EUR/USD

Last week I stated " The levels to watch this week is the new demand point that was created at 1.3485 ( support Pivot.) If we break that level look to see an attack on the main support at 1.3460. If that support breaks Euro Downside target 1.3375 in my opinion. On the upside we still need a break and close above 1.3640 to have a run at long term resistance of 1.3735 and the upper 1.4000 level." Last week we had a test of the 1.3470 level, with the lowing coming in at 1.3472. The market quickly reversed up and created the new natural rally that we have seen with the new short term high of 1.3705. In my opinion we should see some short term consolidation in the EUR/USD and create a bit of a consolidation zone between 1.3630 and 1.3710.

The levels to watch out for this week is the same support of 1.3470 on the downside, and any break and close above the new high of 1.3705, I would make that 1.3715 to take into consideration some lost motion. If the EUR/USD can sustain the rally above 1.3405 we will have a quick move to 1.3751, for more consolidation between the 1.3740 level and 1.3800. This move for me would confirm we are heading to the 1.4000 major resistance. Conversely, if we break and close below the 1.3470 level, expect a target of 1.3350 with the root point low in sight of 1.3105.

Caption " Last Weeks Chart"

GBP/USD

Last week I stated

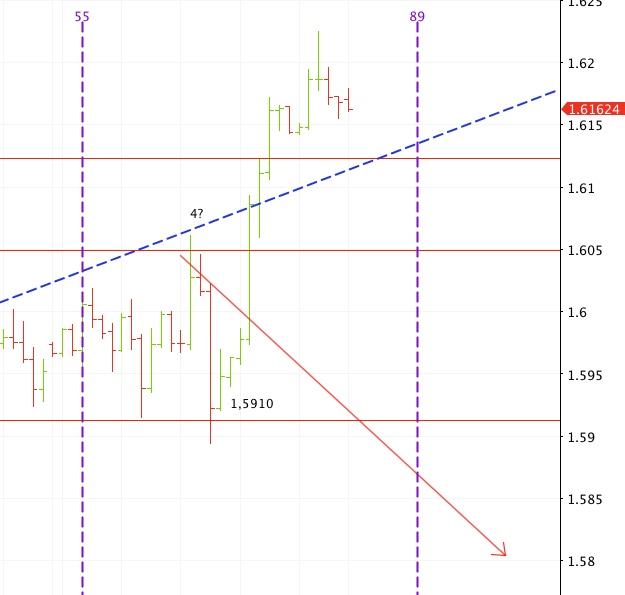

" The call on a break of 1.5990 to sell the next rallies of GBP/USD was spot on, the target on the low side was not hit however, the low only reaching 1.5916. GBP/USD is showing an Interesting pattern on the four hour chart above. We have a potential wave further down if we cannot sustain the rally above 1.6030- 1.6050. I am looking to sell GBP/USD on any failure to close above that short term level. Looking for the 1.5760 target that i wrote about last week. If I am fortunate enough to get a sale at 1.6030 - 50 my stop would have to be 1.6115ish in my opinion."

Caption " This looked Real Exciting At First!"

Last week we had a rally right up into the potential 4 Fibonacci Wave and the GBP/USD retreated nicely from 1.6060 to the low of 1.5894. Its in ability to close below that level (also a classic Head Fake Trade was created there on the 4 hour chart, caused the GBP/USD to become nothing short of Lazarus being resurrected from the dead! The GBP/USD erased all its losses and blew the wave pattern out, forcing a new look. I had taken that short trade at 1.6045 only to be stopped out at Entry causing no loss, but a bit of tremendous confusion. This week I am still slightly bearish on the GBP. I think if the cable breaks below 1.6115, we could see a move back to the 1.6050 level for a new look. Any close above the new high of 1.6225 causes a reaction to 1.6380.

Last week I stated " The USD/JPY currency is locked in a range at the moment 99.00 on the upper end and 97.10 on the lower end in my opinion. I am still looking too sell this cross and I think 134.05 is looking as a good level to start taking a short, once again in my opinion at this time."

Last week USD/JPY dipped right into our buy zone and slowing grind up causing EUR/JPY to rally to 134.20. I am a cautious seller of EUR.JPY, I am looking to see if the EUR/USD consolidates lower and the USD/JPY rally stays contained. Nothing gas changed from last week I expect the USD/JPY to stay in the upper end of the range "i.e." 98.35ish. In my opinion this currency is coiling for a brake in either direction. Any brake of 99.10 cause a short cover rally to 100.30, conversely any brake of 97.50 causes further move down to 96.45 level with the root point low of 95.80 in sight.

EUR/GBP

Last week I stated " This week I expect more of the same as GBP/USD may begin the run to the downside before any EUR/USD reaction. The support level has been moved up slightly to .8420. Any break of the .8380 level concerns and cause a totally new look." The support at .8420 is still well in place, this week I am expecting the GBP/USD to come off a bit, causing this cross to rally further. I think the GBP/USD will be in a bearish tone this week, that will also cause the EUR bulls a bit of a conundrum,

Enjoy The Party…Dance Near The Door…Remember The Market is Always Right..

Tom Strignano Forex Exclusive strives to offer its visitors the many advantages of Internet technology and to provide an interactive and personalized experience. We may use Personally Identifiable Information (your name, e-mail address, street address, telephone number) subject to the terms of this privacy policy. “We will never sell, barter, or rent your email address to any unauthorized third party. Period.”

How we gather information from users

How we collect and store information depends on the page you are visiting, the activities in which you elect to participate and the services provided. For example, you may be asked to provide information when you register for access to certain portions of our site or request certain features, such as newsletters or when you make a purchase. You may provide information when you participate in sweepstakes and contests, message boards and chat rooms, and other interactive areas of our site. Tom Strignano Forex Exclusive Web sites also collect information automatically and through the use of electronic tools that may be transparent to our visitors. For example, we may log the name of your Internet Service Provider or use cookie technology to recognize you and hold information from your visit. Among other things, the cookie may store your user name and password, sparing you from having to re-enter that information each time you visit, or may control the number of times you encounter a particular advertisement while visiting our site. As we adopt additional technology, we may also gather information through other means. In certain cases, you can choose not to provide us with information, for example by setting your browser to refuse to accept cookies, but if you do you may be unable to access certain portions of the site or may be asked to re-enter your user name and password, and we may not be able to customize the site’s features according to your preferences.

What we do with the information we collect

Like other Web publishers, we collect information to enhance your visit and deliver more individualized content and advertising. We respect your privacy and do not share your information with anyone.

Aggregated Information (information that does not personally identify you) may be used in many ways. For example, we may combine information about your usage patterns with similar information obtained from other users to help enhance our site and services (e.g., to learn which pages are visited most or what features are most attractive). Aggregated Information may occasionally be shared with our advertisers and business partners. Again, this information does not include any Personally Identifiable Information about you or allow anyone to identify you individually.

We may use Personally Identifiable Information collected on Tom Strignano Forex Exclusive websites to communicate with you about your registration and customization preferences; our Terms of Service and privacy policy; services and products offered by Tom Strignano Forex Exclusive websites and other topics we think you might find of interest.

Personally Identifiable Information collected by Tom Strignano Forex Exclusive Web sites may also be used for other purposes, including but not limited to site administration, troubleshooting, processing of e-commerce transactions, administration of sweepstakes and contests, and other communications with you. Certain third parties who provide technical support for the operation of our site (our Web hosting service for example) may access such information. We will use your information only as permitted by law. In addition, from time to time as we continue to develop our business, we may sell, buy, merge or partner with other companies or businesses. In such transactions, user information may be among the transferred assets. We may also disclose your information in response to a court order, at other times when we believe we are reasonably required to do so by law, in connection with the collection of amounts you may owe to us, and/or to law enforcement authorities whenever we deem it appropriate or necessary. Please note we may not provide you with notice prior to disclosure in such cases.

Affiliated sites, linked sites and advertisements

Tom Strignano Forex Exclusive expects its partners, advertisers and affiliates to respect the privacy of our users. Be aware, however, that third parties, including our partners, advertisers, affiliates and other content providers accessible through our site, may have their own privacy and data collection policies and practices. For example, during your visit to our site you may link to, or view as part of a frame on a Tom Strignano Forex Exclusive Web site page, certain content that is actually created or hosted by a third party. Also, through a Tom Strignano Forex Exclusive web site page you may be introduced to, or be able to access, information, Web sites, features, contests or sweepstakes offered by other parties. Tom Strignano Forex Exclusive is not responsible for the actions or policies of such third parties. You should check the applicable privacy policies of those third parties when providing information on a feature or page operated by a third party.

While on our site, our advertisers, promotional partners or other third parties may use cookies or other technology to attempt to identify some of your preferences or retrieve information about you. For example, some of our advertising is served by third parties and may include cookies that enable the advertiser to determine whether you have seen a particular advertisement before. Other features available on our site may offer services operated by third parties and may use cookies or other technology to gather information. Tom Strignano Forex Exclusive does not control the use of this technology by third parties or the resulting information, and is not responsible for any actions or policies of such third parties.

You should also be aware that if you voluntarily disclose Personally Identifiable Information on message boards or in chat areas, that information can be viewed publicly and can be collected and used by third parties without our knowledge and may result in unsolicited messages from other individuals or third parties. Such activities are beyond the control of Tom Strignano Forex Exclusive and this policy.

Children

Tom Strignano Forex Exclusive does not knowingly collect or solicit Personally Identifiable Information from or about children under 13 except as permitted by law. If we discover we have received any information from a child under 13 in violation of this policy, we will delete that information immediately.

Changes to this Policy

Tom Strignano Forex Exclusive reserves the right to change this policy at any time. Please check this page periodically for changes. Your continued use of our site following the posting of changes to these terms will mean you accept those changes. Information collected prior to the time any change is posted will be used according to the rules and laws that applied at the time the information was collected.

Governing law

This policy and the use of this Site are governed by Florida,U.S.A.law. If a dispute arises under this Policy we agree to first try to resolve it with the help of a mutually agreed-upon mediator in the following location:Fort Lauderdale, Florida U.S.A.Any costs and fees other than attorney fees associated with the mediation will be shared equally by each of us.

If it proves impossible to arrive at a mutually satisfactory solution through mediation, we agree to submit the dispute to binding arbitration at the following location: Fort Lauderdale, Florida U.S.A., under the rules of the American Arbitration Association. Judgment upon the award rendered by the arbitration may be entered in any court with jurisdiction to do so.

This statement and the policies outlined herein are not intended to and do not create any contractual or other legal rights in or on behalf of any party.

Risk Disclosure:

Risk Disclosure Statement

OFF-EXCHANGE FOREIGN CURRENCY TRANSACTIONS INVOLVE THE LEVERAGED TRADING OF CONTRACTS DENOMINATED IN FOREIGN CURRENCY CONDUCTED WITH A FUTURES COMMISSION MERCHANT OR A RETAIL FOREIGN EXCHANGE DEALER AS YOUR COUNTERPARTY. BECAUSE OF THE LEVERAGE AND THE OTHER RISKS DISCLOSED HERE, YOU CAN RAPIDLY LOSE ALL OF THE FUNDS YOU DEPOSIT FOR SUCH TRADING AND YOU MAY LOSE MORE THAN YOU DEPOSIT. YOU SHOULD BE AWARE OF AND CAREFULLY CONSIDER THE FOLLOWING POINTS BEFORE DETERMINING WHETHER SUCH TRADING IS APPROPRIATE FOR YOU.

(1) TRADING IS NOT ON A REGULATED MARKET OR EXCHANGE—YOUR DEALER IS YOUR TRADING PARTNER WHICH IS A DIRECT CONFLICT OF INTEREST. BEFORE YOU ENGAGE IN ANY RETAIL FOREIGN EXCHANGE TRADING, YOU SHOULD CONFIRM THE REGISTRATION STATUS OF YOUR COUNTERPARTY.

The off-exchange foreign currency trading you are entering into is not conducted on an interbank market, nor is it conducted on a futures exchange subject to regulation as a designated contract market by the Commodity Futures Trading Commission. The foreign currency trades you transact are trades with the futures commission merchant or retail foreign exchange dealer as your counterparty. WHEN YOU SELL, THE DEALER IS THE BUYER. WHEN YOU BUY, THE DEALER IS THE SELLER. As a result, when you lose money trading, your dealer is making money on such trades, in addition to any fees, commissions, or spreads the dealer may charge.

(2) AN ELECTRONIC TRADING PLATFORM FOR RETAIL FOREIGN CURRENCY TRANSACTIONS IS NOT AN EXCHANGE. IT IS AN ELECTRONIC CONNECTION FOR ACCESSING YOUR DEALER. THE TERMS OF AVAILABILITY OF SUCH A PLATFORM ARE GOVERNED ONLY BY YOUR CONTRACT WITH YOUR DEALER.

Any trading platform that you may use to enter off-exchange foreign currency transactions is only connected to your futures commission merchant or retail foreign exchange dealer. You are accessing that trading platform only to transact with your dealer. You are not trading with any other entities or customers of the dealer by accessing such platform. The availability and operation of any such platform, including the consequences of the unavailability of the trading platform for any reason, is governed only by the terms of your account agreement with the dealer.

(3) YOUR DEPOSITS WITH THE DEALER HAVE NO REGULATORY PROTECTIONS.

All of your rights associated with your retail forex trading, including the manner and denomination of any payments made to you, are governed by the contract terms established in your account agreement with the futures commission merchant or retail foreign exchange dealer. Funds deposited by you with a futures commission merchant or retail foreign exchange dealer for trading off-exchange foreign currency transactions are not subject to the customer funds protections provided to customers trading on a contract market that is designated by the Commodity Futures Trading Commission. Your dealer may commingle your funds with its own operating funds or use them for other purposes. In the event your dealer becomes bankrupt, any funds the dealer is holding for you in addition to any amounts owed to you resulting from trading, whether or not any assets are maintained in separate deposit accounts by the dealer, may be treated as an unsecured creditor’s claim.

(4) YOU ARE LIMITED TO YOUR DEALER TO OFFSET OR LIQUIDATE ANY TRADING POSITIONS SINCE THE TRANSACTIONS ARE NOT MADE ON AN EXCHANGE OR MARKET, AND YOUR DEALER MAY SET ITS OWN PRICES.

Your ability to close your transactions or offset positions is limited to what your dealer will offer to you, as there is no other market for these transactions. Your dealer may offer any prices it wishes, and it may offer prices derived from outside sources or not in its discretion. Your dealer may establish its prices by offering spreads from third party prices, but it is under no obligation to do so or to continue to do so. Your dealer may offer different prices to different customers at any point in time on its own terms. The terms of your account agreement alone govern the obligations your dealer has to you to offer prices and offer offset or liquidating transactions in your account and make any payments to you. The prices offered by your dealer may or may not reflect prices available elsewhere at any exchange, interbank, or other market for foreign currency.

(5) PAID SOLICITORS MAY HAVE UNDISCLOSED CONFLICTS

The futures commission merchant or retail foreign exchange dealer may compensate introducing brokers for introducing your account in ways which are not disclosed to you. Such paid solicitors are not required to have, and may not have, any special expertise in trading, and may have conflicts of interest based on the method by which they are compensated. Solicitors working on behalf of futures commission merchants and retail foreign exchange dealers are required to register. You should confirm that they are, in fact registered. You should thoroughly investigate the manner in which all such solicitors are compensated and be very cautious in granting any person or entity authority to trade on your behalf. You should always consider obtaining dated written confirmation of any information you are relying on from your dealer or a solicitor in making any trading or account decisions.

FINALLY, YOU SHOULD THOROUGHLY INVESTIGATE ANY STATEMENTS BY ANY DEALERS OR SALES REPRESENTATIVES WHICH MINIMIZE THE IMPORTANCE OF, OR CONTRADICT, ANY OF THE TERMS OF THIS RISK DISCLOSURE. SUCH STATEMENTS MAY INDICATE POTENTIAL SALES FRAUD. THIS BRIEF STATEMENT CANNOT, OF COURSE, DISCLOSE ALL THE RISKS AND OTHER ASPECTS OF TRADING OFF-EXCHANGE FOREIGN CURRENCY TRANSACTIONS WITH A FUTURES COMMISSION MERCHANT OR RETAIL FOREIGN EXCHANGE DEALER.

Additional Notices and Disclaimers

The services and content that we provide our solely for educational purposes. The generic, non- personalized trade or market recommendations or analyses provided by us are based solely on the judgment of our personnel and should be considered as such. You acknowledge that you enter into any transactions relying on your own judgment. Any market recommendations provided by us are generic only and may or may not be consistent with the market positions or intentions of our firm and/or our affiliates. Any opinions, news, research, analyses, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice.

There are risks associated with utilizing an Internet-based trading system including, but not limited to, the failure of hardware, software, and Internet connection. We are not responsible for communication failures or delays when trading via the Internet. We are not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content on this website is subject to change at any time without notice.

HIGH RISK WARNING:

Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in Forex futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.