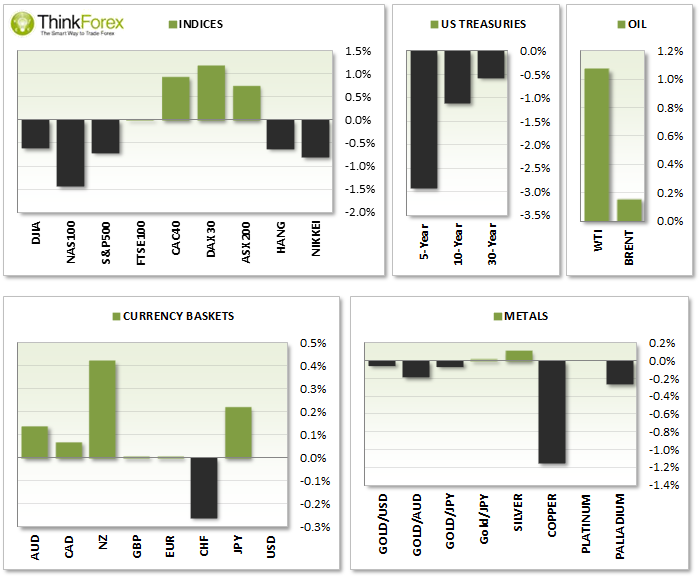

MARKET SNAPSHOT:

ASIA HANDOVER:

FX:

NZD Trade balance beat expectations to see exports at their highest level in nearly 3 years. However with the NZD being the biggest G10 currency the higher Kiwi Dollar will begin to hurt exporters. AUDNZD at 4-week high USDCNH within a whisker of the 1--month highs and currently trading at 6.207

INDICES:

AUS200 and Nikkei opened lower following the lead from Wall Street. Nikkei sold off by 1.6% with the added weight of being ex-dividend day but recovered losses to trade to a 6-day high

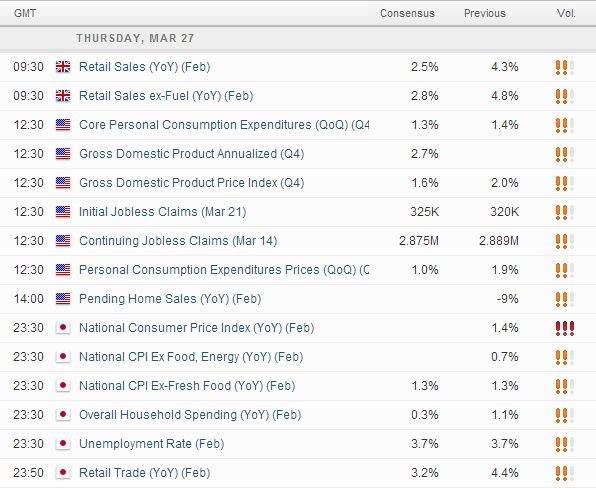

UP NEXT:

CHART OF THE DAY:

EURAUD: Targeting 1.48

Patterns (such as head and shoulders) can take a long time to evolve, and tricky to analyse, let along trade. This is why I prefer to use patterns to provide anticipated direction and price objectives only.

The original analysis was posted on the 25th Feb when I raised the possibility of a Right Shoulder to form, only to see it break to a new high before taking another dip lower.

There are two barriers this has now overcome to turn bearish - 1: Broken trendline and 2: Now trading beneath 1.50

Whilst the overall price objective is down near 1.420 I doubt very much to get there this week! However any retracement towards 1.50 accompanied with bearish setups could provide a decent entry to trade down to 1.48.

A break above 1.50 invalidates the analysis

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY recovers to 142.50 area during BoJ Governor Ueda's presser

USD/JPY stages a modest recovery toward 142.50 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.