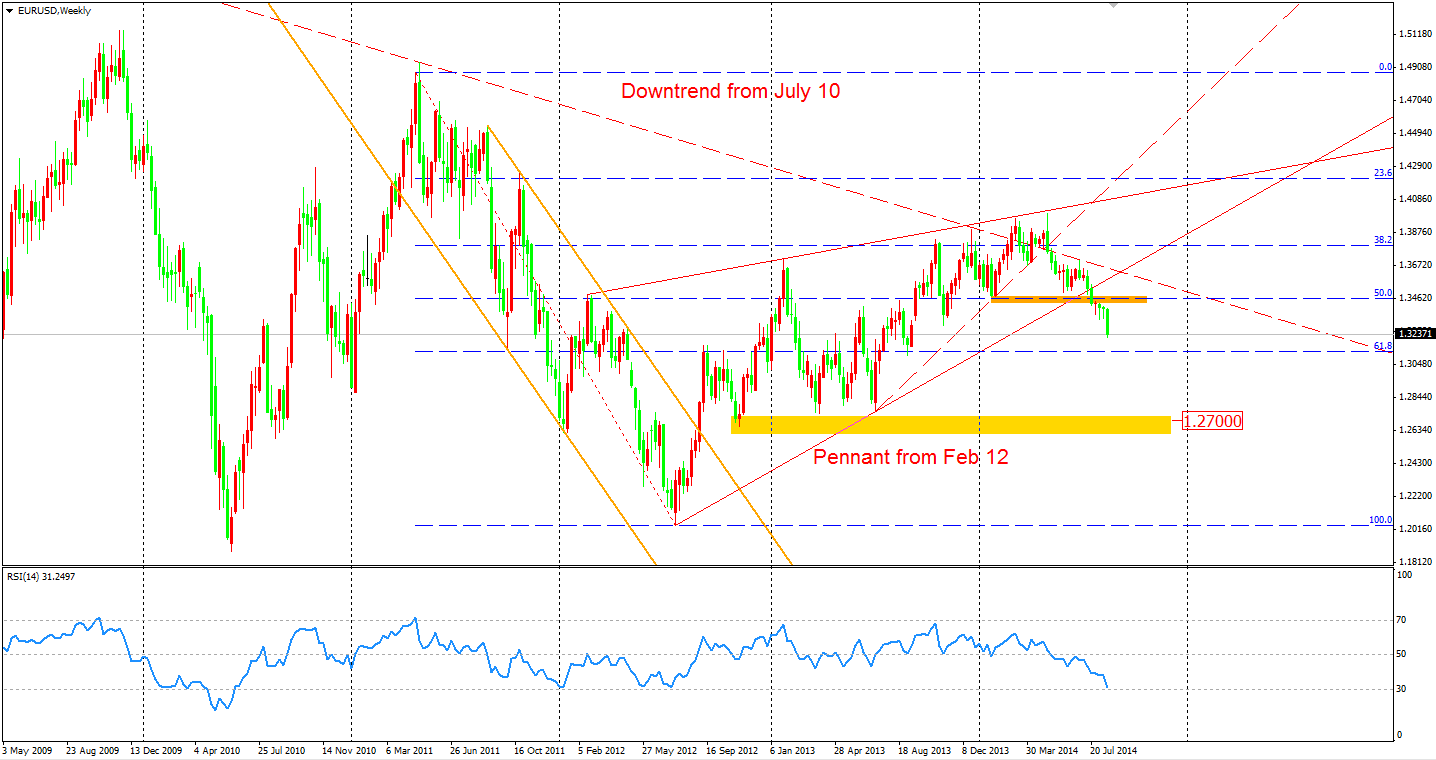

Yellen’s speech can be described as neutral. The markets’ response was limited as the Fed Chairwoman reflected both a dovish and hawkish side. The only currency appeared to be effected, the Euro, fell by over 40 pips against the Dollar. As the rebound in last Thursday confirmed, the 1.33 support had been broken through. The fall of the Euro/Dollar may continue and in the long term, it looks to be heading to 1.27, the low of 2013.

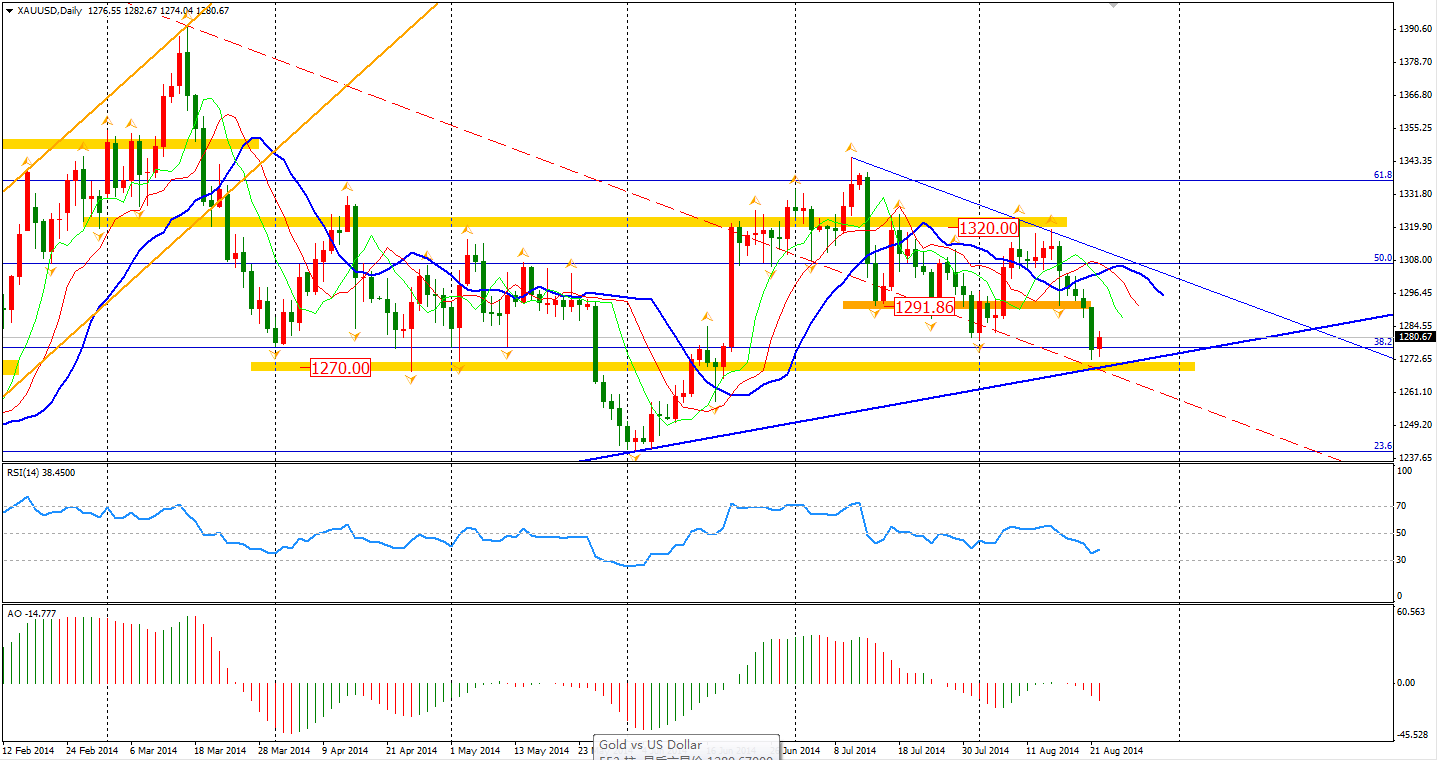

For Gold, the slump temporarily stopped at $1270 per ounce. This area has been a strong support since March and the upward trendline since 2013- at the low of $1180. With expectations that there will be a peaceful result of the meeting between Russian President Putin and Ukrainian President Poroshenko, the markets seem more at ease. Germany has suggested Ukraine accept federalism to alleviate the conflict, showing the largest economy is seeking a peaceful resolution. If so, the middle term outlook of gold price is pessimistic. The breakthrough of $1270 level may imply that the price will once again fall to its former low of $1180.

Asian stock markets closed with little changes on Friday before the Jackson Hole. Shanghai Composite edged 0.46% lower to 2241. The Nikkei Stock Average lost 0.30%. The Australian ASX 200 gained 0.12% to 5646. In the European stock markets, the FTSE fell 0.04%, the German DAX lost 0.66%, and the French CAC Index fell 0.93%. U.S. stocks fell slightly with limited change. The Dows fell 0.22% to 17001. The S&P 500 edged 0.20% lower to 1988, while the Nasdaq Composite Index was up 0.14% to 4538.

No data release during the Asian trading hours and today is UK’s bank holiday. The only data may be worth noting is the German IFO Business Climate at 18:00 AEST.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.