ASIA ROUNDUP:

AUD Consumer Confidence Index rose +1.9% to 94.9 in July. AUDUSD traded back up to yesterday's highs but retraced back towards 0.94 leading up to the employment data.

China CPI came in slightly less than expected by 0.1% at 2.3% but the markets hardly reacted as

UP NEXT:

CAD Housing Starts expected to be slightly slower but still healthy at 191k. This is considered a leading indicator of construction so a positive reading (and above expectations) is generally good for the CAD.

FOMC minutes will be closely scrutinised by traders later today

GBP House Price Index is forecast to have slowed slightly by -0.3%. However last month’s +3.9% was at decade highs, so a negative number means the rate of growth has declined, ever so slightly, from the highs. Only a significant number below expectations should be GBP bearish.

TECHNICAL ANALYSIS:

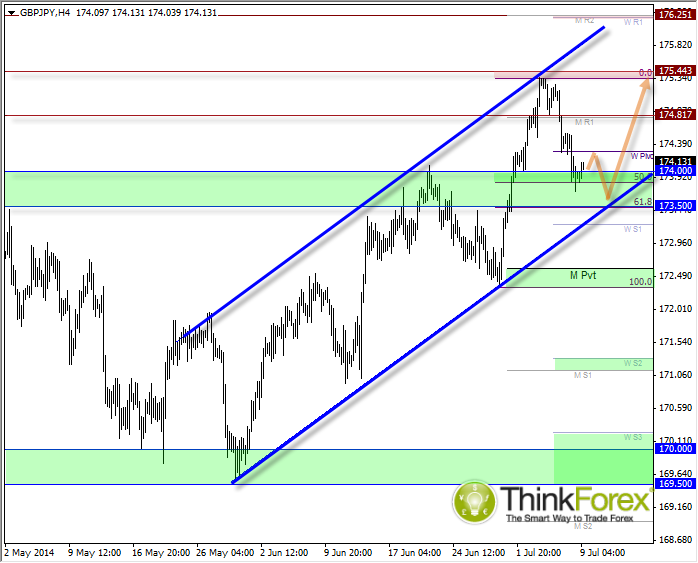

GBPJPY: Retraced to our favoured buy-zone (one dip lower would be better though...)

Following the breakout last week GBPJPY has retreated towards a buy-zone between 173.50 - 174. I am favouring another dip lower before the uptrend resumes because we are now trading beneath the weekly pivot (likely resistance upon first visit) and we have not yet tested the lower channel line. Another reason is this correction seems a little short in time and price compared to the previous decline.

A break below 173.50 would then target the monthly pivot around 172.50 and bring us back within the bullish triangle breakout. Under this scenario I would prefer to stand aside, or only consider short opportunities on much lower timeframes until a clearer trend has been established.

Please view previous analysis for a larger picture:

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

GBP/USD recovers to 1.3300 ahead of UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers near the 1.3300 mark in the European morning on Friday. Traders digest the BoE and Fed policy decisions, awaiting the UK Retail Sales data for further trading impetus.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.