Despite reduced volumes for Thanksgiving, there is still OPEC and Draghi to keep traders interested

Market Overview

As we hit Thanksgiving in the US the outlook for equity markets remains positive, whilst forex majors are fighting back against the dollar in the wake of a sequence of disappointing US data releases yesterday. However, with the US markets closed, the prospect of lower volumes await the European traders following a quiet Asian session. However once more European markets look positive with yet another decent start for the DAX whilst the FTSE 100 continues to lag slightly.

In forex trading, the dollar has remained weak in early trading today. Focus will be on the German flash CPI figures this morning which could give a lead indicator for tomorrow’s Eurozone CPI, whilst ECB President Mario Draghi is set to speak in Finland. If Draghi continues with his usual stance of trying to jawbone the euro lower, this could help to reverse some of the recent dollar weakness.

The major event of the day though is the formal meeting of OPEC in Vienna. A series of fringe meetings have so far not suggested that there is much ground for agreement on cuts, but do not rule out the possibility (see below for possible impacts on both Brent and WTI today). There is also a feeling that there may be some symbolic agreement to cut production from the 30 million barrels of oil per day. However what difference would 1 or 2 million barrels make when OPEC now controls only around 30% of global production and where other countries can easily up production to take advantage of the short fall.

Chart of the Day – Brent Crude

Moving into what could be one of the most important and subsequently volatile days in years for oil, the technical outlook for Brent Crude is still set very negatively. With last week’s rebound again falling over at the falling 21 day moving average (an excellent gauge for Brent), the selling pressure has resumed this week and continued overnight with a breach of the support at $76.76. The next key low does not come in until $71.75. The market is clearly pricing for a lack of agreement at the OPEC meeting and no cut to oil production. The noises coming out from fringe meetings prior to today’s main meeting suggests that this is increasingly likely to be the case. If this is confirmed, expect further price weakness. The shock would come with a production cut which could drive a short covering rally. The overhead resistance levels come in at $81.65 and $85.

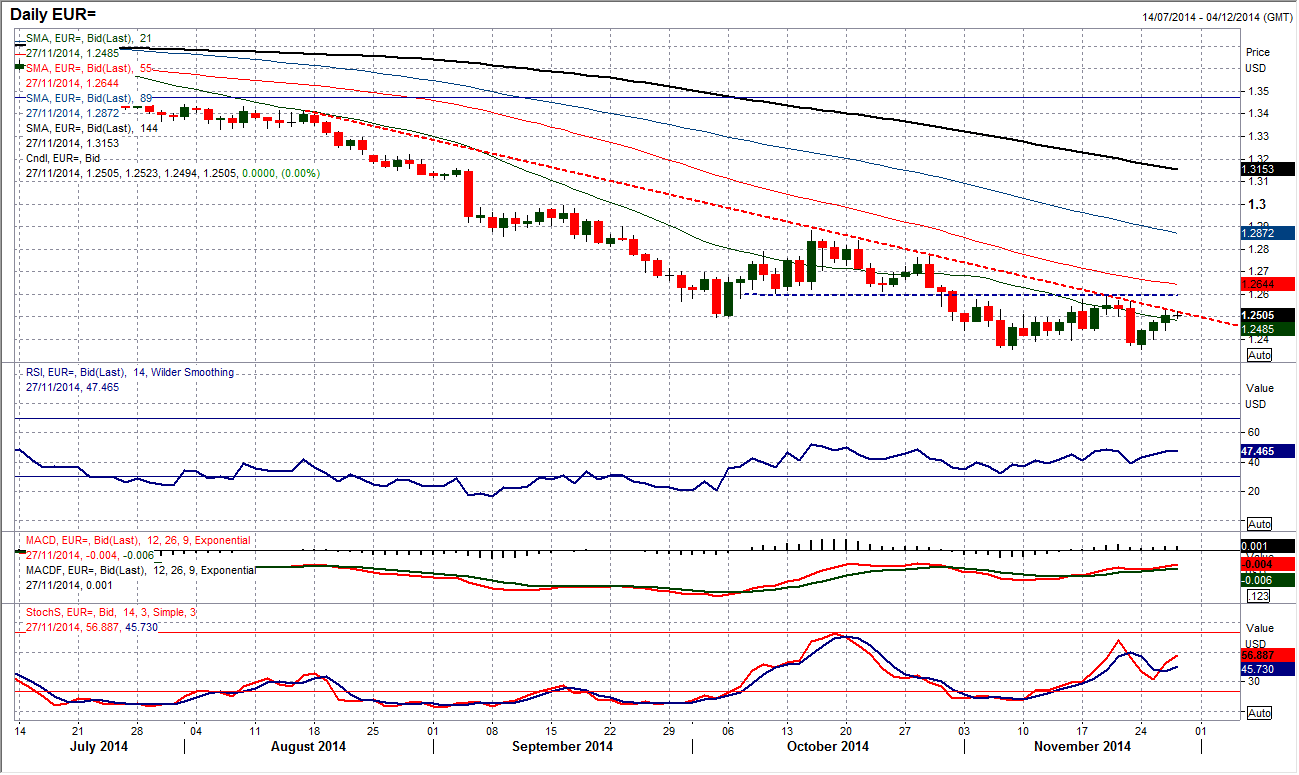

EUR/USD

The euro is back at a key level once more. The rebound that has been seen in the past 3 days has brought the rate once more back to test the resistance of the three month downtrend. For the last three weeks the euro has been trading in a sideways band between the lows at $1.2357 and up towards $1.2600, however within that time the downtrend has now come into play midway through the range and this now becomes an interesting test for the bulls. The momentum indicators are all in prime position to play a strategy of selling into strength, with the RSI again rebounding towards 50 and the MACD lines drifting gradually back towards neutral. That makes today very interesting, despite the fact that volumes may be reduced due to Thanksgiving holiday in the US. The intraday hourly chart is now showing a series of higher lows being left with the latest at $1.2440, however there is also a band of resistance around $1.2520/$1.2530 which has capped the upside and could stunt immediate upside and make the rebound lose momentum. I still favour selling within the range.

GBP/USD

I spoke yesterday about a possible near term base pattern formation which has duly completed on a move above $1.5736. This now implies a target of $1.5885. This plays to the strategy on the daily chart of selling into strength and which continues to show the overriding influence of a 4 month downtrend which currently provides resistance at $1.5900. Daily momentum indicators continue to simply unwind from oversold and Cable remains bearish on a medium/longer term outlook. However near term the bulls have broken through a key level. Hourly momentum indicators look much improved and further rebound looks possible. The immediate support for a pullback is at the $1.5736 neckline. The big caveat is that it is risky buying into downtrends, whilst also upside targets in bear market rallies tend to undershoot their targets before the sellers resume control.

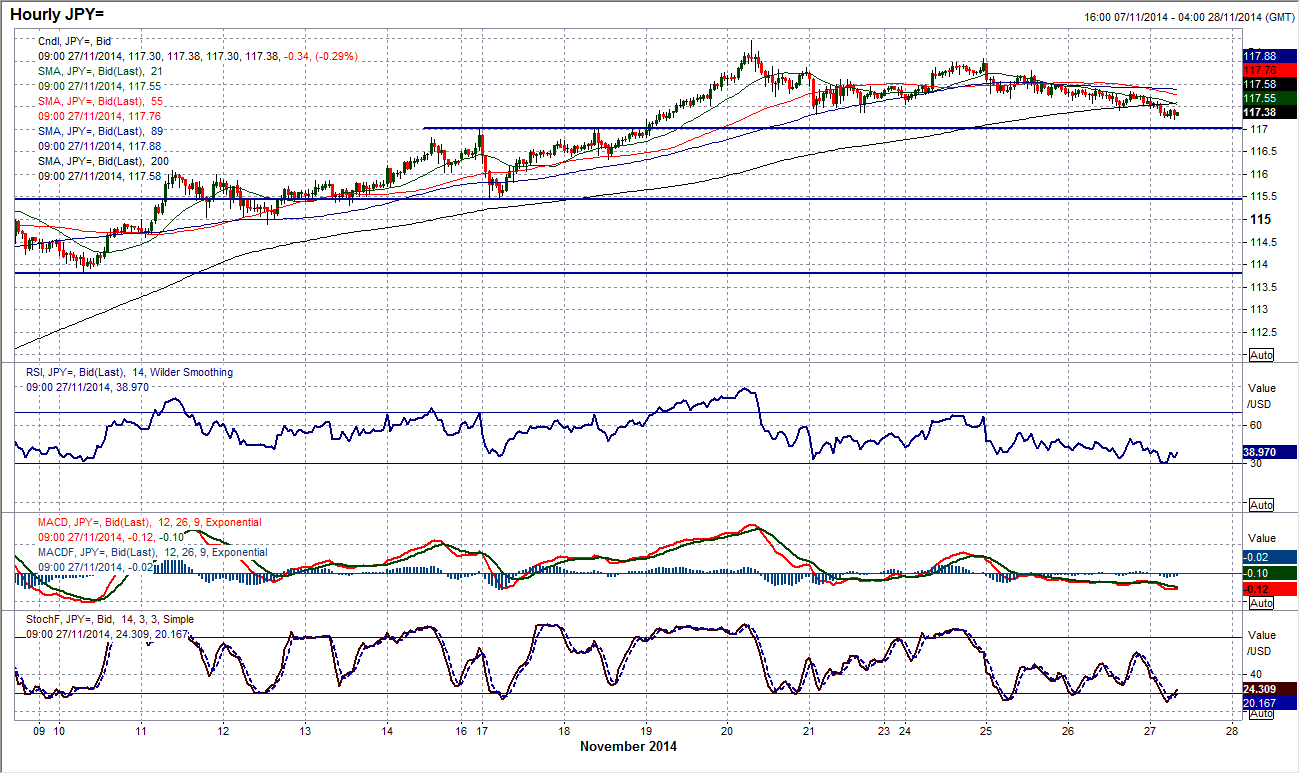

USD/JPY

The consolidation drift lower on Dollar/Yen continues and now we are seeing the first real test of support for a while. After two negative days, the early indications of a third day of downside pressure is seeing the band of support 117.00/117.33 coming under pressure today. The concern on the daily chart is that the MACD lines are today crossing over (if we complete another negative day) whilst the RSI is close to crossing below 70 (which is a theoretical sell signal) and Stochastics are also close to confirming a sell signal. The corrective signals are therefore mounting. On the intraday hourly chart the rate is now below all the moving averages and hourly momentum is also becoming a concern. Look for a 116 handle on the price, as if it starts trading consistently below there the pressure for a correction back towards the key support at 115.44 will grow. A move above the resistance band around 117.90 would calm the nerves for the bulls.

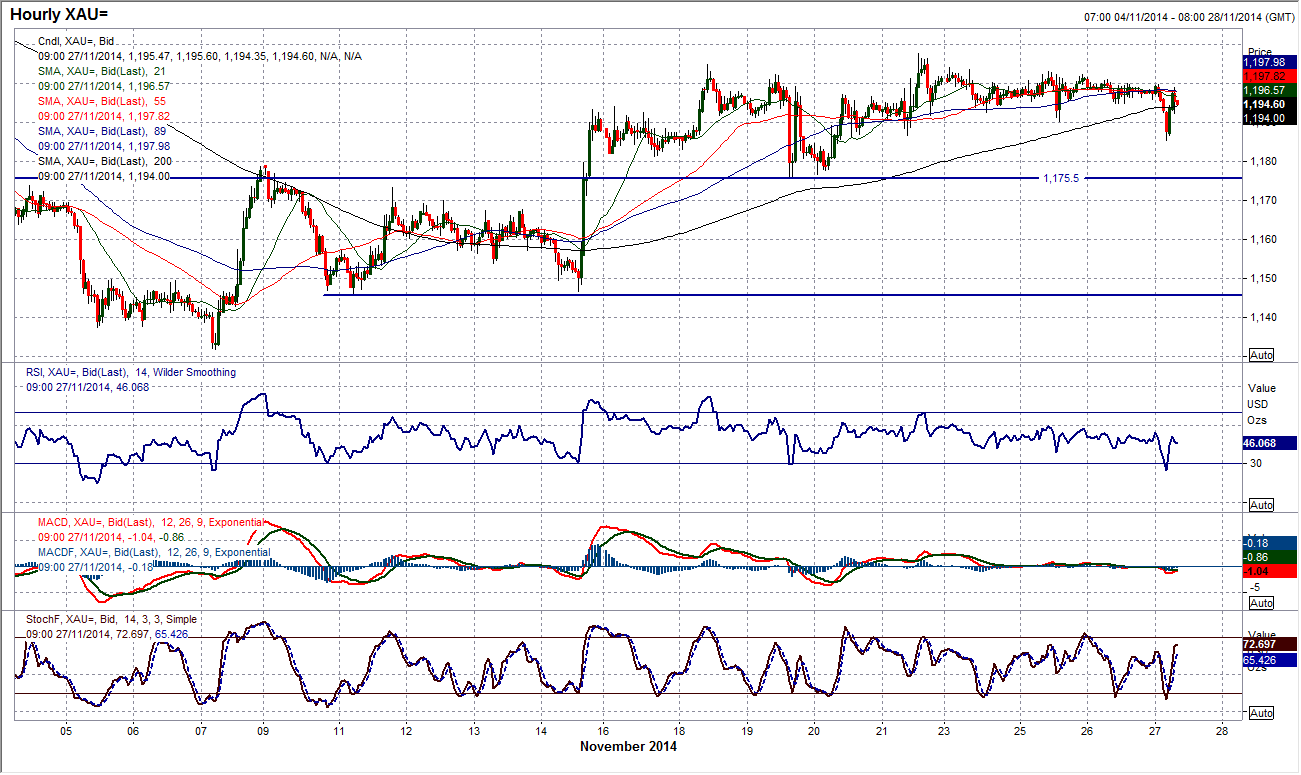

Gold

The consolidation has continued but not without a slight blip overnight. The price has been very settled in recent days (possible building up to this weekend’s crucial Swiss Gold referendum), however there has been a quick test of support overnight, with a $10 spike lower and then back up again. This has left a low at $1185.50, which is above the more considered reaction low at $1175.50. With technical studies becoming increasingly neutral this is the only real movement to speak of in the past few days. There is still a bullish bias to the technical outlook, although it is running out of a bit of impetus (again in front of the Swiss vote). The key resistance comes in at $1207.70.

WTI Oil

Yesterday was an especially pensive day ahead of what could be an extremely volatile day today. The technical outlook remains bearish with the downtrend channel pulling oil lower. However if the early price movement is anything to go by, the market is not anticipating any change to OPEC’s collective strategy, as the support at $73.25 has been breached overnight. However, if there is a cut in the oil production levels by OPEC (which is not expected at this late stage due to a lack of agreement on exactly who will do the cutting), there could be a short covering rally higher in oil today. The key resistance is at $77.83 (Friday’s high). The flip-side of this will be driven by the decision of OPEC not to cut production which would likely continue to drive prices lower, with the next key low at $70.75 (August 2010 low). There is a third potential outcome though. It would be if the market has become so set for the bearish outlook for oil that there is some support that comes in, with the potential for a “sell on rumour, buy on fact” rally. If this is the case then we could be set for a key low in oil due to the fact that the sellers have run out of steam. So there are three options for a huge fundamental news driven trading day. Once more the big winner is likely to be volatility and the options traders buying the straddle/strangle.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.