Analysis for January 28th, 2014

GBP/USD

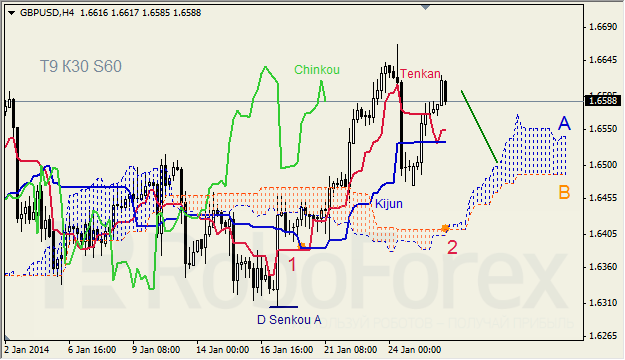

GBPUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); both lines are horizontal and very close to each other. Ichimoku Cloud is still going up (2); Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect decline of the price.

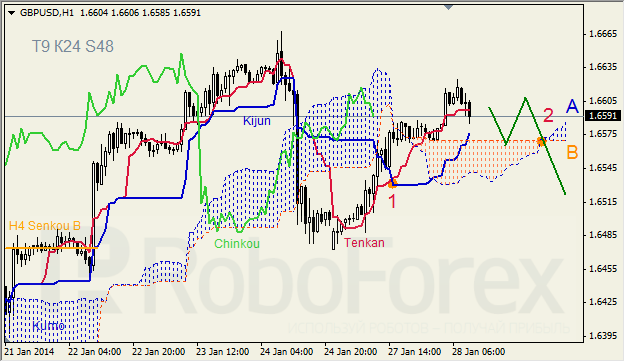

GBPUSD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); Kijun-Sen and Senkou Span A are directed upwards. Ichimoku Cloud is going up (2). Short‑term forecast: we can expect support from Senkou Span B, and attempts of the price to stay below Kumo.

GOLD

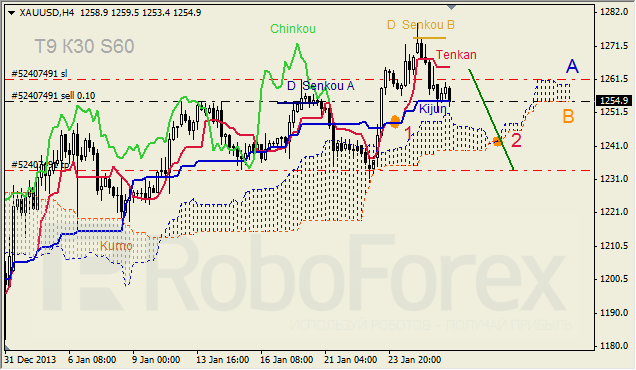

XAUUSD, Time Frame H4. Tenkan-Sen and Kijun-Sen intersected and formed “Golden Cross” (1). D Senkou Span B is resistance level; Ichimoku Cloud is going up (2); Chinkou Lagging Span is on the chart, and the price on Kijun-Sen. Short-term forecast: we can expect decline of the price.

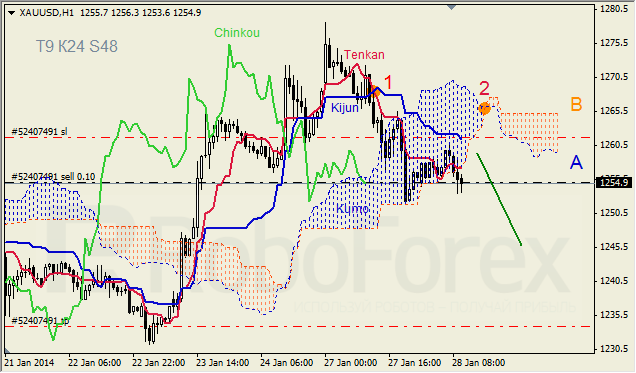

XAUUSD, Time Frame H1. Kijun-Sen is directed downwards. Ichimoku Cloud is going down (2), Chinkou Lagging Span is below the chart, and the price is below the lines. Short‑term forecast: we can expect resistance from Tenkan-Sen – Senkou Span B, and decline of the price.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0850, further support at nine-day EMA

EUR/USD continues to lose ground, trading around 1.0860 during the Asian hours on Friday. From a technical perspective on a daily chart, analysis indicates a sideways trend for the pair as it continues to lie within the symmetrical triangle.

GBP/USD posts modest gains above 1.2650, focus on the Fedspeak

The GBP/USD pair posts modest gains near 1.2670 during the Asian session on Friday. Meanwhile, the USD Index recovers some lost ground after retracing to multi-week lows near 104.00 in the previous session.

Gold price loses momentum, with Fed speakers in focus

Gold price trades with a bearish bias on Friday after retreating from the nearly $2,400 barrier. The bullish move of precious metals in the previous sessions was bolstered by the softer-than-expected US inflation data in April, which triggered hope for rate cuts from the US Federal Reserve.

LINK price jumps 10% as Chainlink races toward tokenization of funds

Chainlink price has remained range-bound for a while, stuck between the $16.00 roadblock to the upside and $13.08 to the downside. However, in light of recent revelations, the token may have further upside potential.

Fed speak tempers rate cut expectations

The biggest takeaway into Friday is the latest round of Fed speak. These Fed officials reiterated their stance rates should be kept restrictive for a longer period of time until there is more clear evidence inflation is heading back towards the 2% target.