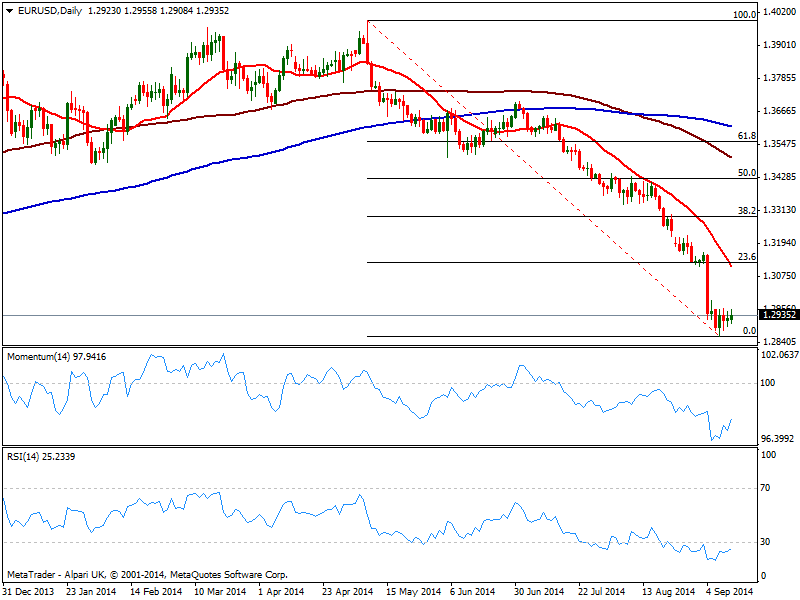

In the same daily chart, 20 SMA converges with the mentioned Fibonacci level, reinforcing the strength of the resistance, and turning it into a critical breakout point for current bearish trend, as if price manages to reach it yet retraces, risk will remain to the downside, with fresh lows anticipating a test of the critical support area at 1.2740, where the pair presents multiple highs and lows in bigger time frames.

A steady recovery above 1.3120 on the other hand may see a stronger upward corrective movement, pointing then to a test of the 1.3300 area, 38.2% retracement of the same bearish rally. But from a fundamental side, there is little support for such a strong recovery; dollar strength is quite undeniable considering the greenback stands at multi-months highs against JPY, AUD and CAD.

Anyway, if fundamentals align with the dominant bearish trend, the EUR/USD will remain condemned despite extreme technical readings, with a weekly close below mentioned 1.2740 level exposing the pair to a test of 1.25 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.