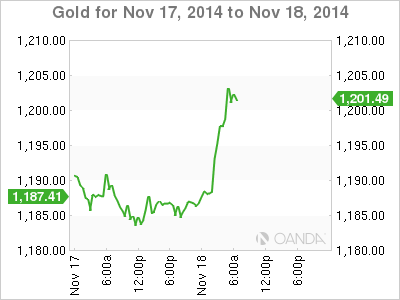

Gold prices continue to moves higher on Tuesday and has broken above the key resistance line of $1200. On the release front, today’s highlight is US Producer Price Index, a key inflation indicator. The markets are expecting another weak reading, with an estimate of -0.1%.

ECB head Mario Draghi and his colleagues are under strong pressure to “do something” to kick-start the weak Eurozone economy. Deep interest rate cuts haven’t had much effect, so the ECB has purchased covered bonds and asset-backed securities. So far, these securities have been from the private sector, and the ECB could decide to expand these purchases to government bonds, known has quantitative easing. However, there is resistance to quantitative easing from national central banks, such as the powerful Bundesbank. Speaking before a European parliamentary committee on Monday, Draghi said that further stimulus measures could include quantitative easing.

US consumer indicators looked strong on Friday. Retail Sales and Core Retail Sales both posted gains of 0.3%, edging above the estimate of 0.2%. UoM Consumer Sentiment continued its upward trend, climbing to 89.7 points in November. This was the indicator’s strongest performance since July 2007. Meanwhile, US Unemployment Claims has looked solid in recent readings, but the key indicator jumped to 290 thousand, missing the estimate of 282 thousand. This marked a seven-week high for the key indicator. The news wasn’t any better from JOLTS Jobs Openings, which weakened to 4.74M, down from 4.84M a month earlier. The estimate stood at 4.81M.

XAU/USD 1201.51 H: 1204.65 L: 1183.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.