European equity indices have been trading lower across the board for a large part of this morning session, but currently trading mixed, despite a positive Asian session overnight. Ahead of tomorrow’s non-farm payroll (NFP) report, the markets continue to focus on upcoming Central Bank’s potential monetary policy moves.

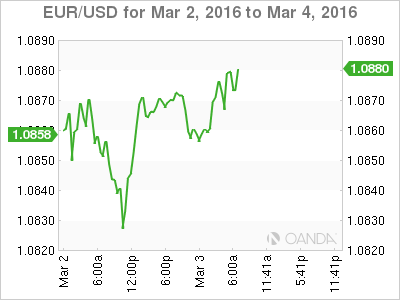

In FX, the EUR remains somewhat steady around €1.0860 despite high hopes of more ECB stimulus next week (March 10). Many believe that other Central Banks would have to follow Draghi’s lead. For instance, the Swiss National Bank (SNB) may also be pressured into having to cut their NIRP deeper. The next fortnight is expected to have a massive bearing on global yield curves.

1. Yen: Futures dealers most short in four-years

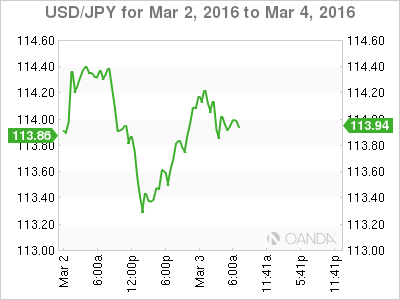

For many pro-traders, yen is a good proxy for market risk (Yen/carry-trade and risk-on assets). Over the past four-years, the relationship between the yen and equities has been exceptionally tight (on an inverse basis). When the value of the yen has dropped, equities tend to rally and vice-versa.

Tech analysts are suggesting current signals from the futures markets may be pointing to a significant decline for Yen, and that could be great news for ‘bulls’ with an appetite for risk.

Bank of Japan (BoJ) Governor Kuroda continues to repeat that Japanese policy makers stand ready to lower rates further if necessary (March 15). The Governor has pledged to continue with negative rates (NIRP) and QE until their +2% inflation target takes hold. Kuroda’s negative interest rate move in late January had no material currency impact, apart from the initial brief yen pressure to ¥121.50 on the announcement.

According to the recent future positions reports, dealers/trader/speculators currently hold an “extreme” net-short position in yen futures. In fact, they have not been this short in more than four-years, right before when the yen spiraled in a -40% decline that lasted for 36-months.

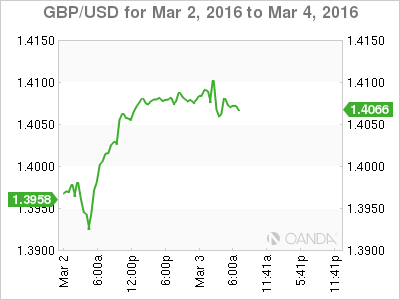

2. GBP Bears go walk about, until ….

Cable bottomed out on Monday around £1.3850 and has started reversing some losses since that time, with GBP/USD up sharply to £1.4100 in the overnight session.

The pound has found a temporary bottom despite all of this week’s negativity. There have been two unfavorable polls on the UK’s continued European membership. An ORB poll out Monday saw +52% in favor of leaving and +48% responding they would vote to remain in the EU. Tuesday’s ICM poll saw both sides deadlocked, +41% for staying and +41% for leaving.

Yesterday, Conservative PM Cameron unveiled his government’s case for remaining within the EU, and argued that those in favor of leaving need to outline a detailed plan for Britain outside the EU, including the impact on the economy and prices. Polling day is June 23 and the next three-and half months is expected to a contentious affair causing much volatility for sterling and the pound-crosses.

This morning’s U.K services PMI print came in at 52.7 for February, well below expectation (55.1), and hot on the heels of this weeks weaker U.K manufacturing and construction PMI’s.

Perhaps it’s an ominous sign for the U.K economy? Do not be surprised to see more analysts beginning to lower their expectations for Q1 U.K GDP. Nevertheless, data like this will be a wake up call for the Bank of England (BoE) – they should be able to put to bed any talks for a tighter monetary policy any time soon.

The BoE will meet on March 17. The Governor has kept the bank’s key rate on hold at +0.5% for almost seven-years and the market yield curve shows a +25 basis-point rise is not priced in for another three-years.

3. Asian and Euro PMI’s mixed

February services PMI’s for China, Hong Kong, and Japan came in mixed or lower overnight. China’s print slowed to 51.2 from 52.4, while the composite PMI returned to contraction of 49.4 vs. 50.1 prior.

Analysts note that the world’s second largest economy is still “weak and unstable,” although the relative outperformance in services is indicative of continued improvement in their economic structure.

Hong Kong’s PMI was a touch firmer but has now been in contraction for one full-year (46.4 vs. 46.1 prior). This autonomous territory on the southern coast of China has been affected from the global slowdown and lower tourist activity.

Japan PMI’s also retreated amid slowdown in new-order growth, decline in hiring, and weaker forecasts towards activity over the twelve-month outlook. (The BoJ continues to speak in favor of the anticipated impact of negative rates on tackling deflation, but is also wary that there would be a limit on how much further Central Banks can push rates into negative territory).

Not a total surprise, but Euro services PMI readings have also been mixed this morning – Germany, Spain and Italy all beat expectations, while there were a surprise miss in the U.K and France.

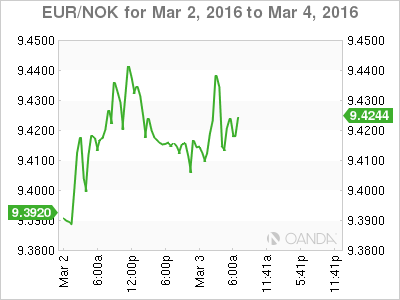

4. Norges Bank actions

Futures traders are speculating that Norway’s Central Bank will have to cut its main interest rates to zero from +0.75bps by year-end to support their economy through a plummeting oil price induced slowdown.

Inflation has been close to the Central Bank’s desired +2.5% target over the past few months, but “risks are falling as revenues from the oil sector drop and future investments suspended.”

It’s a fine balancing act for policy makers. With other Tier 1 Central Bank’s on the verge of going deeper into NIRP territory, Central Bank’s like Norges may have no latitude, but to cut their benchmark rates to keep the NOK (€9.4243) from strengthening. On March 17 the market will be looking for a rate cut.

5. China’s National Peoples Congress

This weekend, Chinese leaders will begin ten-days of policy meetings to plan out how to tackle the nation’s economic challenges and meet the government’s goal of doubling per-capita income by 2020.

Many expect authorities to roll out a larger budget deficit, infrastructure projects and policies to support supply side reforms.

Can such measures reverse the ongoing slowdown in the world’s second largest economy? To date, Chinese authorities have put up an average growth target of +6.5% for the next five-years.

Capital Markets continue to focus on the Yuan and its rate of “manipulated” depreciation and its impact on China’s foreign reserves. Do not be surprised to see China announce initatives to tighter capital controls.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.