Market Overview

Market sentiment continues to be thrown around with the movement in the oil price. Yesterday’s eventual sell-off on equity markets again can as oil reversed earlier gains to close down once more as the precipitous decline shows little sign of stabilising. The concerns will not have been helped overnight by the decline in the flash Chinese manufacturing PMI which fell to a 7 month low and is now back into contraction territory at 49.5. Although this will increase speculation of further easing by the People’s Bank of China, the concerns over a lack of demand in Asia are having a significant impact on global markets. Not only that, but in an attempt to try and stem the tide of sharp losses on the Rouble, the Russian central bank has hikes interest rates by 6.5% to 17% overnight. The Rouble has initially strengthened and it will be interesting to see if this creates any meaningful and sustained reversal.

Wall Street had a fluctuating session which ended with a close lower by 0.6%. The continued pressure on the oil price and in reaction to yesterday’s losses has meant that shares in Asia have been sharply lower too, with the notable exception on Shanghai which remains supported on a day of bad news by the speculation of easier monetary policy. European markets are trading higher in early exchanges.

In forex trading, the dollar is under pressure again, with broad losses against all the major currencies, whilst gold and silver have also both found support. Traders will be looking towards a packed day of data today. The early morning is dominated by the Eurozone flash manufacturing PMIs, so expect the euro to be flying around. The UK CPI inflation figure will also be keenly watched by sterling traders at 09:30GMT, with an expectation that there will be a further slide in inflation to 1.2% (from 1.3%). There is then the German ZEW Economic Sentiment at 10:00GMT with an expectation of another improvement to 19.8 (from 11.5 last month). The US building permits (1.06m exp) and housing starts (1.04m exp) are at 13:30GMT before the US flash manufacturing PMI at 14:45GMT (56.1 exp).

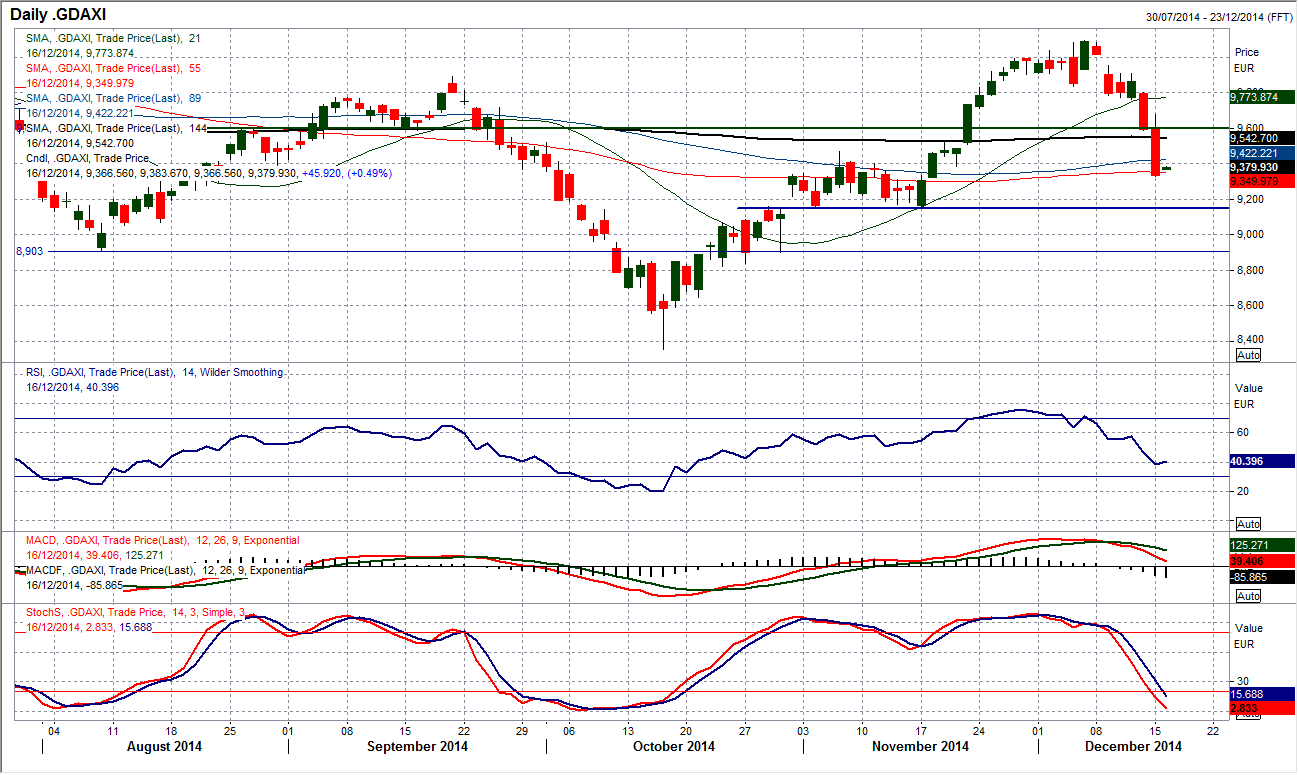

Chart of the Day – DAX Xetra

The DAX has been slammed in the past couple of days. The index has lost over 500 points in the past 2 days alone and there has almost been a element of panic. The concern is that the selling has accelerated into the close on both days, with 250 points lost in the final two hours of trading yesterday. This is a concern because it is often the time of the day at which the smart money will be trading. The index is now back into a band of support between 9150/9467 although whether technical supports make much of a difference at this stage will be interesting to see. There has been a slight rebound in early trading today, but there again it was a similar story yesterday before the sellers got the bit between their teeth. Momentum indicators are all in correction mode now with RSI, MACD and Stochastics all sharply falling. A loss of 9150 would re-open 8900 again which was an old support.

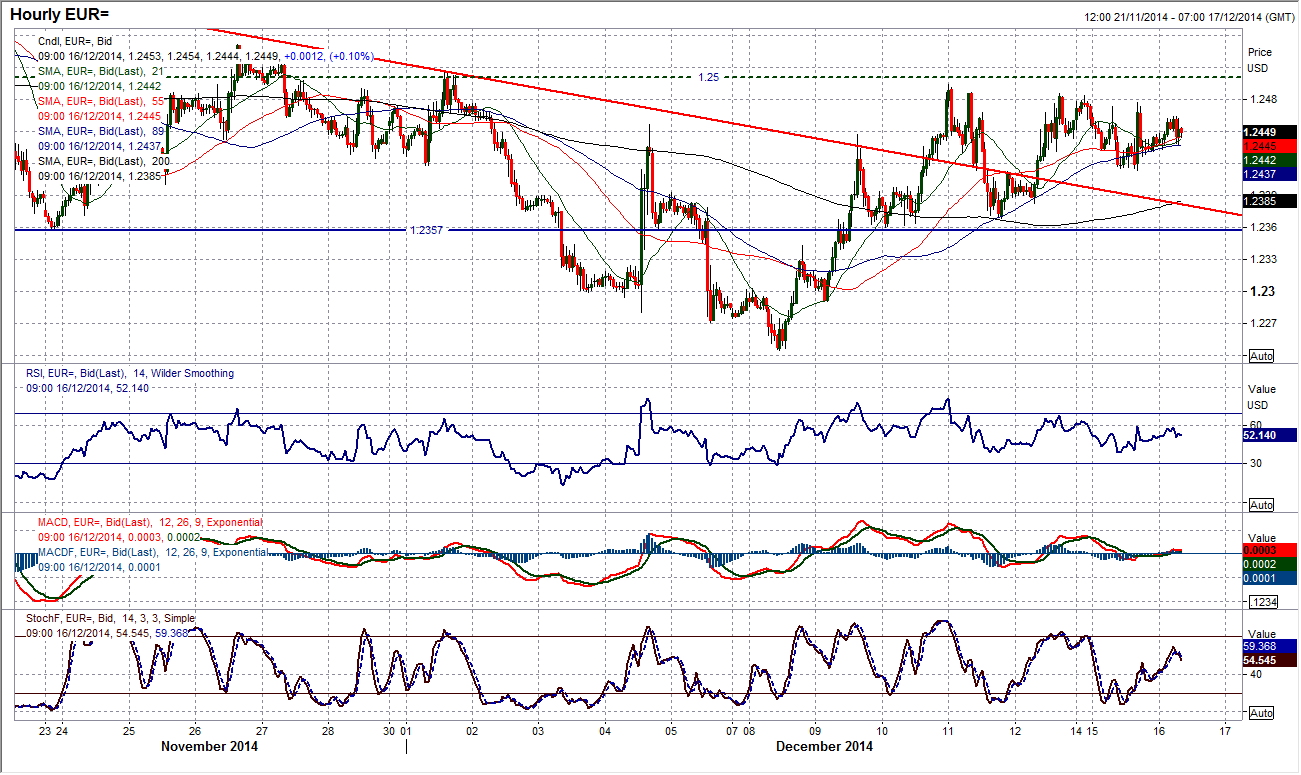

EUR/USD

The chart of the euro has really quietened down in recent sessions as forex markets have searched for direction. The result is that having seen the price action in the past week breaking the big downtrend to neutralise the near/medium term outlook, the euro has been unable to push on. Trading below the first real key reaction high within the downtrend, at $1.2531, means that this is still just nothing more than a consolidation at this stage. The intraday hourly chart shows that a pivot resistance around $1.2500 remains an immediate barrier, however interestingly, the rising 89 hour moving average (at $1.2440) is a basis of support. It looks as though the market is looking for the next catalyst (and is probably consolidating in front of the FOMC on Wednesday), so for the next day and a half this outlook could continue. The key near term support remains $1.2357.

GBP/USD

Cable is still conforming to its downtrend that has been dragging the rate lower since July, with yesterday’s decline once more apparently leaving a lower high, at $1.5756. Whilst this is not confirmed as a key reaction high, the way Cable has traded over the past few months, and with momentum indicators still in a configuration that suggests selling into strength, the signs are there that this will be the latest reaction high, below the previous high at $1.5825. The intraday hourly chart shows that yesterday’s sell-off broke below the support at $1.5650 which arguably completes a top formation which should open for further correction and a likely retest of the lows. The initial reaction today has been for a drift back higher, however, there is a band of resistance $1.5650/$1.5690 which should now restrain a rally. I am happy to now play this range on Cable (down to the low at $1.5540) and would prefer to be selling into the strength.

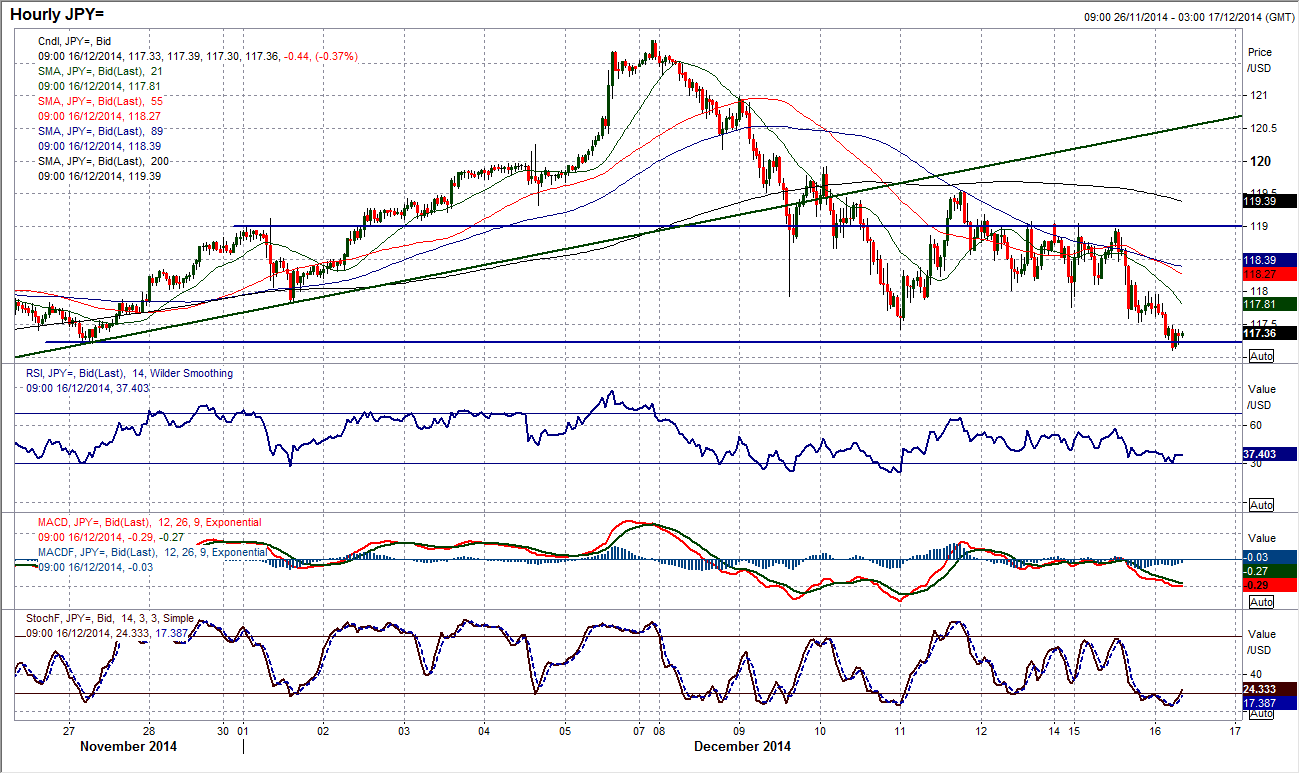

USD/JPY

It is getting incredibly close for me to have to call a head and shoulders top pattern. In the past couple of hours Dollar/Yen has dipped (only briefly) below 117.22 and this means that the key support of the first higher low (from 27th November) within the old uptrend is under threat. The magnitude of the pattern and its implications (it would imply a potential downside target of 112.60) suggest that I should wait for a daily close below the support before turning bearish near/medium term. The momentum indicators continue to fall away and the pressure is to the downside. The set up on the intraday hourly chart is also negative and suggests that there is minor resistance for any rebounds now around 118 and with key resistance at 119. The outlook is coming under increasing pressure.

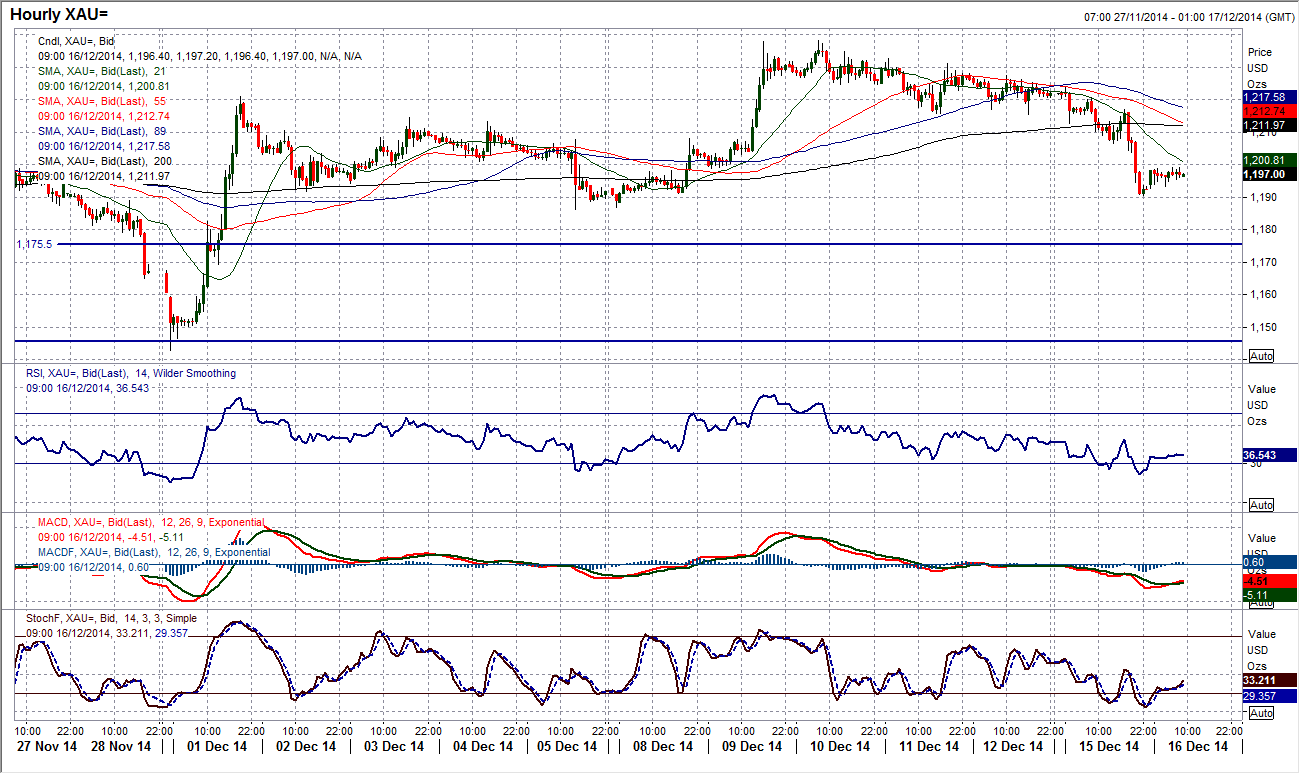

Gold

With yesterday’s weakness which dragged gold back below $1200, the price action over the next few days becomes very important for the medium term outlook. The downside move on gold has clearly kept intact the long term downtrend, but is yet to breach the key near/medium term reaction low at $1186.10. An initial element of support has come in overnight from $1190.60 and it will be interesting to see how the European trading session reacts today. The intraday hourly momentum indicators are not looking especially positive and across the course of the drift lower in the past week, there have been a series of lower highs and lower lows which are now accelerating. A breach of the $1186.10 low and subsequently if the old key floor at $1180.70 was again breached, the bearish outlook would be once more in control. There is minor resistance at $1206.50 and then around $1217.

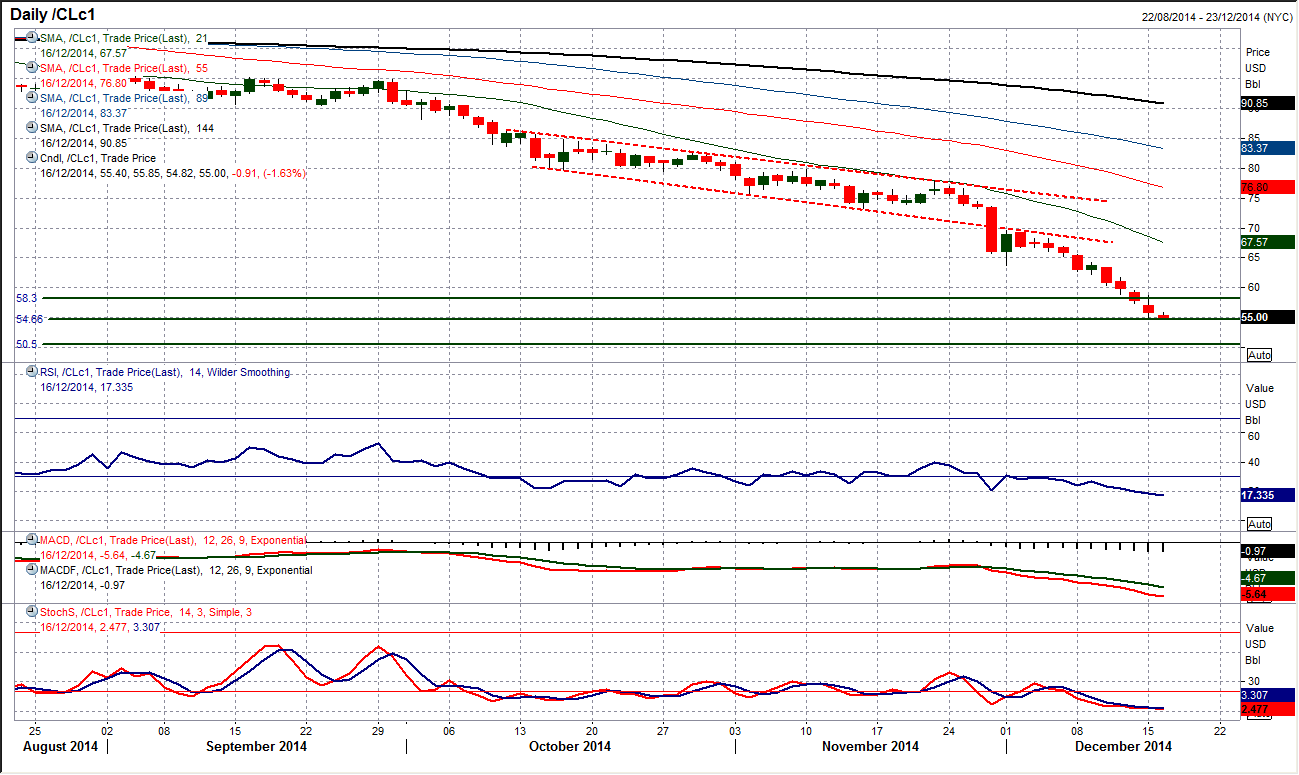

WTI Oil

Another incredible trading day on WTI yesterday, and one which once again drove investor sentiment. An initial rebound threatened a near term recovery, but with a failure to break through an intraday ceiling at $58.73 (which was just under a previous floor from Thursday last week at $58.80) the sellers came back in as the US trading session took control and the price got smashed again. This continues the sequence of now eight sessions of lower highs and lower lows. This means that yesterday’s high at $58.73 is now the key near term resistance. Momentum continues to plummet with the RSI is back below 20 and there is still little reason to expect an imminent recovery. Continue to use any intraday rallies as a chance to sell. The daily chart continues to show supports from 2009 (for what they are worth) at $54.66 and then $50.50.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.