Key Highlights

A recovery in the EURUSD pair failed this past week, as the pair started to trade lower once again.

There was a support trend line formed on the hourly chart of the EURUSD pair, which was broken to help sellers gain control.

Euro Zone Manufacturing Purchasing Managers Index (PMI) will be released by the Markit Economics today, which is forecasted to remain stable at 52.3.

In New Zealand, the Visitor Arrivals released report was by the Statistics New Zealand today, which pointed an increase of 8.9% in October 2015.

EURUSD Technical Analysis

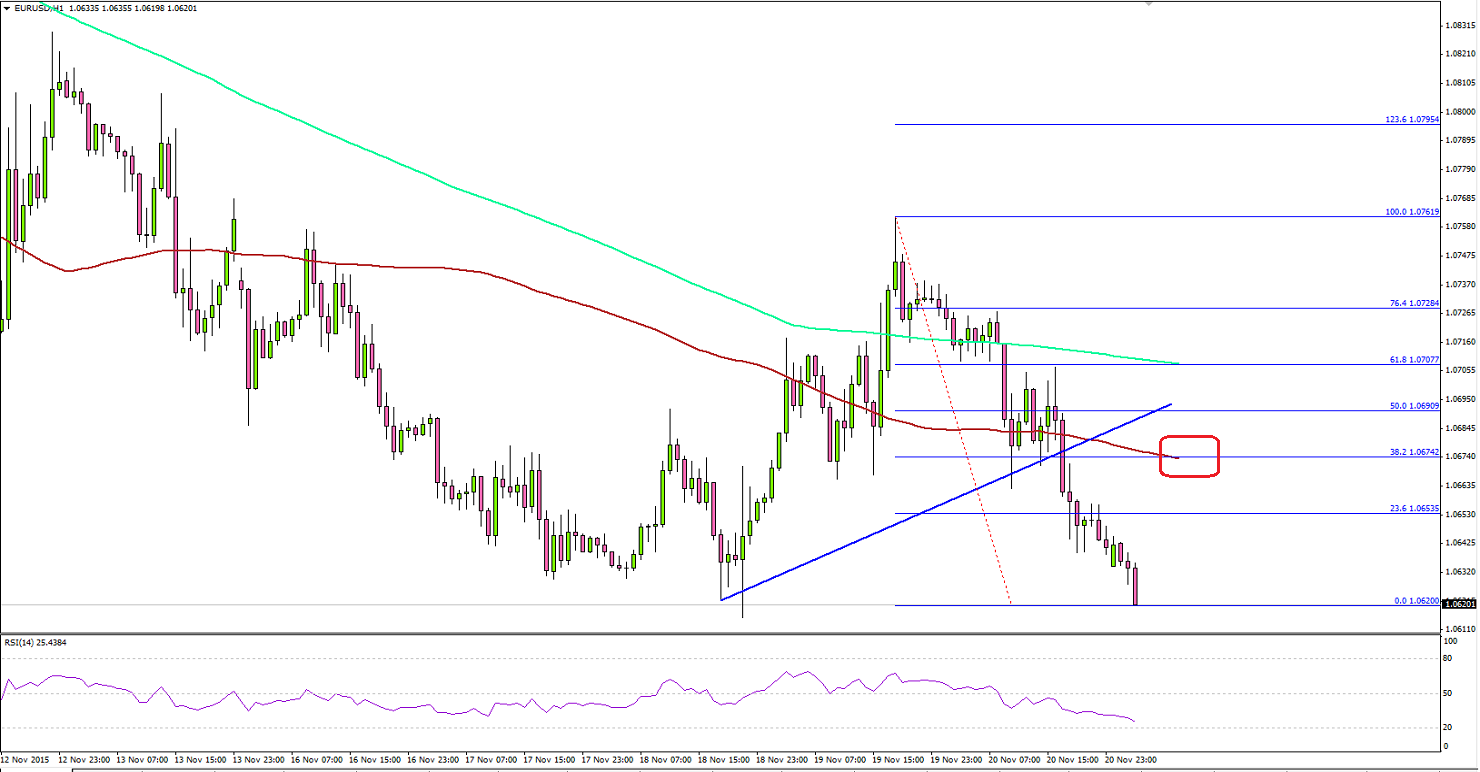

The EURUSD pair managed to climb higher this past week towards 1.0760 where it failed completely and started to move lower again. There was a bullish trend line formed on the hourly chart of the EURUSD pair, which was broken recently. The point to note is the fact that the pair settled below the 100 and 200 hourly simple moving average, which is a strong sell signal.

The pair is currently trading near the last swing low of 1.0600-20. A break below it may take the pair further lower may be towards 1.0580. On the upside, the 100 hourly MA can be seen as a major resistance moving ahead that might prevent the upside if the pair corrects higher in the short term.

Euro Zone Manufacturing and Services PMI

Today, the Euro Zone will witness a lot of economic releases, including the Euro Zone Manufacturing Purchasing Managers Index (PMI) (captures business conditions in the manufacturing sector) by the Markit Economics. The forecast is lined up for no change in the PMI from 52.3 in November 2015. Any miss in the result may impact EURUSD pair and might take it lower in the short term.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.