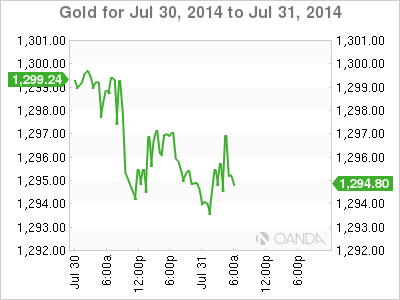

Gold prices are steady on Thursday, as the metal continues to trade close to the $1300 level. In the European session, the spot price stands at $1295.01 per ounce. In the US, today's highlight is Unemployment Claims. The markets are braced for a rise in claims, which would likely have a negative impact on the dollar.

In the US, GDP soared in the second quarter, expanding at an annual rate of 4.0%. This easily beat the estimate of 3.1%. The boost in economic activity was boosted by strong consumer confidence and business activity in Q2. Meanwhile, ADP Nonfarm Payrolls was unable to keep pace. The key employment indicator dropped to 218 thousand, compared to 284 thousand a month earlier. This was well off the estimate of 234 thousand. If the official Nonfarm Payrolls follows suit with a weak reading on Friday, the US dollar could give up its recent gains.

The Federal Reserve released a policy statement on Wednesday, with the Fed sounding somewhat dovish in tone. Policymakers acknowledged lower unemployment levels, but noted that "there remains significant underutilization of labor resources" in the economy. The Fed statement reinforces the view that the US central bank is in no rush to raise interest rates after the termination of QE, which is expected in October. As well, the Fed said that inflation levels have moved somewhat closer to the Fed's target of 2.0%.

CB Consumer Confidence was outstanding on Tuesday, pointing to a sharp increase in June. The key indicator jumped to 90.9 points, crushing the estimate of 85.5 points. This was the indicator's highest level since September 2007. Consumer confidence is closely tracked by analysts since a confident consumer is likely to increase consumption, which is critical for economic growth.

XAU/USD 1295.02 H: 1297.35 L: 1294.22

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

Bank of Japan keeps interest rate steady, as expected

The Bank of Japan (BoJ) board members decided to hold the key interest rate steady at 0%, following its April monetary policy review meeting on Friday. The decision came in line with the market expectations.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.