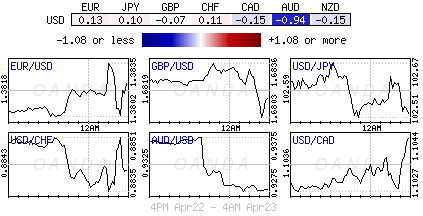

Despite major currency volatility falling to its lowest level in seven-years, there has been some movement in the forex market now that the Easter holidays are over. Fundamental data releases stretching from Australia to London in the overnight session have renewed some intraday interest in some of the major currency pairs, albeit small, any movement at this juncture is a positive and certainly preferred to than watching "paint dry" - this forex market desperately needs to break out of its tightly confined trading ranges.

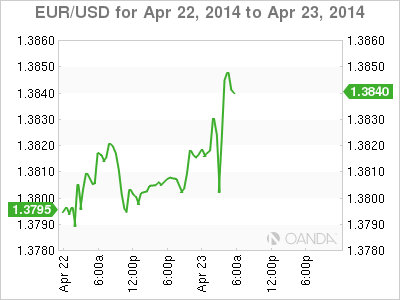

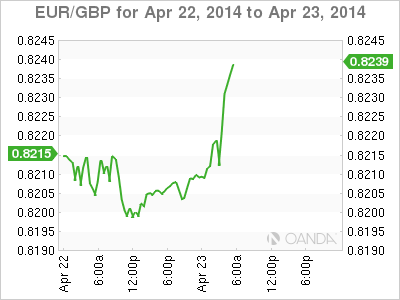

The 18-member single currency the EUR, the nemesis of many a portfolio position, could not go down and has now decided to climb higher for the time being at least. For a brief period, the EUR was hemmed in and comfortable trading within arms length of €1.3800 due to option related interest. The market has been waiting for Euro-zone flash PMI data to either push the EUR markets out of their recent "reverie" or with weaker readings strengthening the case of more ECB action. To date, flows into European equities and the peripheral debt market have been supporting the EUR, however, many investors still require fundamental assurance and that has come in the form of some flash PMI readings.

The Eurozone composite flash PMI managed to conjure a 54 print, stronger than the 53.1 that were expected. It's near a three-year high, but not surprisingly much of the strength continues to be driven by Germany (56.3). The composite for France stands at 50.5 (just in expansion territory) and even with France lagging, the strength in the composite would suggest that the periphery is not as weak as many had expected. It seems to have returned to being "fragile and uneven." Some positive prints have managed to push the EUR to session highs (€1.3848) with Scandinavian pension funds having the largest appetite for the currency. Do not be surprised that these elevated levels begin to attract some speculative top picking given that Draghi speaks tomorrow. The recent dovishness dialogue from other ECB talking heads would suggest that the market could expect Draghi to "coo" as well. However, real money buying interest has been noted on shallow dips from the highs (€1.3855). Better US data has led the specs into EUR/USD shorts and with this morning's slight improvement in Euro-zone data will begin to put these shorts under some pressure. Assuming nothing geopolitically untoward, FOMC and Euro-zone CPI on April 30th will be the next critical event for EUR position holders.

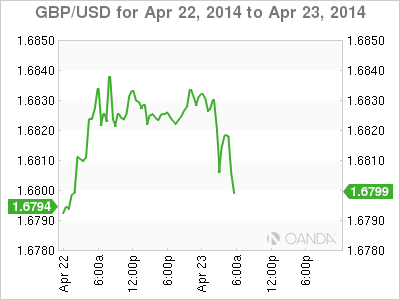

The pound has been unable to make fresh 5-year highs after this morning's BoE minutes saw downward pressure on the inflation front. As expected, there was a 'no' change decision on QE being left on hold at +0.5% and £375b respectively. However, the headline that the MPC saw a range of views with regard to the degree of "slack" in the economy has left near term gilt futures trading higher and GBP trading under pressure (£1.6790). The MPC estimated in forward guidance II that "slack" equated to 1% to 1.5% of GDP.

BoE officials are also struggling to make sense of the UK's big rise in self-employment and what effect it will have on inflation. Carney and company believes that much of the "slack" is concentrated in the labor market; despite a falling unemployment rate the concept of "underemployed" seems prevalent. UK self-employment rose by +200k in the three-months to January and accounts for 50% of total employment in the past four-years. Governor Carney is trying to understand if this phenomenon is a true change in work practices or a "disguised" form of labor slack in the UK economy. The fixed income traders have been pricing in a rate hike for the BoE early next year. Nonetheless, expect the BoE to kindly remind the market that "the precise timing of and the speed of rate hikes will depend on how quickly 'spare capacity' in the UK economy is used up." While corrective moves deeper into the £1.6700's cannot be ruled out the scope for many is for new multi-year highs from sterling. Interested investors remain better buyers of the pound on dips.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.