S&P 500 completed top intact to leave bearish risks

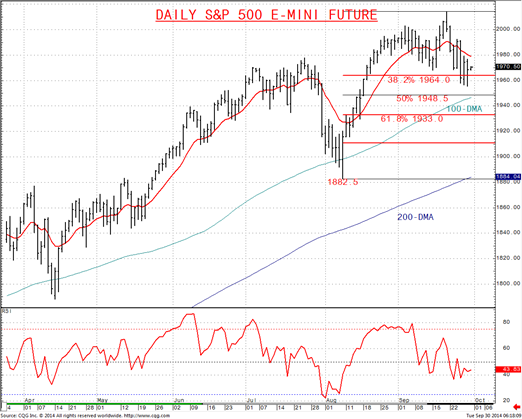

An erratic Monday session, but a lower low and lower high reinforces negative pressures from the Thursday plunge from ahead of a firm barrier at 1999.25 through 1968.0 and the 38.2% retrace of the rally from August in the ADC chart at 1964.0.

This activity completed a more notable topping structure, and still favours a deeper correction through month-end and targets chart/ retrace support at 1950.0/48.5 next

Overshoot threat is to the 100-day MA, currently 1946.25 and maybe the 61.8% retrace at 1933.0.

WHAT CHANGES THIS?

- Above 1979.25 eases bear risks; through 1992.5 signals a neutral tone, only shifting positive above 1999.25.

4 Hour S&P 500 E-mini December Future Chart

Daily S&P 500 Future Adjusted Continuation Chart

THERE IS SUBSTANTIAL RISK OF LOSS IN TRADING FUTURES, OPTIONS AND FX PRODUCTS. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.